Region:Global

Author(s):Shubham

Product Code:KRAA0810

Pages:96

Published On:August 2025

By Type:The market is segmented into various types of consulting services, including Strategy Consulting, Operations Consulting, Technology Consulting, Risk Management Consulting, Sustainability Consulting, Procurement Consulting, Logistics & Transportation Consulting, Inventory & Demand Planning Consulting, and Others. Each of these segments plays a crucial role in addressing specific client needs and challenges. Strategy Consulting focuses on long-term supply chain planning and transformation; Operations Consulting addresses process optimization and efficiency; Technology Consulting supports digitalization and IT integration; Risk Management Consulting helps identify and mitigate supply chain risks; Sustainability Consulting guides clients on environmental and social responsibility; Procurement Consulting optimizes sourcing and supplier management; Logistics & Transportation Consulting improves distribution networks; Inventory & Demand Planning Consulting enhances forecasting and inventory control; and Others include niche and specialized services .

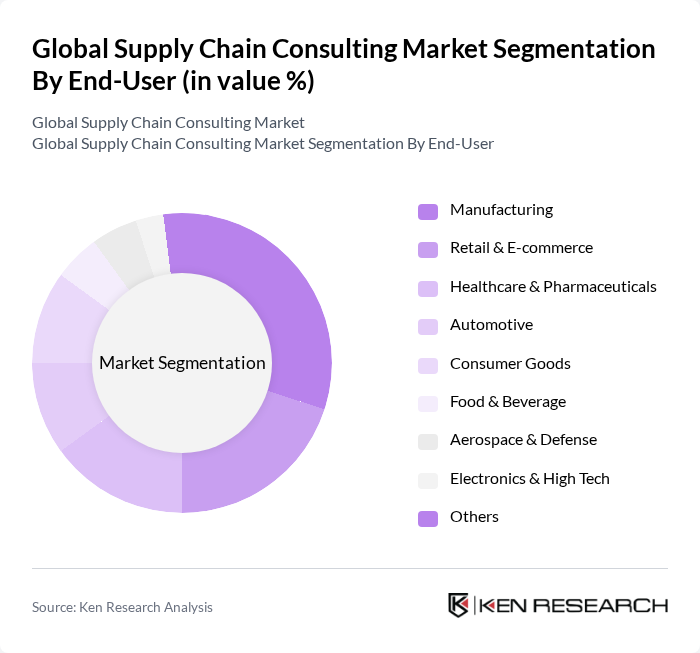

By End-User:The end-user segmentation includes Manufacturing, Retail & E-commerce, Healthcare & Pharmaceuticals, Automotive, Consumer Goods, Food & Beverage, Aerospace & Defense, Electronics & High Tech, and Others. Each sector has unique supply chain challenges that require tailored consulting solutions. Manufacturing leads due to the need for process optimization and global sourcing; Retail & E-commerce drives demand for omnichannel logistics and last-mile delivery solutions; Healthcare & Pharmaceuticals focus on regulatory compliance and cold chain management; Automotive emphasizes supplier risk management and just-in-time delivery; Consumer Goods and Food & Beverage require demand forecasting and inventory optimization; Aerospace & Defense prioritize security and traceability; Electronics & High Tech need rapid product lifecycle management; and Others include specialized industries with unique supply chain requirements .

The Global Supply Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting, Accenture, PwC Advisory Services, KPMG, Ernst & Young (EY), Capgemini, Oliver Wyman, Kearney (formerly A.T. Kearney), Roland Berger, Gartner, Chainalytics (a NTT DATA company), L.E.K. Consulting, Genpact, IBM Consulting, Infosys Consulting, Wipro Consulting, Tata Consultancy Services (TCS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the supply chain consulting market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. Companies are increasingly focusing on building resilient supply chains that can withstand disruptions, emphasizing the need for agile consulting solutions. Additionally, the integration of sustainability practices is becoming a priority, as businesses seek to align with environmental goals. This shift will create new avenues for consulting firms to innovate and provide value-added services in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting Technology Consulting Risk Management Consulting Sustainability Consulting Procurement Consulting Logistics & Transportation Consulting Inventory & Demand Planning Consulting Others |

| By End-User | Manufacturing Retail & E-commerce Healthcare & Pharmaceuticals Automotive Consumer Goods Food & Beverage Aerospace & Defense Electronics & High Tech Others |

| By Service Model | On-site Consulting Remote/Virtual Consulting Hybrid Consulting |

| By Industry Vertical | Aerospace & Defense Food & Beverage Pharmaceuticals Electronics & High Tech Energy & Utilities Others |

| By Geographic Focus | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Consulting Duration | Short-term Projects Long-term Engagements |

| By Pricing Model | Fixed Pricing Hourly Billing Performance-based Pricing Retainer-based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 100 | Supply Chain Managers, Operations Directors |

| Retail Logistics Strategy | 60 | Logistics Coordinators, Retail Operations Managers |

| Healthcare Supply Chain Management | 50 | Pharmaceutical Supply Chain Officers, Hospital Logistics Managers |

| Technology Integration in Supply Chains | 40 | IT Managers, Digital Transformation Leads |

| Global Trade Compliance and Risk Management | 45 | Compliance Officers, Risk Management Specialists |

The Global Supply Chain Consulting Market is valued at approximately USD 24 billion, reflecting a significant growth driven by the increasing complexity of supply chains and the demand for operational efficiency and digital transformation in logistics and procurement processes.