Region:Asia

Author(s):Geetanshi

Product Code:KRAB0034

Pages:81

Published On:August 2025

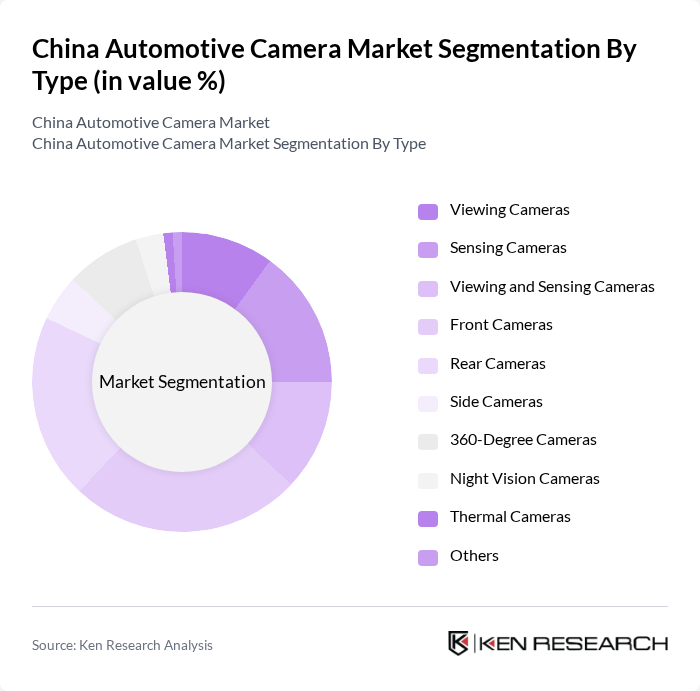

By Type:The market is segmented into various types of automotive cameras, including Viewing Cameras, Sensing Cameras, Viewing and Sensing Cameras, Front Cameras, Rear Cameras, Side Cameras, 360-Degree Cameras, Night Vision Cameras, Thermal Cameras, and Others. Among these, Front Cameras are leading the market due to their critical role in safety features and ADAS applications. The increasing focus on vehicle safety and the growing trend of autonomous driving are driving the demand for these cameras.

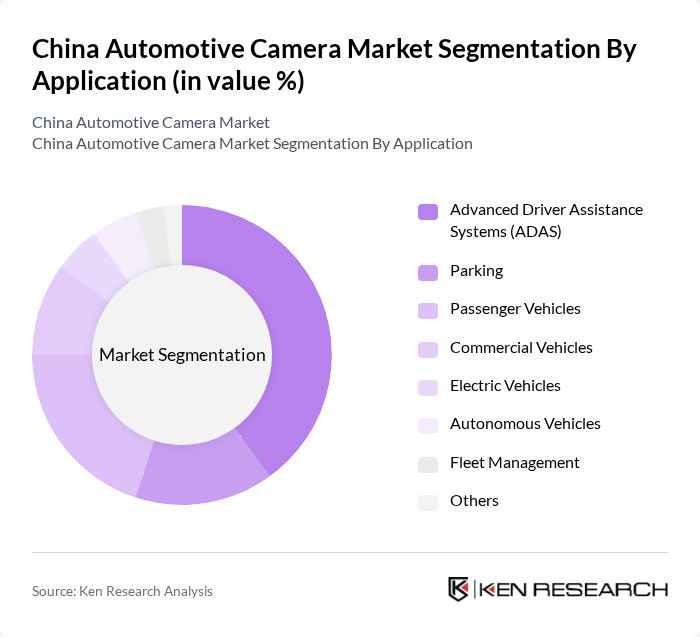

By Application:The applications of automotive cameras include Advanced Driver Assistance Systems (ADAS), Parking, Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Autonomous Vehicles, Fleet Management, and Others. The ADAS segment is the most significant contributor to the market, driven by the increasing adoption of safety features in vehicles and the growing consumer preference for advanced technology in automobiles.

The China Automotive Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Huawei Technologies Co., Ltd., Sunny Optical Technology (Group) Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Desay SV Automotive Co., Ltd., Suzhou INVO Automotive Electronics Co., Ltd., OmniVision Technologies, Inc., Panasonic Corporation, Sony Group Corporation, Continental AG, Robert Bosch GmbH, Denso Corporation, Valeo SA, Aptiv PLC, ZF Friedrichshafen AG, Ambarella, Inc., Mobileye Global Inc., NXP Semiconductors N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive camera market in China appears promising, driven by technological advancements and increasing consumer demand for safety features. As electric and autonomous vehicles gain traction, the integration of sophisticated camera systems will become essential. Furthermore, the rise of connected car technologies will enhance the functionality of these systems, leading to improved safety and user experience. The market is expected to evolve rapidly, with innovations in AI and machine learning playing a pivotal role in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Viewing Cameras Sensing Cameras Viewing and Sensing Cameras Front Cameras Rear Cameras Side Cameras Degree Cameras Night Vision Cameras Thermal Cameras Others |

| By Application | Advanced Driver Assistance Systems (ADAS) Parking Passenger Vehicles Commercial Vehicles Electric Vehicles Autonomous Vehicles Fleet Management Others |

| By End-User | OEMs Aftermarket Fleet Operators Government Agencies Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Region | North China South China East China West China Others |

| By Price Range | Low-End Cameras Mid-Range Cameras High-End Cameras Luxury Cameras |

| By Technology | Analog Cameras Digital Cameras Smart Cameras Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Automotive Camera Production | 100 | Product Managers, R&D Engineers |

| Suppliers of Camera Components | 80 | Supply Chain Managers, Quality Assurance Leads |

| Automotive Safety Regulators | 40 | Policy Makers, Compliance Officers |

| Automotive Aftermarket Retailers | 70 | Sales Managers, Technical Support Staff |

| Industry Experts and Analysts | 60 | Market Analysts, Technology Consultants |

The China Automotive Camera Market is valued at approximately USD 4.6 billion, driven by the increasing demand for advanced driver assistance systems (ADAS) and stringent safety regulations aimed at enhancing vehicle safety features.