Region:Middle East

Author(s):Shubham

Product Code:KRAA0752

Pages:94

Published On:August 2025

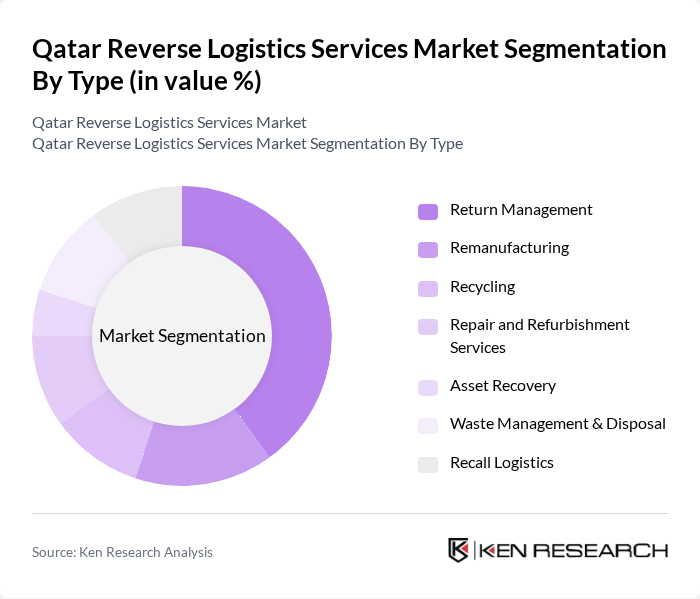

By Type:The reverse logistics services market can be segmented into various types, including Return Management, Remanufacturing, Recycling, Repair and Refurbishment Services, Asset Recovery, Waste Management & Disposal, and Recall Logistics. Among these, Return Management is the most significant segment, driven by the rapid growth of e-commerce and the increasing volume of product returns. Companies are investing in efficient return management systems to enhance customer satisfaction and reduce operational costs .

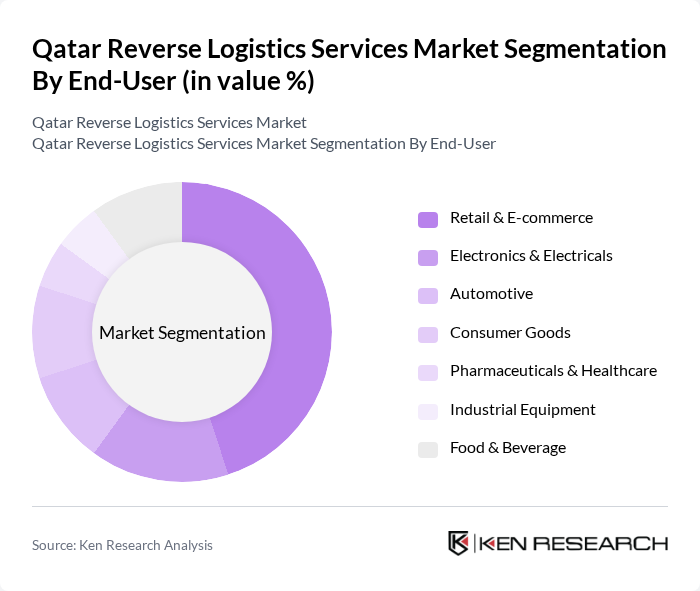

By End-User:The end-user segmentation of the reverse logistics services market includes Retail & E-commerce, Electronics & Electricals, Automotive, Consumer Goods, Pharmaceuticals & Healthcare, Industrial Equipment, and Food & Beverage. The Retail & E-commerce segment is the largest, driven by the increasing online shopping trends and the need for efficient return processes. Companies are focusing on enhancing their reverse logistics capabilities to meet customer expectations and improve service levels .

The Qatar Reverse Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), Qatar Logistics, Qatar Post, Agility Logistics Qatar, DHL Express Qatar, Aramex Qatar, Kuehne + Nagel Qatar, DB Schenker Qatar, CEVA Logistics Qatar, Al-Futtaim Logistics Qatar, Al Jazeera Shipping & Logistics, Qatar Airways Cargo, Mena Logistics Qatar, Milaha (Qatar Navigation), Bin Yousef Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the reverse logistics market in Qatar appears promising, driven by increasing e-commerce activities and a strong emphasis on sustainability. As businesses adapt to consumer demands for efficient return processes, investments in technology and infrastructure are expected to rise. Additionally, the government's support for green initiatives will likely encourage companies to adopt sustainable practices, further enhancing the market's growth potential. Overall, the reverse logistics sector is poised for significant transformation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Remanufacturing Recycling Repair and Refurbishment Services Asset Recovery Waste Management & Disposal Recall Logistics |

| By End-User | Retail & E-commerce Electronics & Electricals Automotive Consumer Goods Pharmaceuticals & Healthcare Industrial Equipment Food & Beverage |

| By Service Type | Transportation & Collection Services Warehousing & Storage Services Inventory & Returns Management Packaging & Sorting Services Documentation & Compliance Services Resale & Secondary Market Services |

| By Distribution Channel | Direct (In-house) Logistics Third-Party Logistics (3PL) Providers Online Platforms & Marketplaces Retail Partnerships Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Others |

| By Customer Type | B2B (Business-to-Business) B2C (Business-to-Consumer) Government & Public Sector NGOs & Non-profits Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 70 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 50 | E-commerce Managers, Fulfillment Center Supervisors |

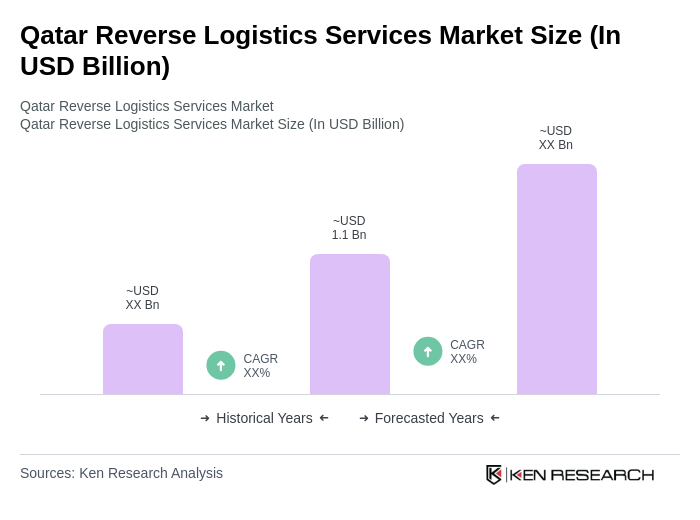

The Qatar Reverse Logistics Services Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing demand for sustainable practices, the rise of e-commerce, and the need for efficient waste management solutions.