Region:North America

Author(s):Geetanshi

Product Code:KRAA5544

Pages:84

Published On:September 2025

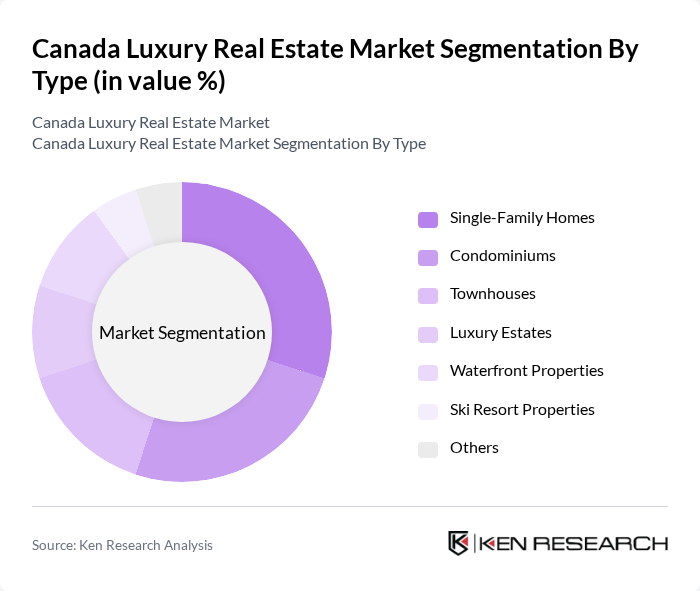

By Type:The luxury real estate market in Canada can be segmented into various types, including Single-Family Homes, Condominiums, Townhouses, Luxury Estates, Waterfront Properties, Ski Resort Properties, and Others. Each of these subsegments caters to different consumer preferences and investment strategies, with unique features and amenities that appeal to affluent buyers.

The Single-Family Homes subsegment dominates the luxury real estate market in Canada, driven by consumer preferences for privacy, space, and customization. These properties often feature expansive lots, high-end finishes, and desirable locations, making them highly sought after by affluent buyers. The trend towards remote work has also increased demand for larger homes that can accommodate home offices and leisure spaces, further solidifying the position of single-family homes as the leading choice in the luxury market.

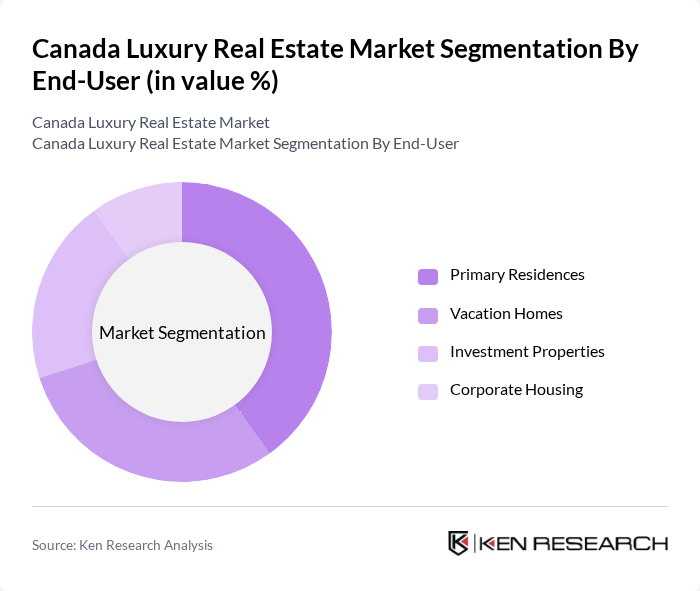

By End-User:The luxury real estate market can also be segmented by end-user categories, including Primary Residences, Vacation Homes, Investment Properties, and Corporate Housing. Each category reflects different buyer motivations, from personal use to investment strategies, influencing the types of properties that are in demand.

Primary Residences represent the largest segment in the luxury real estate market, as affluent buyers prioritize purchasing homes that serve as their main living spaces. This trend is fueled by a desire for stability and investment in quality living environments. Additionally, the rise in remote work has led many high-net-worth individuals to seek larger homes that accommodate both personal and professional needs, further driving demand in this category.

The Canada Luxury Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sotheby's International Realty Canada, Engel & Völkers, Royal LePage, RE/MAX, Coldwell Banker, The Agency, Bosley Real Estate Ltd., Oakwyn Realty Ltd., Century 21, Harvey Kalles Real Estate, Johnston & Daniel, Chestnut Park Real Estate Limited, Remax Hallmark Realty Ltd., Right at Home Realty Inc., Forest Hill Real Estate Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada luxury real estate market appears promising, driven by ongoing urbanization and a growing affluent population. As cities expand, the demand for luxury properties is expected to rise, particularly in emerging markets outside major urban centers. Additionally, technological advancements in real estate transactions and a shift towards sustainable living will likely shape the market landscape, creating new opportunities for developers and investors. The integration of smart home technologies will further enhance property appeal, attracting discerning buyers.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Condominiums Townhouses Luxury Estates Waterfront Properties Ski Resort Properties Others |

| By End-User | Primary Residences Vacation Homes Investment Properties Corporate Housing |

| By Price Range | Below CAD 1 Million CAD 1 Million - CAD 3 Million CAD 3 Million - CAD 5 Million Above CAD 5 Million |

| By Location | Urban Centers Suburban Areas Rural Locations |

| By Property Features | Smart Home Features Eco-Friendly Designs Luxury Amenities |

| By Investment Type | Direct Ownership Real Estate Investment Trusts (REITs) Fractional Ownership |

| By Sales Channel | Real Estate Agents Online Platforms Auctions Direct Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Home Buyers | 150 | Affluent Individuals, Real Estate Investors |

| Real Estate Agents | 100 | Luxury Property Specialists, Brokers |

| Developers of Luxury Properties | 80 | Real Estate Developers, Project Managers |

| Financial Advisors | 70 | Wealth Managers, Investment Consultants |

| Luxury Property Management Firms | 60 | Property Managers, Operations Directors |

The Canada luxury real estate market is valued at approximately CAD 15 billion, driven by increasing demand from affluent buyers, foreign investments, and a strong economy that supports high-value transactions, particularly in urban areas.