Chile Offshore Wind Power Market Overview

- The Chile Offshore Wind Power Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the country's commitment to renewable energy, favorable wind conditions, and increasing investments in sustainable infrastructure. The government’s initiatives to reduce carbon emissions and diversify energy sources have significantly contributed to the market's expansion.

- Key players in this market include regions such as Biobío and Magallanes, which dominate due to their extensive coastlines and high wind potential. The geographical advantages, combined with supportive local policies and investments from both domestic and international companies, have positioned these areas as leaders in offshore wind energy development.

- In 2023, the Chilean government implemented a new regulation mandating that all new energy projects must include a minimum percentage of renewable energy sources. This regulation aims to ensure that at least 20% of the energy produced comes from renewable sources by 2025, thereby promoting the growth of offshore wind power and other renewable technologies.

Chile Offshore Wind Power Market Segmentation

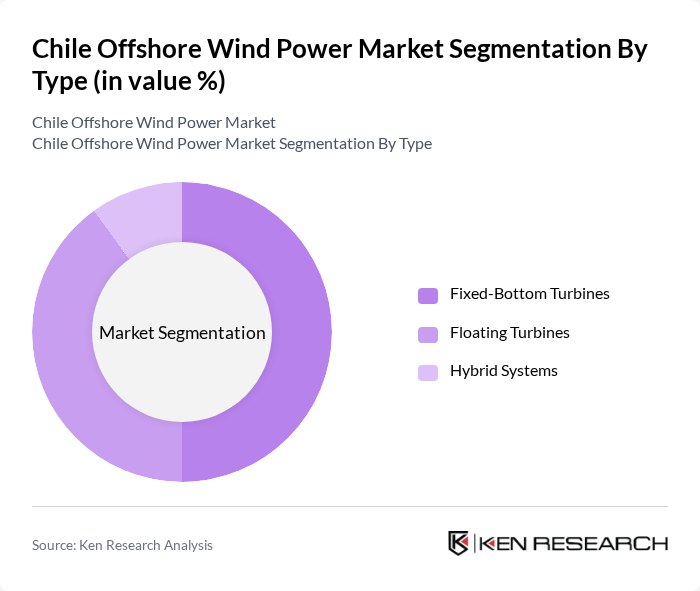

By Type:The market is segmented into three main types: Fixed-Bottom Turbines, Floating Turbines, and Hybrid Systems. Each type serves different operational needs and geographical conditions, with fixed-bottom turbines being more common in shallower waters, while floating turbines are gaining traction in deeper offshore locations.

The Fixed-Bottom Turbines segment is currently dominating the market due to their established technology and lower installation costs compared to floating systems. These turbines are particularly effective in the coastal areas of Chile, where water depths are manageable for fixed installations. However, the Floating Turbines segment is expected to grow as technology advances and deeper waters become more accessible for wind energy generation.

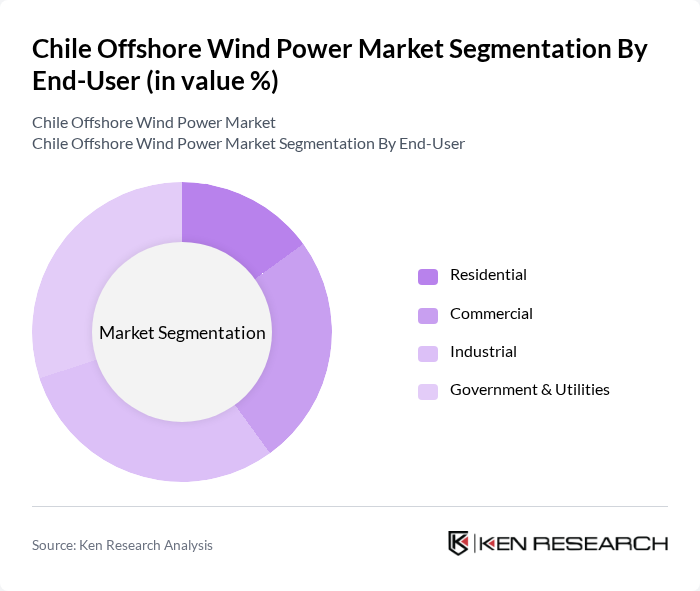

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. Each end-user segment has unique energy demands and regulatory requirements, influencing their adoption of offshore wind power solutions.

The Industrial segment is leading the market, driven by the high energy consumption needs of manufacturing and processing industries. These sectors are increasingly turning to offshore wind power to meet their energy requirements sustainably and cost-effectively. Government & Utilities also play a significant role, as they are responsible for large-scale energy production and distribution, often investing in offshore wind projects to meet national energy goals.

Chile Offshore Wind Power Market Competitive Landscape

The Chile Offshore Wind Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enel Green Power Chile, Acciona Energy Chile, Mainstream Renewable Power, Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, EDF Renewables, Engie Energía Chile, EDP Renewables, Nordex SE, GE Renewable Energy, Iberdrola Renovables, Senvion S.A., RWE Renewables, Ørsted A/S, Aker Solutions contribute to innovation, geographic expansion, and service delivery in this space.

Chile Offshore Wind Power Market Industry Analysis

Growth Drivers

- Increasing Energy Demand:Chile's energy consumption is projected to reach 80 terawatt-hours (TWh) in the future, driven by industrial growth and urbanization. The country's commitment to renewable energy sources aims to meet this rising demand sustainably. With a population exceeding 19 million, the need for reliable energy sources is critical. The government’s target of generating 70% of its electricity from renewables by 2050 further emphasizes the urgency for offshore wind power development, positioning it as a key player in the energy mix.

- Government Support and Incentives:The Chilean government has implemented various policies to promote renewable energy, including offshore wind. In the future, the government allocated approximately $1 billion for renewable energy projects, including offshore wind initiatives. Additionally, the introduction of tax incentives and subsidies for renewable energy investments has attracted both local and international investors. This supportive regulatory framework is crucial for fostering growth in the offshore wind sector, ensuring that projects can secure financing and achieve timely implementation.

- Technological Advancements:The offshore wind sector in Chile is benefiting from significant technological advancements, particularly in turbine efficiency and installation techniques. In the future, the average capacity of offshore wind turbines is expected to exceed 10 megawatts (MW), enhancing energy output and reducing costs. Innovations in floating wind technology are particularly relevant for Chile, given its deep coastal waters. These advancements not only improve the feasibility of offshore projects but also contribute to lowering the levelized cost of energy (LCOE), making wind power more competitive.

Market Challenges

- High Initial Investment Costs:The capital required for offshore wind projects in Chile is substantial, with estimates ranging from $3 million to $6 million per MW installed. This high initial investment poses a significant barrier to entry for many developers. In the future, the total investment needed for planned offshore wind projects is projected to exceed $5 billion. Securing financing for such large-scale projects remains a challenge, particularly in a market where investors are cautious about long-term returns in the renewable sector.

- Regulatory Hurdles:Navigating the regulatory landscape in Chile can be complex for offshore wind projects. The permitting process often involves multiple governmental agencies, which can lead to delays and increased costs. In the future, it is estimated that the average time to obtain necessary permits for offshore wind projects could take up to 3 years. This regulatory uncertainty can deter potential investors and slow down the overall growth of the offshore wind market, impacting project timelines and financial viability.

Chile Offshore Wind Power Market Future Outlook

The Chile offshore wind power market is poised for significant growth, driven by increasing energy demands and supportive government policies. As technological advancements continue to lower costs and improve efficiency, the sector is expected to attract more investments. The focus on sustainability and the transition to clean energy will further enhance the market's appeal. In the future, the integration of offshore wind into the national grid will be crucial, paving the way for a more resilient and diversified energy landscape in Chile.

Market Opportunities

- Expansion of Offshore Wind Farms:The Chilean coastline offers vast potential for offshore wind development, with estimates suggesting over 30 GW of capacity could be harnessed. This presents a significant opportunity for developers to invest in new projects, particularly in regions with high wind speeds. The government’s commitment to renewable energy targets will likely facilitate the establishment of additional offshore wind farms, creating jobs and stimulating local economies.

- International Collaboration and Investment:Chile's offshore wind sector is attracting international interest, with foreign investments projected to reach $2 billion in the future. Collaborations with global energy firms can bring in advanced technologies and expertise, enhancing project viability. This influx of capital and knowledge will not only accelerate project development but also position Chile as a leader in the Latin American renewable energy market, fostering a sustainable energy future.