Region:Asia

Author(s):Shubham

Product Code:KRAC0888

Pages:83

Published On:August 2025

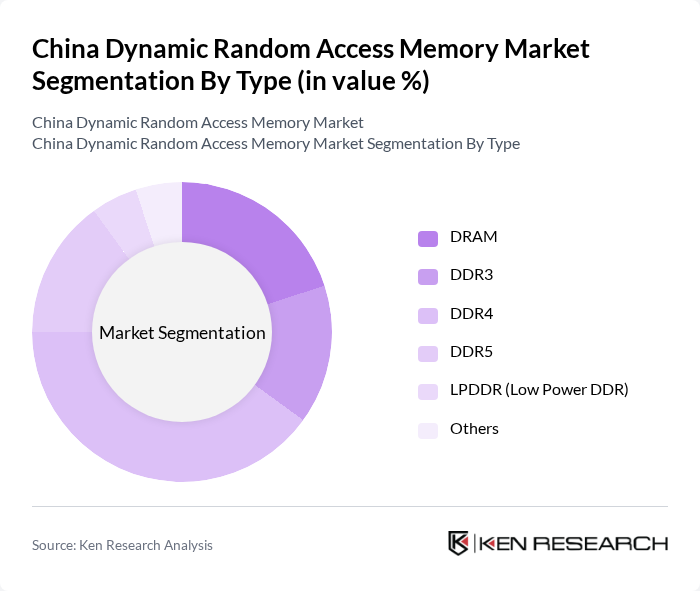

By Type:The market can be segmented into various types of dynamic random access memory, including DRAM, DDR3, DDR4, DDR5, LPDDR (Low Power DDR), and others. Among these, DDR4 remains the dominant type due to its widespread adoption in consumer electronics and data centers, driven by its balance of performance and power efficiency. DDR5 is rapidly gaining traction as the next-generation standard, particularly for high-performance computing and AI workloads, but DDR4 continues to be the preferred choice for mainstream applications .

By End-User:The end-user segmentation includes consumer electronics, automotive, data centers, industrial applications, and telecommunications. The consumer electronics segment is the largest, driven by the increasing demand for smartphones, tablets, and laptops. Data centers are also a significant end-user, as they require high-capacity memory solutions to support cloud computing and big data analytics. The automotive sector is experiencing notable growth due to the integration of advanced driver-assistance systems and infotainment solutions, while industrial and telecom applications continue to expand with the adoption of IoT and 5G technologies .

The China Dynamic Random Access Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., ChangXin Memory Technologies, Inc. (CXMT), Winbond Electronics Corporation, Nanya Technology Corporation, Powerchip Semiconductor Manufacturing Corporation (PSMC), GigaDevice Semiconductor Inc., Kingston Technology Company, Inc., Transcend Information, Inc., ADATA Technology Co., Ltd., Team Group Inc., Apacer Technology Inc., Silicon Power Computer & Communications Inc., Shenzhen Longsys Electronics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China DRAM market appears promising, driven by technological advancements and increasing demand across various sectors. The shift towards DDR5 memory technology is expected to enhance performance and energy efficiency, aligning with global trends. Additionally, the integration of AI in memory management will optimize data processing capabilities. As the market adapts to these trends, local manufacturers are likely to benefit from government support and investment, fostering a competitive landscape that encourages innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | DRAM DDR3 DDR4 DDR5 LPDDR (Low Power DDR) Others |

| By End-User | Consumer Electronics Automotive Data Centers Industrial Applications Telecommunications |

| By Application | Mobile Devices Personal Computers Servers Gaming Consoles Networking Equipment |

| By Distribution Channel | Direct Sales Online Retail Distributors |

| By Price Range | Low-End Mid-Range High-End |

| By Component | Memory Chips Modules Controllers |

| By Technology | D DRAM D DRAM Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Device DRAM Usage | 100 | Product Managers, R&D Engineers |

| PC DRAM Market Insights | 60 | Supply Chain Managers, Procurement Specialists |

| Server DRAM Applications | 50 | Data Center Operations Managers, IT Directors |

| Automotive DRAM Integration | 40 | Automotive Engineers, Electronics Designers |

| Consumer Electronics DRAM Trends | 50 | Market Analysts, Product Development Managers |

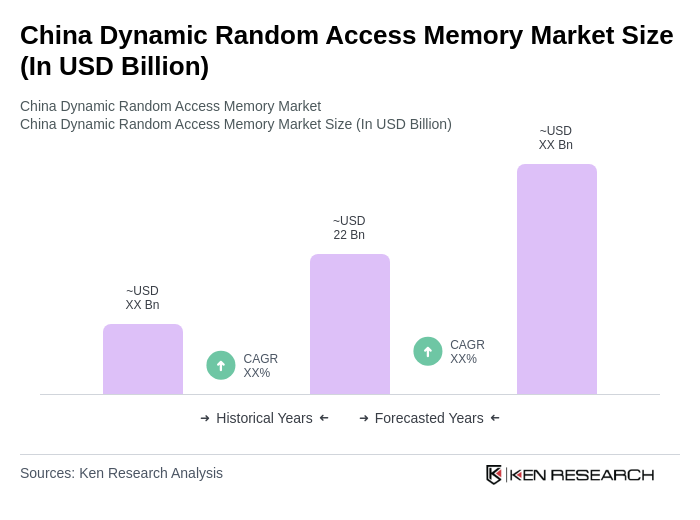

The China Dynamic Random Access Memory market is valued at approximately USD 22 billion, driven by the increasing demand for high-performance computing, mobile devices, and data centers, alongside advancements in artificial intelligence and cloud computing applications.