Region:Global

Author(s):Geetanshi

Product Code:KRAD5915

Pages:81

Published On:December 2025

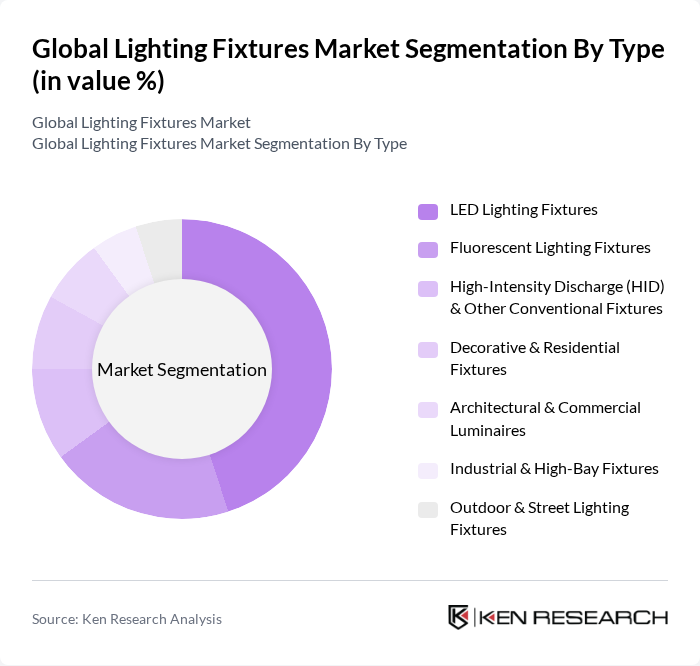

By Type:The market is segmented into various types of lighting fixtures, including LED Lighting Fixtures, Fluorescent Lighting Fixtures, High-Intensity Discharge (HID) & Other Conventional Fixtures, Decorative & Residential Fixtures, Architectural & Commercial Luminaires, Industrial & High-Bay Fixtures, and Outdoor & Street Lighting Fixtures. Among these, LED Lighting Fixtures are leading the market due to their high energy efficiency, longer operating life, rapid declines in cost per lumen, and strong compatibility with smart controls and IoT platforms, making them the preferred choice for new installations and retrofit projects in both residential and non-residential applications.

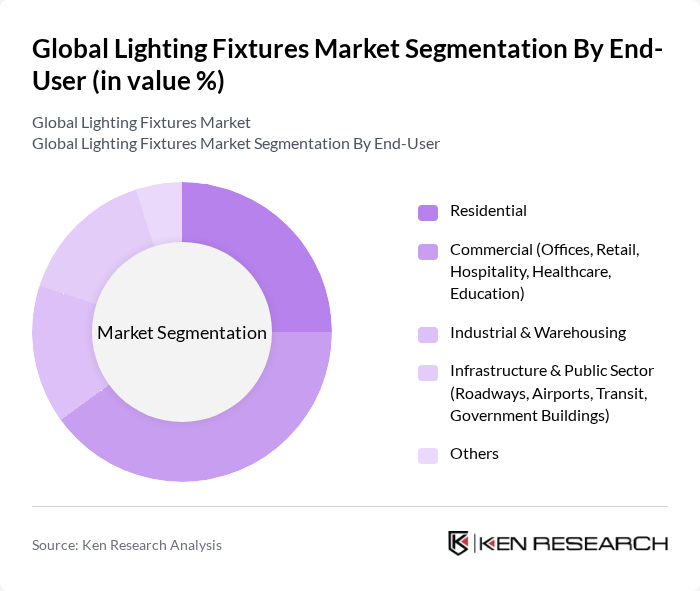

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial & Warehousing, Infrastructure & Public Sector (Roadways, Airports, Transit, Government Buildings), and Others. The Commercial segment is currently dominating the market, supported by extensive use of architectural and commercial luminaires in offices, retail, hospitality, healthcare, and educational facilities, where end-users are prioritizing LED retrofits, human-centric and tunable white lighting, and smart building-integrated solutions to reduce energy and maintenance costs and to enhance occupant comfort and customer experience.

The Global Lighting Fixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), OSRAM Licht AG (ams-OSRAM AG), Acuity Brands, Inc., Hubbell Lighting, Inc. (Hubbell Incorporated), General Electric Company (GE Lighting, a Savant company), Zumtobel Group AG, Fagerhult Group, Eaton Corporation plc (Cooper Lighting Solutions), Cree, Inc. (Cree Lighting / Wolfspeed), Panasonic Corporation, Legrand SA, Lutron Electronics Co., Inc., Schneider Electric SE, Thorn Lighting (Zumtobel Group), Opple Lighting Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lighting fixtures market appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart home technologies gain traction, the integration of IoT in lighting systems is expected to enhance user experience and energy management. Additionally, the shift towards eco-friendly products will likely accelerate, with consumers increasingly prioritizing sustainable options. These trends indicate a dynamic market landscape, where innovation and environmental responsibility will shape future developments in lighting solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Lighting Fixtures Fluorescent Lighting Fixtures High-Intensity Discharge (HID) & Other Conventional Fixtures Decorative & Residential Fixtures Architectural & Commercial Luminaires Industrial & High-Bay Fixtures Outdoor & Street Lighting Fixtures |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial & Warehousing Infrastructure & Public Sector (Roadways, Airports, Transit, Government Buildings) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Indoor Lighting Outdoor & Street Lighting Architectural & Accent Lighting Emergency & Safety Lighting Smart & Connected Lighting |

| By Installation Type | New Construction Installations Retrofit & Renovation Installations Others |

| By Distribution Channel | Online Retail & E-commerce Platforms Offline Retail (Specialty Stores, DIY Stores, Hypermarkets) Direct Sales & Project Channels (B2B, EPC, System Integrators) Others |

| By Product Design | Modern & Contemporary Design Traditional & Classic Design Custom & Project-Specific Design Human-Centric & Ergonomic Lighting Design |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Lighting Fixtures | 120 | Homeowners, Interior Designers |

| Commercial Lighting Solutions | 110 | Facility Managers, Architects |

| Industrial Lighting Applications | 90 | Plant Managers, Safety Officers |

| Smart Lighting Technologies | 80 | IT Managers, Smart Home Consultants |

| Outdoor and Street Lighting | 70 | Urban Planners, Municipal Engineers |

The Global Lighting Fixtures Market is valued at approximately USD 145 billion, driven by the demand for energy-efficient solutions, LED technology adoption, and urbanization trends across various sectors including residential, commercial, and industrial applications.