Region:North America

Author(s):Dev

Product Code:KRAB0901

Pages:85

Published On:October 2025

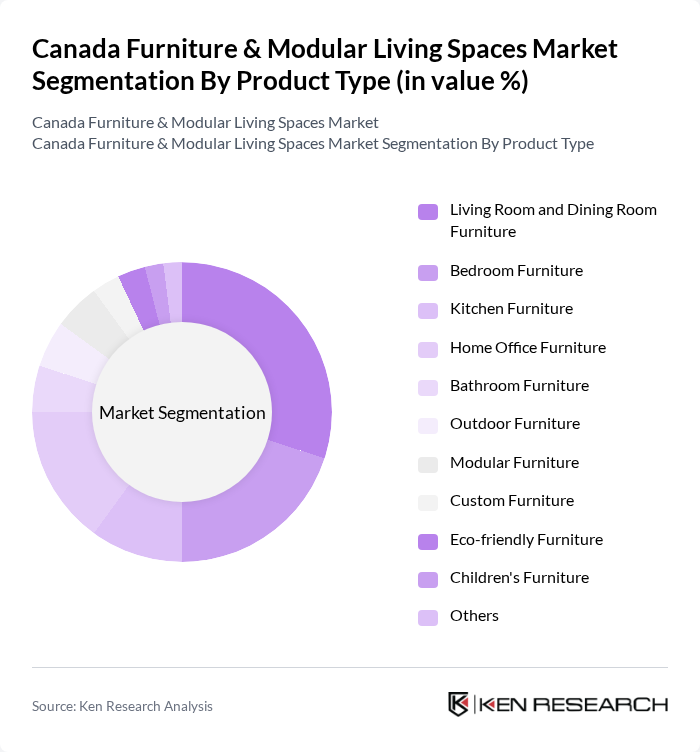

By Product Type:The product type segmentation includes categories such as Living Room and Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Home Office Furniture, Bathroom Furniture, Outdoor Furniture, Modular Furniture, Custom Furniture, Eco-friendly Furniture, Children's Furniture, and Others. Living Room and Dining Room Furniture remains the leading sub-segment, driven by consumer demand for stylish, functional, and space-saving designs that enhance the aesthetic appeal of living spaces. The popularity of open-concept layouts and multi-functional furniture further supports demand for versatile dining and living room solutions. Modular and eco-friendly furniture categories are also experiencing increased traction, reflecting sustainability and customization trends .

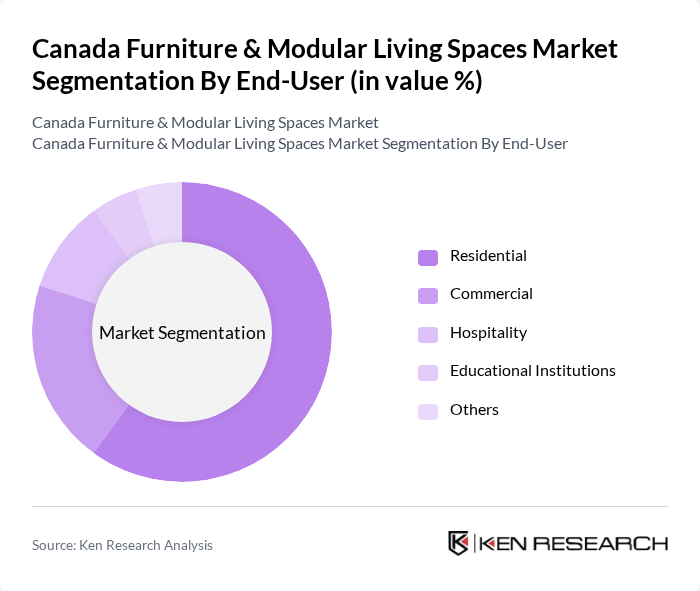

By End-User:The end-user segmentation encompasses Residential, Commercial, Hospitality, Educational Institutions, and Others. The Residential segment is the dominant category, reflecting the continued trend of home renovations, increased interest in interior design, and the rise of remote and hybrid work models. As more individuals invest in creating personalized and functional living environments, demand for diverse furniture types tailored to residential needs continues to grow. The Commercial and Hospitality segments are also expanding, supported by renewed activity in office and hospitality spaces .

The Canada Furniture & Modular Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Canada, Structube, Leon's Furniture, The Brick, EQ3, Wayfair Canada, Ashley HomeStore Canada, Urban Barn, Dufresne Group, Canadian Tire, Home Depot Canada, Rona, Bouclair, JYSK Canada, and Palliser Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada furniture and modular living spaces market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will likely rise. Additionally, the integration of smart technology into furniture design is expected to enhance user experience. Companies that prioritize sustainability and customization will be well-positioned to capture market share, adapting to the changing landscape and consumer expectations in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Living Room and Dining Room Furniture Bedroom Furniture Kitchen Furniture Home Office Furniture Bathroom Furniture Outdoor Furniture Modular Furniture Custom Furniture Eco-friendly Furniture Children's Furniture Others |

| By End-User | Residential Commercial Hospitality Educational Institutions Others |

| By Distribution Channel | Home Centers Specialty Furniture Stores Online Retail Wholesale Distributors Direct Sales Other Distribution Channels |

| By Material | Wood Metal Plastic & Polymer Fabric Others |

| By Price Range | Economy Mid-range Premium Luxury Others |

| By Design Style | Contemporary Traditional Industrial Scandinavian Others |

| By Functionality | Multi-functional Single-purpose Modular Customizable Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Renters |

| Modular Living Space Trends | 60 | Interior Designers, Architects |

| Consumer Preferences in Furniture | 80 | Young Professionals, Families |

| Retail Sector Insights | 40 | Store Managers, Sales Associates |

| Market Trends in Sustainable Furniture | 50 | Sustainability Advocates, Eco-conscious Consumers |

The Canada Furniture & Modular Living Spaces Market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by consumer demand for stylish, functional, and customizable living solutions.