Region:North America

Author(s):Geetanshi

Product Code:KRAC0042

Pages:80

Published On:August 2025

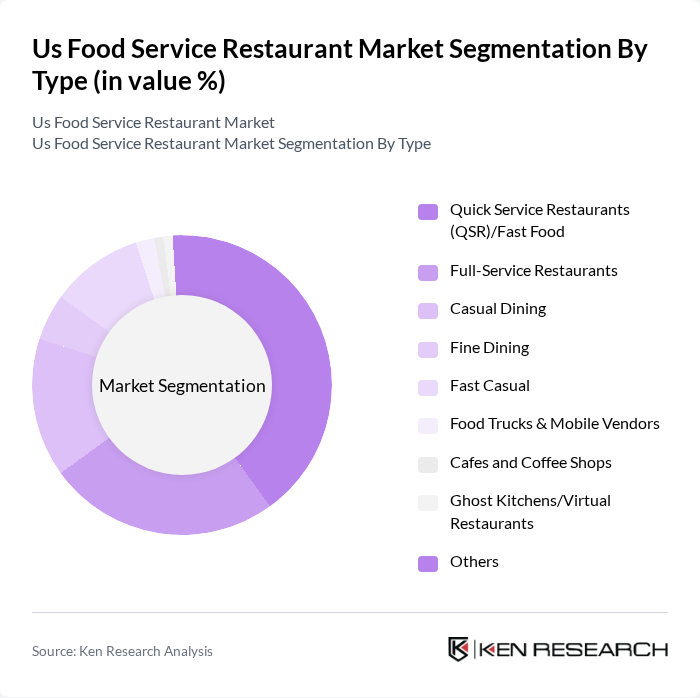

By Type:The market is segmented into various types of food service establishments, including Quick Service Restaurants (QSR)/Fast Food, Full-Service Restaurants, Casual Dining, Fine Dining, Fast Casual, Food Trucks & Mobile Vendors, Cafes and Coffee Shops, Ghost Kitchens/Virtual Restaurants, and Others. Each of these segments caters to different consumer preferences and dining experiences. Quick Service Restaurants remain the dominant segment, driven by consumer preference for convenience and affordability. Fast Casual and Ghost Kitchens are experiencing growth due to demand for flexible, tech-enabled dining options.

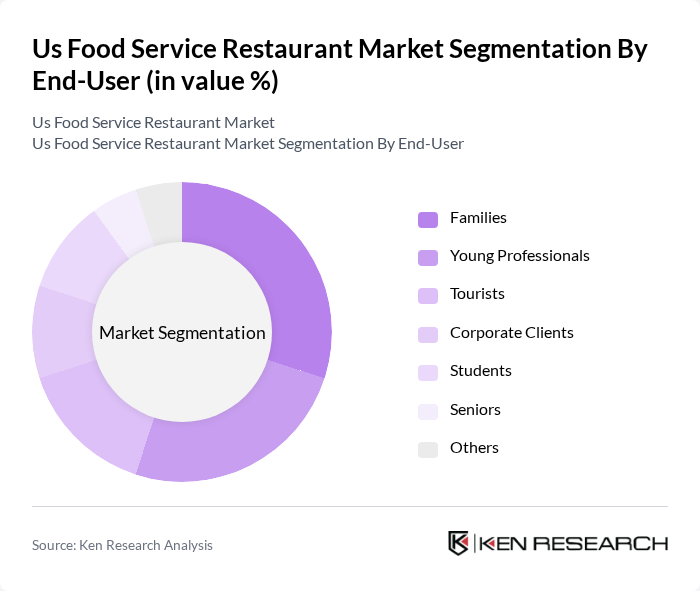

By End-User:The end-user segmentation includes Families, Young Professionals, Tourists, Corporate Clients, Students, Seniors, and Others. Each group has distinct dining preferences and spending habits, influencing the types of food service establishments that thrive in the market. Families and young professionals are the largest consumer groups, with young professionals driving demand for fast casual and delivery-focused formats.

The Us Food Service Restaurant Market is characterized by a dynamic mix of regional and international players. Leading participants such as McDonald's Corporation, Starbucks Corporation, Yum! Brands, Inc. (KFC, Taco Bell, Pizza Hut), Domino's Pizza, Inc., Chipotle Mexican Grill, Inc., Darden Restaurants, Inc. (Olive Garden, LongHorn Steakhouse), Restaurant Brands International Inc. (Burger King, Popeyes, Tim Hortons), Panera Bread Company, Shake Shack Inc., Wingstop Inc., Bloomin' Brands, Inc. (Outback Steakhouse, Carrabba's Italian Grill), Brinker International, Inc. (Chili's Grill & Bar, Maggiano's Little Italy), Cracker Barrel Old Country Store, Inc., Texas Roadhouse, Inc., BJ's Restaurants, Inc., Inspire Brands, Inc. (Arby's, Dunkin', Sonic Drive-In, Buffalo Wild Wings), The Wendy's Company, Papa John's International, Inc., JAB Holding Company (Krispy Kreme, Panera Bread, Pret A Manger), CAVA Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. food service restaurant market is poised for transformation as it adapts to evolving consumer preferences and technological advancements. The integration of AI and automation is expected to streamline operations, enhancing efficiency and customer experience. Additionally, sustainability practices will become increasingly important, with restaurants focusing on eco-friendly sourcing and waste reduction. As the market navigates challenges, innovative solutions will drive growth and reshape the dining landscape, positioning the industry for a resilient future.

| Segment | Sub-Segments |

|---|---|

| By Type | Quick Service Restaurants (QSR)/Fast Food Full-Service Restaurants Casual Dining Fine Dining Fast Casual Food Trucks & Mobile Vendors Cafes and Coffee Shops Ghost Kitchens/Virtual Restaurants Others |

| By End-User | Families Young Professionals Tourists Corporate Clients Students Seniors Others |

| By Service Type | Dine-In Takeout Delivery (including third-party platforms) Catering Drive-Thru Others |

| By Cuisine Type | American Italian Asian (Chinese, Japanese, Thai, etc.) Mexican Mediterranean Middle Eastern Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Location | Urban Suburban Rural Highway/Travel Centers Others |

| By Franchise vs Independent | Franchise Independent Chain-Owned Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fast Food Chains | 100 | Franchise Owners, Regional Managers |

| Casual Dining Restaurants | 80 | Restaurant Managers, Head Chefs |

| Food Trucks and Mobile Vendors | 60 | Owner-Operators, Marketing Managers |

| Fine Dining Establishments | 40 | Executive Chefs, General Managers |

| Delivery and Takeout Services | 50 | Operations Managers, Customer Experience Leads |

The US Food Service Restaurant Market is valued at approximately USD 1.2 trillion, reflecting a significant growth driven by consumer demand for convenience, food delivery services, and a trend towards dining out.