Region:Asia

Author(s):Shubham

Product Code:KRAA8528

Pages:88

Published On:November 2025

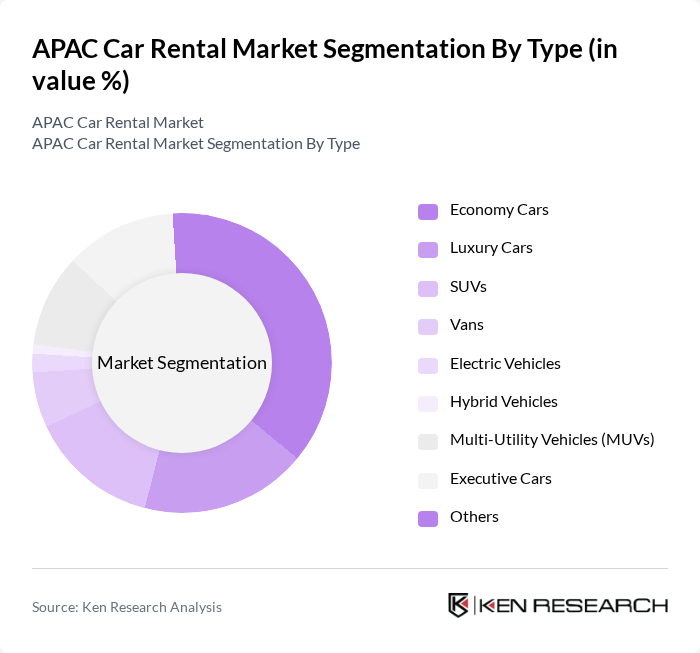

By Type:The market is segmented into various types of vehicles available for rental, including Economy Cars, Luxury Cars, SUVs, Vans, Electric Vehicles, Hybrid Vehicles, Multi-Utility Vehicles (MUVs), Executive Cars, and Others. Each type caters to different consumer preferences and needs, influencing the overall market dynamics.

The Economy Cars segment dominates the market due to their affordability and practicality for a wide range of consumers, including tourists and local residents. The increasing trend of budget travel and the need for cost-effective transportation options have led to a higher demand for economy vehicles. Additionally, the rise of ride-sharing services has further popularized this segment, as consumers seek economical solutions for short-term rentals. The Luxury Cars segment follows, appealing to affluent customers seeking premium experiences, particularly in urban centers.

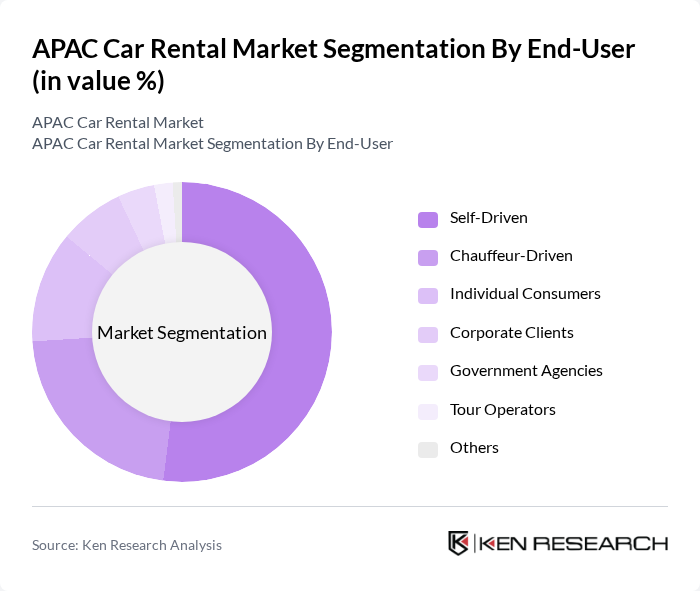

By End-User:The market is segmented based on end-users, including Self-Driven, Chauffeur-Driven, Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, and Others. This segmentation reflects the diverse needs and preferences of different customer groups in the car rental market.

The Self-Driven segment leads the market, driven by the growing preference for personal mobility and the flexibility it offers. Consumers increasingly favor self-driven rentals for leisure and business travel, allowing them to explore destinations at their own pace. The Chauffeur-Driven segment is also significant, particularly among corporate clients and tourists seeking convenience and comfort. This trend is supported by the rise in business travel and the demand for premium services.

The APAC Car Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Global Holdings, Avis Budget Group, Enterprise Holdings, Sixt SE, Europcar Mobility Group, Carzonrent India, GoCar Malaysia, DriveMyCar (Australia), Redspot Car Rentals (Australia), Orix Rent-A-Car (Japan), Zoomcar (India), eHi Car Services (China), Shouqi Car Rental (China), Times Mobility (Japan), Keddy by Europcar contribute to innovation, geographic expansion, and service delivery in this space.

The APAC car rental market is poised for significant evolution, driven by technological innovations and changing consumer preferences. As urbanization continues to rise, rental services will increasingly cater to the demand for sustainable and flexible transportation options. The integration of electric vehicles into rental fleets and the expansion of digital platforms will enhance customer experiences. Additionally, partnerships with ride-sharing services will create synergies, allowing car rental companies to tap into new customer segments and improve service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy Cars Luxury Cars SUVs Vans Electric Vehicles Hybrid Vehicles Multi-Utility Vehicles (MUVs) Executive Cars Others |

| By End-User | Self-Driven Chauffeur-Driven Individual Consumers Corporate Clients Government Agencies Tour Operators Others |

| By Region | China India Japan South Korea Southeast Asia Oceania Rest of Asia-Pacific |

| By Rental Duration | Short-Term Rentals Long-Term Rentals Monthly Rentals Others |

| By Booking Channel | Online Platforms Mobile Apps Travel Agencies Direct Rentals Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Cash Payments Others |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Frequent Travelers, Vacation Planners |

| Corporate Car Rentals | 90 | Corporate Travel Managers, HR Executives |

| Airport Rental Services | 60 | Airport Operations Managers, Rental Desk Supervisors |

| Long-term Rentals | 50 | Fleet Managers, Business Owners |

| Luxury Car Rentals | 40 | Luxury Travel Advisors, High-net-worth Individuals |

The APAC Car Rental Market is valued at approximately USD 42 billion, driven by factors such as urbanization, rising disposable incomes, and a growing preference for flexible transportation options among consumers, particularly in urban areas.