Region:Asia

Author(s):Rebecca

Product Code:KRAA6122

Pages:99

Published On:September 2025

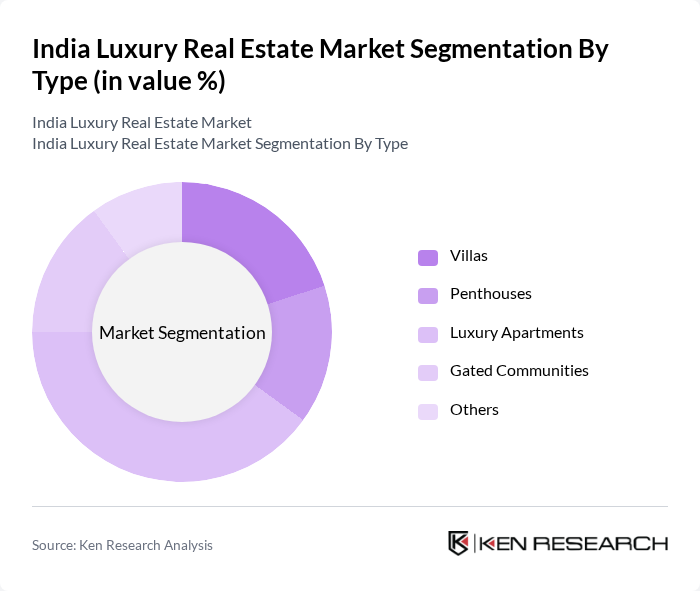

By Type:The luxury real estate market can be segmented into various types, including Villas, Penthouses, Luxury Apartments, Gated Communities, and Others. Among these, Luxury Apartments have emerged as the most popular choice due to their modern amenities, security features, and prime locations in urban areas. The trend towards vertical living in metropolitan cities has further propelled the demand for luxury apartments, making them a preferred investment option for affluent buyers.

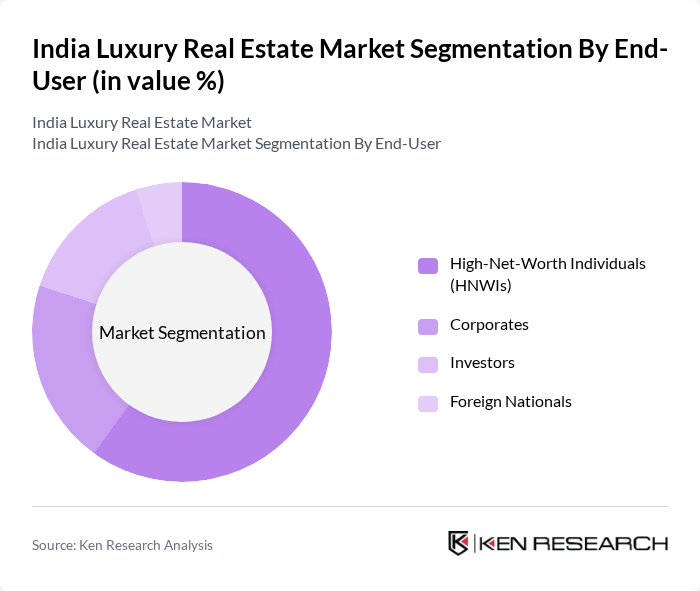

By End-User:The end-user segmentation includes High-Net-Worth Individuals (HNWIs), Corporates, Investors, and Foreign Nationals. High-Net-Worth Individuals represent the largest segment, driven by their increasing wealth and desire for exclusive living spaces. This demographic is particularly attracted to properties that offer luxury amenities, privacy, and a prestigious address, making them the primary consumers in the luxury real estate market.

The India Luxury Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DLF Limited, Godrej Properties Limited, Oberoi Realty Limited, Prestige Estates Projects Limited, Brigade Enterprises Limited, Sobha Limited, Mahindra Lifespace Developers Limited, Tata Housing Development Company Limited, K Raheja Corp, Puravankara Limited, Ashiana Housing Limited, Sunteck Realty Limited, Kolte Patil Developers Limited, Anant Raj Limited, Parsvnath Developers Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury real estate market in India appears promising, driven by a combination of rising disposable incomes and urbanization. As more affluent individuals seek luxury homes, the demand for high-end properties is expected to increase. Additionally, the integration of technology in real estate transactions is likely to streamline processes, making it easier for buyers and investors. Sustainable developments will also gain traction, aligning with global trends towards eco-friendly living, further enhancing market appeal.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Penthouses Luxury Apartments Gated Communities Others |

| By End-User | High-Net-Worth Individuals (HNWIs) Corporates Investors Foreign Nationals |

| By Region | North India South India East India West India |

| By Price Range | Below INR 1 Crore INR 1 Crore - 5 Crore INR 5 Crore - 10 Crore Above INR 10 Crore |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Private Equity Government Schemes |

| By Property Features | Smart Home Features Eco-Friendly Designs Luxury Amenities Customization Options |

| By Sales Channel | Direct Sales Real Estate Brokers Online Platforms Auctions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apartment Buyers | 150 | High-Net-Worth Individuals, Real Estate Investors |

| Luxury Villa Market | 100 | Property Developers, Wealth Managers |

| Commercial Luxury Real Estate | 80 | Corporate Executives, Investment Analysts |

| Luxury Rental Market | 70 | Property Managers, Rental Agents |

| Foreign Investment in Luxury Real Estate | 60 | International Investors, Real Estate Consultants |

The India Luxury Real Estate Market is valued at approximately USD 30 billion, driven by increasing disposable incomes, urbanization, and a growing number of high-net-worth individuals (HNWIs) seeking premium properties in metropolitan areas.