Region:North America

Author(s):Rebecca

Product Code:KRAB1753

Pages:81

Published On:October 2025

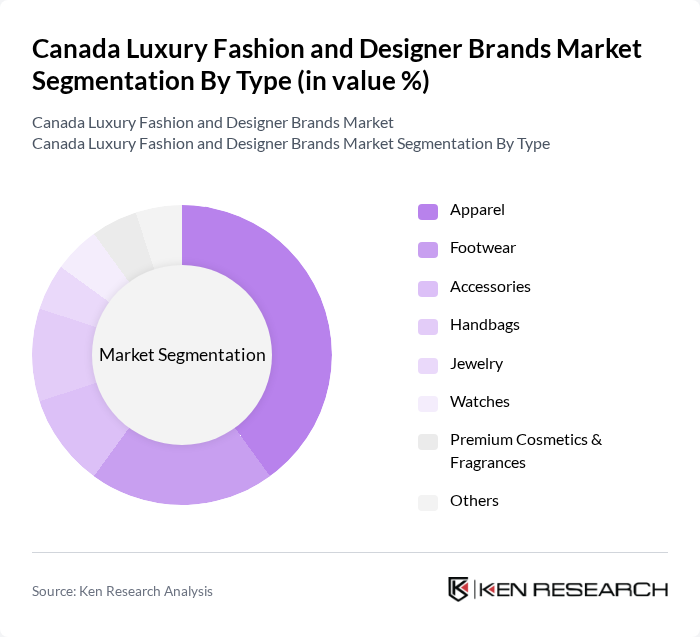

By Type:The luxury fashion market is segmented into various types, including Apparel, Footwear, Accessories, Handbags, Jewelry, Watches, Premium Cosmetics & Fragrances, and Others. Among these,Apparelis the leading sub-segment, driven by consumer preferences for high-quality clothing, the influence of fashion trends, and the growing demand for exclusive, limited-edition pieces. Footwear and Handbags also hold significant market shares, as consumers increasingly seek luxury items that reflect their personal style and status. The demand for Premium Cosmetics & Fragrances is growing, particularly among younger consumers who prioritize brand prestige, product quality, and ethical sourcing .

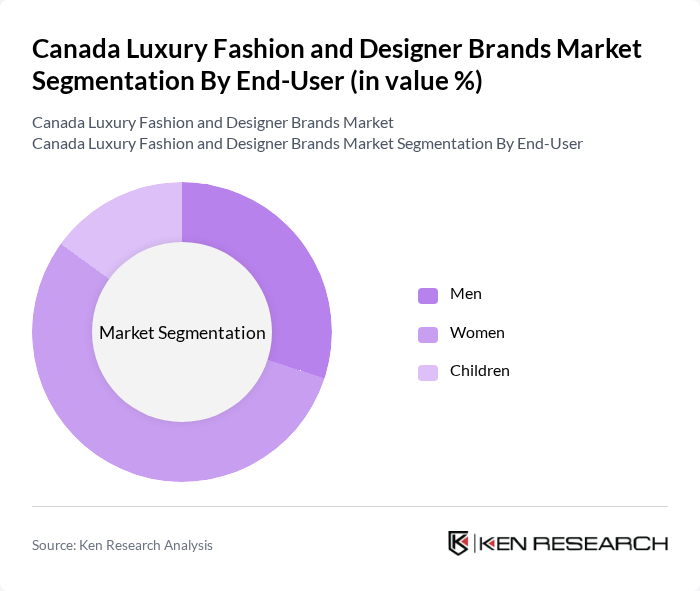

By End-User:The luxury fashion market is segmented by end-user into Men, Women, and Children.Womenrepresent the largest segment, driven by a higher propensity to spend on luxury fashion and a wider variety of products available. The Men's segment is also significant, with increasing interest in luxury apparel and accessories among male consumers. The Children’s segment, while smaller, is growing as parents are willing to invest in high-quality, branded items for their children. The rise of gender-neutral and inclusive fashion collections is also influencing purchasing patterns across all end-user categories .

The Canada Luxury Fashion and Designer Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Chanel S.A., Gucci, Prada S.p.A., Burberry Group plc, Hermès International S.A., Ralph Lauren Corporation, Dolce & Gabbana, Versace, Valentino S.p.A., Fendi, Salvatore Ferragamo S.p.A., Michael Kors, Tory Burch LLC, Tiffany & Co., Richemont SA (Cartier, Montblanc, etc.), Rolex SA, Canada Goose Holdings Inc., Lululemon Athletica Inc., Aritzia Inc., Roots Corporation, Brunello Cucinelli S.p.A., Loewe S.A., Armani Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada luxury fashion market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to thrive. Additionally, the integration of digital marketing strategies and augmented reality in shopping experiences will enhance consumer engagement. These trends indicate a dynamic market landscape where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Premium Cosmetics & Fragrances Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Direct Sales Luxury Boutiques |

| By Price Range | Premium Super Premium Affordable Luxury |

| By Brand Positioning | Established Luxury Brands Emerging Designers Fast Fashion Luxury Canadian Luxury Brands |

| By Consumer Behavior | Brand Loyalty Trend-Driven Purchases Occasion-Based Purchases |

| By Sustainability Focus | Eco-Friendly Brands Ethical Production Brands Circular Fashion Brands Indigenous & Local Artistry Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 120 | Affluent Consumers, Fashion Enthusiasts |

| Designer Accessories Market | 90 | Luxury Brand Managers, Retail Buyers |

| Footwear Trends in Luxury Fashion | 60 | Footwear Designers, Retail Store Managers |

| Consumer Sentiment on Sustainability | 70 | Eco-conscious Shoppers, Fashion Influencers |

| Impact of E-commerce on Luxury Sales | 50 | E-commerce Directors, Digital Marketing Specialists |

The Canada Luxury Fashion and Designer Brands Market is valued at approximately USD 5.1 billion, driven by increasing disposable income and a growing number of affluent consumers interested in high-end fashion and luxury goods.