Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1972

Pages:84

Published On:August 2025

By Type:

The major subsegments under this category include Strategy Consulting, Operations Consulting, Technology Consulting, Implementation Consulting, Sourcing and Procurement Consulting, Risk Management Consulting, Supply Chain Optimization Consulting, and Others. Among these, Operations Consulting is currently the leading subsegment, driven by the increasing need for efficiency and cost reduction in supply chain processes. Companies are focusing on optimizing their operations to remain competitive, which has led to a surge in demand for specialized consulting services in this area. The adoption of digital tools and process automation is further accelerating demand for operations-focused consulting .

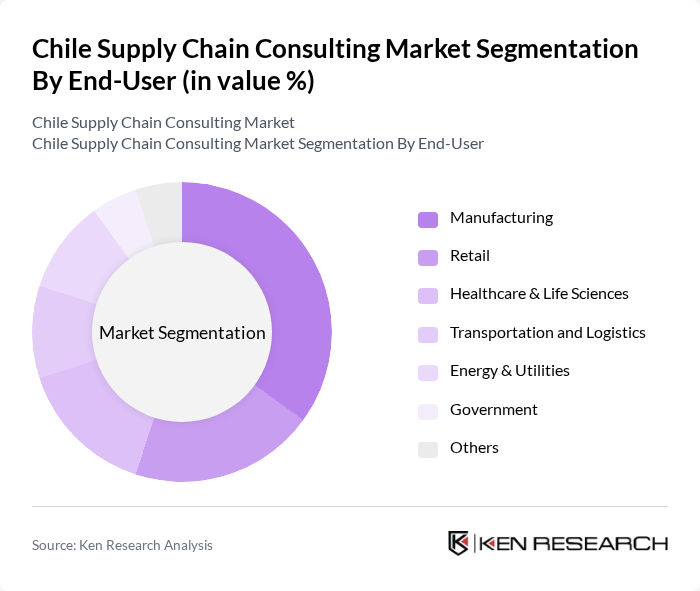

By End-User:

This segmentation includes Manufacturing, Retail, Healthcare & Life Sciences, Transportation and Logistics, Energy & Utilities, Government, and Others. The Manufacturing sector is the dominant end-user, as it heavily relies on efficient supply chain management to optimize production processes and reduce costs. The increasing focus on lean manufacturing, just-in-time inventory practices, and digital transformation in production environments has further fueled the demand for consulting services tailored to this sector. Retail and healthcare are also significant contributors, driven by the need for agile supply chains and regulatory compliance .

The Chile Supply Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte Chile, PwC Chile, KPMG Chile, EY Chile, Accenture Chile, Boston Consulting Group (BCG) Chile, McKinsey & Company Chile, Bain & Company Chile, Roland Berger Chile, Oliver Wyman Chile, Kearney Chile, Capgemini Chile, Tata Consultancy Services (TCS) Chile, Infosys Consulting Chile, Cognizant Technology Solutions Chile, Grupo EULEN Chile, LOGÍSTICA S.A., Miebach Consulting Chile, Alaya Consulting Chile, Synchro Logística Chile contribute to innovation, geographic expansion, and service delivery in this space .

The Chile supply chain consulting market is poised for transformative growth, driven by the increasing adoption of digital technologies and a heightened focus on sustainability. As companies prioritize efficiency and resilience in their supply chains, consulting firms will play a crucial role in guiding these transitions. The integration of AI and data analytics will enhance decision-making processes, while sustainability initiatives will reshape operational strategies, ensuring that firms remain competitive in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting Technology Consulting Implementation Consulting Sourcing and Procurement Consulting Risk Management Consulting Supply Chain Optimization Consulting Others |

| By End-User | Manufacturing Retail Healthcare & Life Sciences Transportation and Logistics Energy & Utilities Government Others |

| By Service Model | On-site Consulting Remote Consulting Hybrid Consulting |

| By Project Duration | Short-term Projects Long-term Projects |

| By Industry Vertical | Consumer Goods Automotive Electronics Pharmaceuticals Food & Beverage |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Geographic Focus | Domestic Focus International Focus |

| By Pricing Model | Fixed Pricing Hourly Billing Retainer Fees Performance-based Fees |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Supply Chain Management | 60 | Supply Chain Managers, Operations Directors |

| Agricultural Logistics Solutions | 50 | Logistics Coordinators, Procurement Managers |

| Retail Distribution Networks | 40 | Warehouse Managers, Retail Operations Heads |

| Freight Forwarding Services | 40 | Logistics Service Providers, Freight Managers |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Analysts |

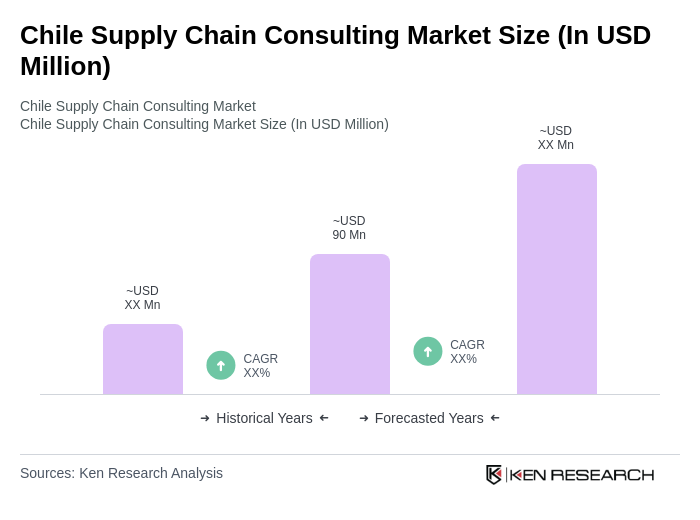

The Chile Supply Chain Consulting Market is valued at approximately USD 90 million, reflecting a five-year historical analysis. This growth is driven by the increasing complexity of supply chains and the demand for efficiency in logistics and operations.