Region:Asia

Author(s):Rebecca

Product Code:KRAC0222

Pages:80

Published On:August 2025

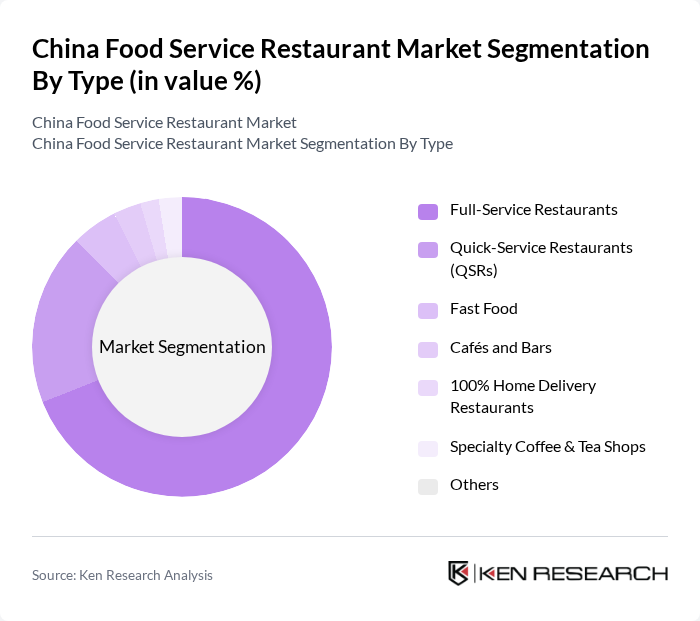

By Type:The market is segmented into Full-Service Restaurants, Quick-Service Restaurants (QSRs), Fast Food, Cafés and Bars, 100% Home Delivery Restaurants, Specialty Coffee & Tea Shops, and Others. Full-Service Restaurants represent the largest segment by value, reflecting the continued popularity of traditional dining experiences. Quick-Service Restaurants (QSRs) and Fast Food outlets have gained significant traction due to their convenience, affordability, and appeal to urban consumers with fast-paced lifestyles. Cafés, bars, and specialty coffee & tea shops are experiencing rapid growth, supported by the rising coffee culture and demand for premium beverages .

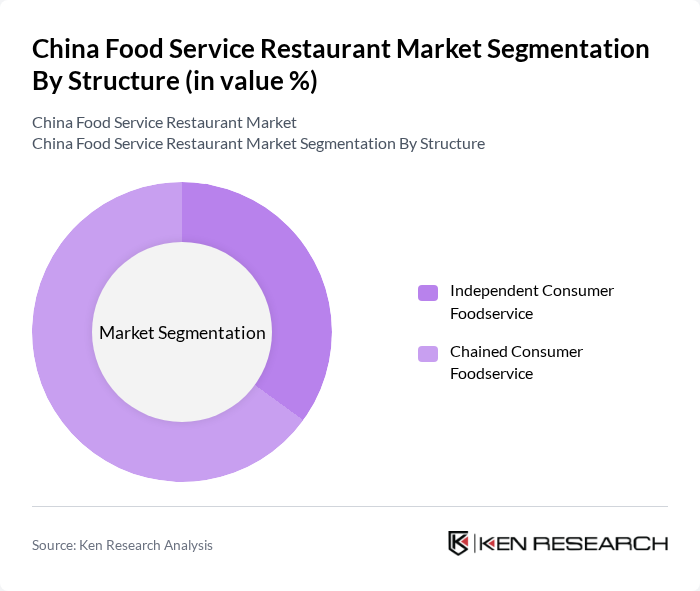

By Structure:The market is divided into Independent Consumer Foodservice and Chained Consumer Foodservice. Chained Consumer Foodservice leads the market, driven by strong brand recognition, standardized quality, and extensive marketing strategies. Independent establishments offer unique and localized dining experiences but face challenges in scaling and achieving broad brand visibility compared to their chained counterparts .

The China Food Service Restaurant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yum China Holdings, Inc., Haidilao International Holding Ltd., Jollibee Foods Corporation, Dicos (Chongqing Hongjiu Fruit Co., Ltd.), Xiabu Xiabu Catering Management Co., Ltd., Starbucks Corporation, McDonald's China (Golden Arches (China) Co., Ltd.), KFC (Yum China Holdings, Inc.), Pizza Hut (Yum China Holdings, Inc.), Din Tai Fung, Little Sheep Group Ltd., Quanjude (China Quanjude (Group) Co., Ltd.), Ajisen (China) Holdings Ltd., Meituan Dianping, Bafang Yunji International Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China food service restaurant market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, restaurants will increasingly focus on enhancing customer experiences through innovative dining concepts and improved service delivery. Additionally, the integration of technology, such as AI and data analytics, will streamline operations and personalize customer interactions, fostering loyalty and repeat business. The market is poised for growth as it adapts to these trends and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants Quick-Service Restaurants (QSRs) Fast Food Cafés and Bars % Home Delivery Restaurants Specialty Coffee & Tea Shops Others |

| By Structure | Independent Consumer Foodservice Chained Consumer Foodservice |

| By Service Type | Dine-In Takeaway Delivery Catering Services Ghost Kitchens/Cloud Kitchens Others |

| By Cuisine Type | Chinese Western Asian (Non-Chinese) Fusion/International Others |

| By Location | Urban Areas Suburban Areas Rural Areas Tourist Attractions Transportation Hubs (Airports, Train Stations) Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Franchise vs. Independent | Franchise Independent Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fast Food Chains | 80 | Franchise Owners, Regional Managers |

| Casual Dining Restaurants | 60 | Restaurant Managers, Marketing Directors |

| Fine Dining Establishments | 40 | Head Chefs, Owners |

| Food Delivery Services | 50 | Operations Managers, Delivery Coordinators |

| Consumer Dining Preferences | 100 | General Consumers, Food Enthusiasts |

The China Food Service Restaurant Market is valued at approximately USD 896 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and changing consumer preferences towards dining out and food delivery services.