Region:Middle East

Author(s):Dev

Product Code:KRAB2134

Pages:96

Published On:October 2025

By Product Type:The luxury fashion market is segmented into various product types, including clothing and apparel, footwear, leather goods, watches, jewelry, eyewear, and other product types. Among these, clothing and apparel dominate the market due to the high demand for designer wear and seasonal collections. Consumers are increasingly seeking unique and high-quality clothing that reflects their personal style and status, driving significant sales in this segment. Digital commerce and omnichannel retailing are accelerating growth in all segments, with immersive online experiences and AI-enabled personal shopping assistants enhancing consumer engagement .

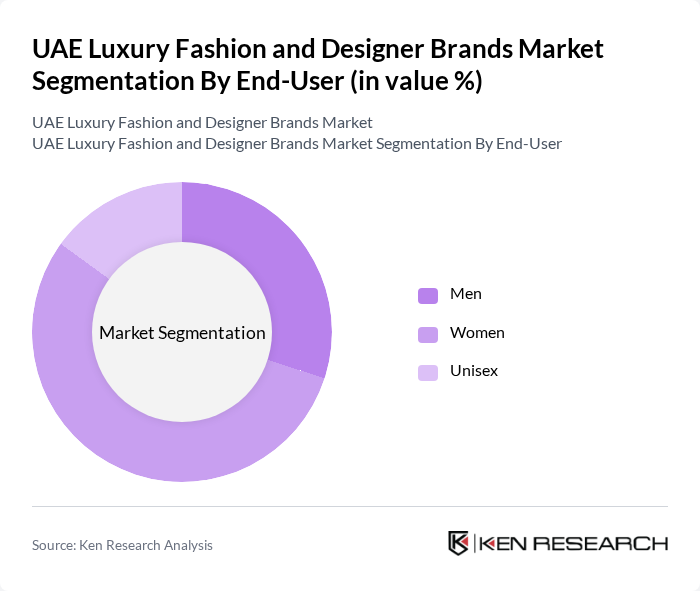

By End-User:The market is segmented by end-user demographics, including men, women, and unisex products. Women represent the largest segment, driven by a strong inclination towards luxury fashion and accessories. The increasing participation of women in the workforce and their growing purchasing power have significantly contributed to the demand for luxury products tailored specifically for them. The segment is further supported by targeted marketing campaigns and exclusive product launches catering to female consumers .

The UAE Luxury Fashion and Designer Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chalhoub Group, Al Tayer Group, Azadea Group, Al-Futtaim Group, Landmark Group, Majid Al Futtaim Fashion, Paris Gallery, Rivoli Group, The Luxury Closet, Ounass, Level Shoes, Namshi, Farfetch Middle East, Net-a-Porter Middle East, Boutique 1 contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury fashion market is poised for dynamic growth, driven by increasing disposable incomes and a burgeoning tourism sector. As digital transformation continues, brands are expected to enhance their online presence, catering to a tech-savvy consumer base. Additionally, sustainability will play a crucial role, with consumers increasingly favoring brands that prioritize ethical practices. The integration of innovative technologies, such as augmented reality, will further enhance the shopping experience, making luxury fashion more accessible and engaging for consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Clothing and Apparel Footwear Leather Goods Watches Jewelry Eyewear Other Product Types |

| By End-User | Men Women Unisex |

| By Distribution Channel | Single-Brand Store Multi-Brand Store Online Luxury Store Other Distribution Channels |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Local Brands International Brands |

| By Consumer Demographics | Age Group Gender Income Level |

| By Occasion | Casual Wear Formal Wear Special Events Seasonal Collections |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 100 | High-income Consumers, Fashion Enthusiasts |

| Designer Accessories Buyers | 80 | Luxury Brand Loyalists, Trendsetters |

| Footwear Market Participants | 60 | Retail Managers, Fashion Buyers |

| Online Luxury Shoppers | 90 | eCommerce Users, Digital Natives |

| Luxury Fashion Influencers | 40 | Fashion Bloggers, Social Media Influencers |

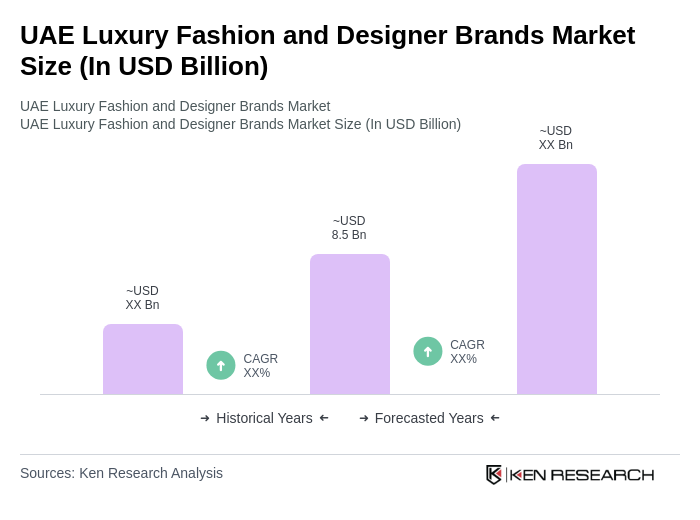

The UAE Luxury Fashion and Designer Brands Market is valued at approximately USD 8.5 billion, driven by increasing disposable incomes, a growing tourism sector, and a rising demand for luxury goods among both local and expatriate populations.