Region:North America

Author(s):Shubham

Product Code:KRAA0762

Pages:93

Published On:August 2025

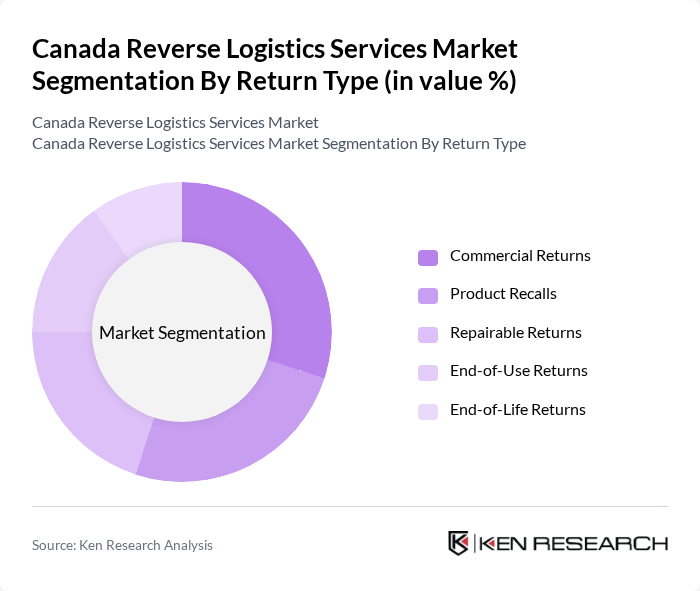

By Return Type:The return type segmentation includes Commercial Returns, Product Recalls, Repairable Returns, End-of-Use Returns, and End-of-Life Returns. Each sub-segment addresses distinct business scenarios: Commercial Returns cover standard customer returns, Product Recalls involve the return of defective or unsafe products, Repairable Returns focus on items eligible for repair and reintegration, End-of-Use Returns pertain to products returned after their intended usage period, and End-of-Life Returns involve items at the end of their functional lifespan, often destined for recycling or responsible disposal .

The Commercial Returns sub-segment leads the market, driven by the rapid expansion of e-commerce and the resulting increase in product returns. Consumers are more inclined to purchase online, knowing that return processes are streamlined and accessible. This has prompted retailers to invest in robust return management systems, making commercial returns a central focus. The ease and transparency of returns are key factors influencing consumer purchasing behavior and loyalty .

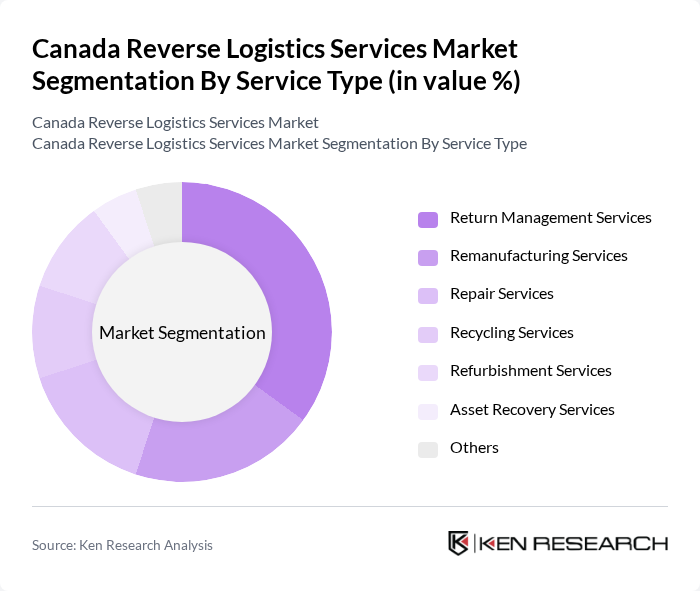

By Service Type:The service type segmentation includes Return Management Services, Remanufacturing Services, Repair Services, Recycling Services, Refurbishment Services, Asset Recovery Services, and Others. Return Management Services focus on the end-to-end handling of returns, Remanufacturing Services restore used products to like-new condition, Repair Services address minor defects, Recycling Services ensure responsible material recovery, Refurbishment Services upgrade or restore returned goods, Asset Recovery Services maximize value from returned assets, and Others encompass niche or emerging service categories .

Return Management Services dominate the market, reflecting the increasing complexity of returns in the e-commerce sector. Companies are investing in advanced return management platforms and automation to streamline processes, reduce operational costs, and improve customer experience. The focus on efficient and transparent return handling is critical for maintaining competitiveness in a rapidly evolving retail and logistics landscape .

The Canada Reverse Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Supply Chain (Canada), UPS Supply Chain Solutions (Canada), Purolator Inc., Canada Post, SCI Group Inc., Metro Supply Chain Group, DB Schenker (Canada), DHL Supply Chain (Canada), Kuehne + Nagel Ltd. (Canada), DSV Solutions (Canada), XPO Logistics (Canada), CEVA Logistics (Canada), GXO Logistics (Canada), Maersk Logistics (Canada), TFI International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada reverse logistics services market appears promising, driven by the increasing emphasis on sustainability and technological innovation. As businesses adapt to consumer demands for efficient return processes, the integration of AI and automation will enhance operational efficiency. Furthermore, the rise of omnichannel retailing will necessitate robust reverse logistics strategies, ensuring seamless customer experiences. Companies that embrace these trends are likely to gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Commercial Returns Product Recalls Repairable Returns End-of-Use Returns End-of-Life Returns |

| By Service Type | Return Management Services Remanufacturing Services Repair Services Recycling Services Refurbishment Services Asset Recovery Services Others |

| By End-User | E-commerce Retail Automotive Electronics Pharmaceuticals Consumer Goods Others |

| By Service Model | Third-Party Logistics (3PL) In-House Logistics Hybrid Model |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships |

| By Industry Vertical | Manufacturing Telecommunications Food and Beverage Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 50 | eCommerce Managers, Fulfillment Center Supervisors |

The Canada Reverse Logistics Services Market is valued at approximately USD 5.6 billion, driven by the growth in e-commerce, environmental regulations, and the need for efficient return management systems.