Region:Asia

Author(s):Dev

Product Code:KRAB0464

Pages:86

Published On:August 2025

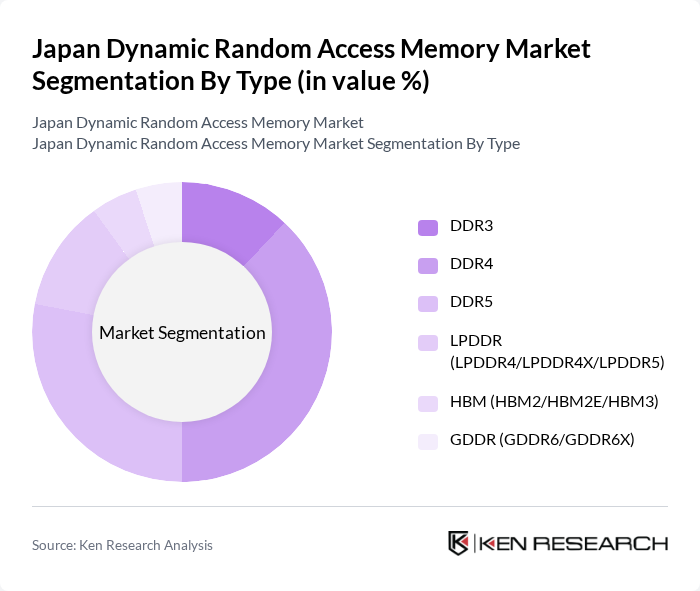

By Type:

The Japan Dynamic Random Access Memory market is significantly influenced by the DDR4 and DDR5 segments, which are dominating due to their widespread adoption in consumer PCs/PC OEM channels and data centers, with DDR5 rapidly gaining share as platform transitions by CPU vendors accelerate. DDR4 remains prevalent for cost/performance, while DDR5 adoption is buoyed by higher bandwidth/efficiency benefits, and AI/gaming workloads further drive higher?end memory, including HBM and GDDR, albeit from a smaller base.

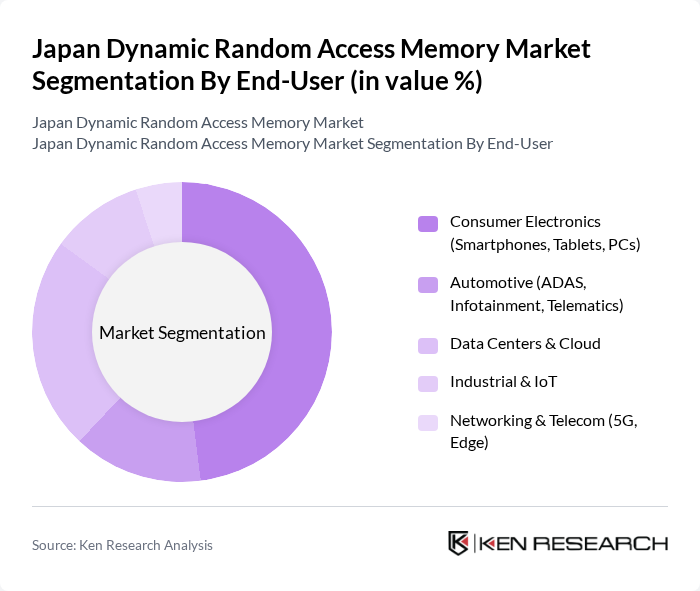

By End-User:

The consumer electronics segment is the largest end-user of dynamic random access memory in Japan, reflecting robust demand for smartphones, tablets, and PCs, while data centers increasingly adopt higher-density DRAM for cloud and AI workloads. The automotive sector is an emerging user with growing DRAM needs for ADAS, infotainment, and domain/zone controllers, supported by Japan’s strong auto OEM/ Tier?1 base.

The Japan Dynamic Random Access Memory market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., SK hynix Inc., Micron Technology, Inc. (incl. Micron Memory Japan K.K.), Nanya Technology Corporation, Winbond Electronics Corporation, Elpida Memory, Inc. (now Micron Memory Japan), Kioxia Holdings Corporation, Renesas Electronics Corporation, Rohm Co., Ltd. (ROHM Semiconductor), Socionext Inc., Fujitsu Limited, Infineon Technologies AG, STMicroelectronics N.V., Texas Instruments Incorporated, Alliance Memory, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan DRAM market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of DRAM in AI applications is expected to enhance processing capabilities, while the development of 5G technology will further boost data transmission speeds. Additionally, the focus on energy-efficient memory solutions aligns with global sustainability trends, positioning the Japanese DRAM market for growth. As manufacturers adapt to these trends, they will likely explore innovative solutions to meet evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | DDR3 DDR4 DDR5 LPDDR (LPDDR4/LPDDR4X/LPDDR5) HBM (HBM2/HBM2E/HBM3) GDDR (GDDR6/GDDR6X) |

| By End-User | Consumer Electronics (Smartphones, Tablets, PCs) Automotive (ADAS, Infotainment, Telematics) Data Centers & Cloud Industrial & IoT Networking & Telecom (5G, Edge) |

| By Application | Mobile Devices Personal Computers & Laptops Servers & Enterprise Storage Gaming Consoles & Graphics Automotive Electronics |

| By Distribution Channel | Direct Sales (OEM/ODM) Authorized Distributors Online B2B Platforms Retail/Aftermarket |

| By Price Range | Value Tier (Commodity DRAM) Performance Tier (Mainstream DDR/LPDDR) Premium Tier (HBM/GDDR/High-capacity ECC) |

| By Technology | DDR4 DDR5 LPDDR4/LPDDR5 HBM2E/HBM3 |

| By Region | Kanto Kansai Chubu Kyushu (incl. Kumamoto) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, Supply Chain Analysts |

| Automotive DRAM Applications | 75 | Engineering Managers, Procurement Specialists |

| Data Center Operators | 90 | IT Managers, Operations Directors |

| Research Institutions and Universities | 50 | Academic Researchers, Technology Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Regulators |

The Japan Dynamic Random Access Memory market is valued at approximately USD 3 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for high-performance computing, mobile innovation, and expanding data center deployments.