Canada Used Vehicle and Auto Finance Market Overview

- The Canada Used Vehicle and Auto Finance Market is valued at approximatelyUSD 18 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for affordable transportation options, a significant shift toward online used-vehicle marketplaces, and the expansion of certified pre-owned (CPO) programs. The market has also seen a notable uptick in financing options, with digital platforms and contactless delivery models making it easier for consumers to purchase used vehicles and access competitive financing solutions. Inventory constraints, resulting from pandemic-era production shortages, have further supported higher prices and sustained demand for used vehicles .

- Key cities such as Toronto, Vancouver, and Montreal dominate the market due to their large populations and economic activity. These urban centers have a higher concentration of dealerships and financing institutions, catering to diverse consumer needs. The prevalence of digital classified portals and e-retailers in these cities has further accelerated the shift to online channels, with more than half of all used car transactions now occurring digitally. Additionally, robust public transportation systems in these cities encourage residents to consider used vehicles as a flexible alternative for personal mobility .

- In 2023, the Canadian government introduced theConsumer Protection in Auto Leasing and Financing Disclosure Regulations, 2023issued by Innovation, Science and Economic Development Canada. This regulation mandates comprehensive disclosure of interest rates, total loan costs, and all ancillary fees in auto finance contracts. The regulation covers all federally regulated financial institutions and aims to ensure that consumers are fully informed before making financing decisions, thereby promoting transparency and fairness in the auto finance market .

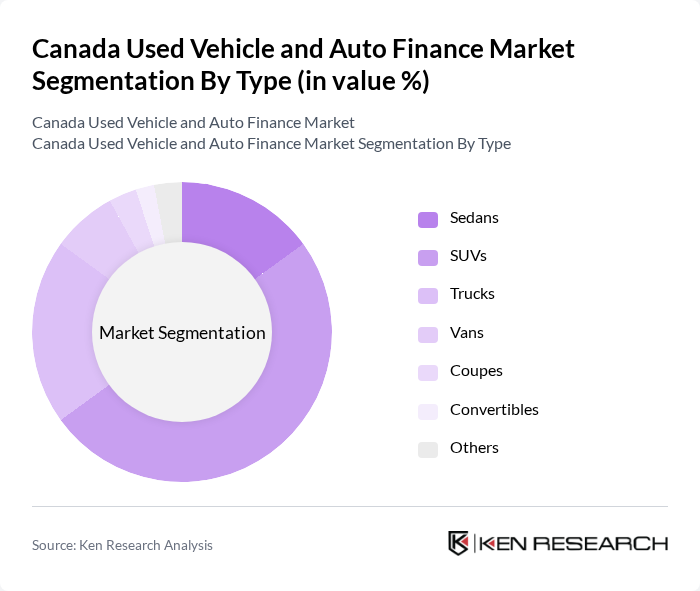

Canada Used Vehicle and Auto Finance Market Segmentation

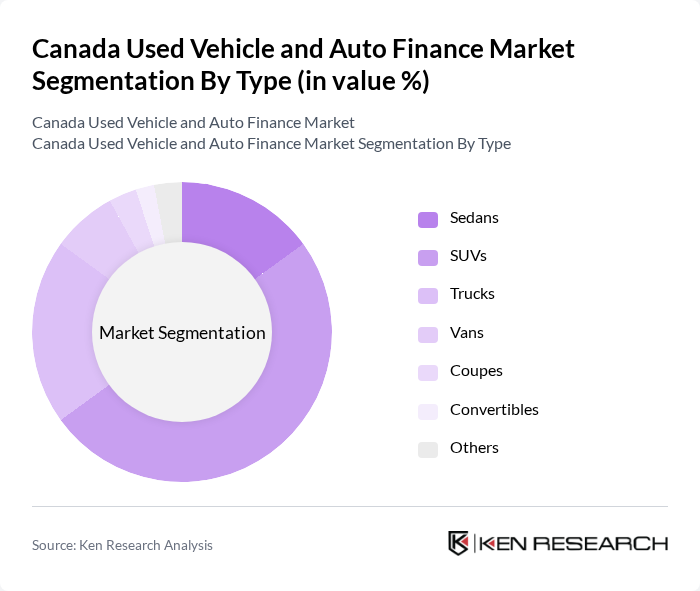

By Type:The market is segmented into various types of vehicles, including sedans, SUVs, trucks, vans, coupes, convertibles, and others.SUVshave gained significant popularity, now accounting for the majority of used vehicle transactions, driven by their versatility and spaciousness, which appeal to families and individuals alike. Sedans remain a staple choice for urban commuters, while trucks are favored for their utility and performance, particularly in regions with harsher climates or rural needs. The diversity in vehicle types allows consumers to select options that best fit their lifestyle and budget .

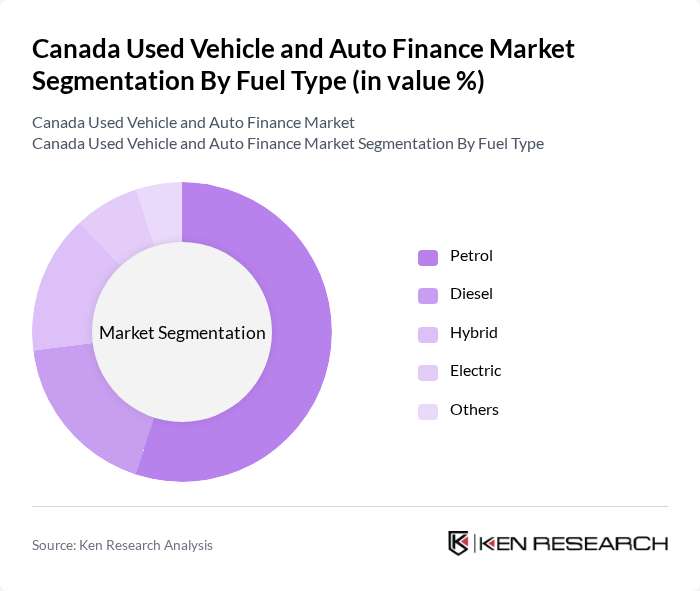

By Fuel Type:This segmentation includes petrol, diesel, hybrid, electric, and others.Petrolremains the dominant fuel type due to its widespread availability and established infrastructure, accounting for the majority of used vehicle sales. Diesel vehicles are favored for their fuel efficiency, especially in the truck segment. The share ofhybrid and electric vehiclesis steadily increasing, supported by provincial incentives and growing consumer awareness of sustainability. Hybrid vehicles, in particular, are gaining market share and higher average prices, reflecting a gradual shift toward alternative fuel options in the used market .

Canada Used Vehicle and Auto Finance Market Competitive Landscape

The Canada Used Vehicle and Auto Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoTrader.ca, CarGurus Canada, Kijiji Autos, Canadian Black Book, TD Auto Finance, Scotiabank, RBC Royal Bank, Bank of Montreal (BMO), Honda Financial Services Canada, Ford Credit Canada Company, Toyota Financial Services Canada, Nissan Canada Finance, Volkswagen Finance Canada, Mercedes-Benz Financial Services Canada, Hyundai Motor Finance Canada, Carpages.ca, Clutch Canada, Canada Drives, AutoCapital Canada, Axis Auto Finance contribute to innovation, geographic expansion, and service delivery in this space.

Canada Used Vehicle and Auto Finance Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Affordable Vehicles:The demand for used vehicles in Canada is driven by a significant increase in consumer preference for affordability. In future, the average price of a new vehicle reached CAD 66,000, while used vehicles averaged CAD 39,000. This price gap has led to a robust increase in used vehicle sales, with over 2.8 million transactions recorded annually, according to the Canadian Automobile Dealers Association (CADA).

- Expansion of Online Vehicle Marketplaces:The rise of digital platforms has transformed the used vehicle market, with online sales increasing by 25% in future. Websites like AutoTrader and Kijiji Autos reported over 5 million listings, facilitating easier access for consumers. This shift is supported by a 40% increase in internet penetration in Canada, reaching over 94%, enabling more consumers to explore options online, thus driving sales.

- Rising Availability of Flexible Financing Options:The availability of diverse financing solutions has significantly boosted the used vehicle market. In future, approximately 60% of used vehicle purchases were financed, with average loan amounts reaching CAD 25,000. Financial institutions have introduced more flexible terms, including lower down payments and extended loan durations, which have contributed to a 20% increase in financing approvals, according to the Canadian Bankers Association.

Market Challenges

- Economic Fluctuations Affecting Consumer Spending:Economic instability poses a significant challenge to the used vehicle market. In future, Canada experienced a GDP growth rate of only 1.5%, down from 3.0%. This slowdown has led to reduced consumer confidence, with a 10% decline in discretionary spending reported. Consequently, many potential buyers are postponing vehicle purchases, impacting overall sales in the used vehicle sector.

- Regulatory Changes Impacting Financing Terms:Recent regulatory changes have introduced stricter guidelines for auto financing, affecting lenders' ability to offer competitive rates. In future, the Office of the Superintendent of Financial Institutions (OSFI) implemented new capital requirements, leading to a 15% increase in interest rates for auto loans. This has made financing less accessible for consumers, potentially stalling growth in the used vehicle market.

Canada Used Vehicle and Auto Finance Market Future Outlook

The future of the Canada used vehicle and auto finance market appears promising, driven by technological advancements and evolving consumer preferences. The increasing adoption of digital financing solutions is expected to streamline the purchasing process, enhancing customer experience. Additionally, the growth of eco-friendly used vehicles aligns with consumer trends towards sustainability, potentially expanding market reach. As dealerships adapt to these changes, they will likely capture a larger share of the market, fostering innovation and competition.

Market Opportunities

- Increasing Adoption of Digital Financing Solutions:The shift towards digital financing presents a significant opportunity for growth. With over 70% of consumers preferring online applications, financial institutions can streamline processes, reducing approval times. This efficiency can lead to higher conversion rates, potentially increasing financing volumes by 30% in future, according to industry forecasts.

- Growth in Eco-Friendly Used Vehicles:The rising demand for eco-friendly vehicles is creating new market opportunities. In future, sales of used electric and hybrid vehicles increased by 40%, reflecting consumer interest in sustainability. This trend is expected to continue, with projections indicating that eco-friendly used vehicles could represent 25% of total used vehicle sales in future, according to the Canadian Electric Vehicle Association.