Region:Asia

Author(s):Dev

Product Code:KRAC0369

Pages:82

Published On:August 2025

By Type:The gaming market can be segmented into various types, including Mobile Games, PC Games, Console Games, Online Games, E-sports, Cloud Gaming, VR/AR Games, Casual Games, and Others. Among these, mobile games have emerged as the leading segment due to their accessibility and the increasing number of smartphone users. The convenience of mobile gaming allows players to engage in gaming experiences anytime and anywhere, significantly driving user engagement and revenue growth.

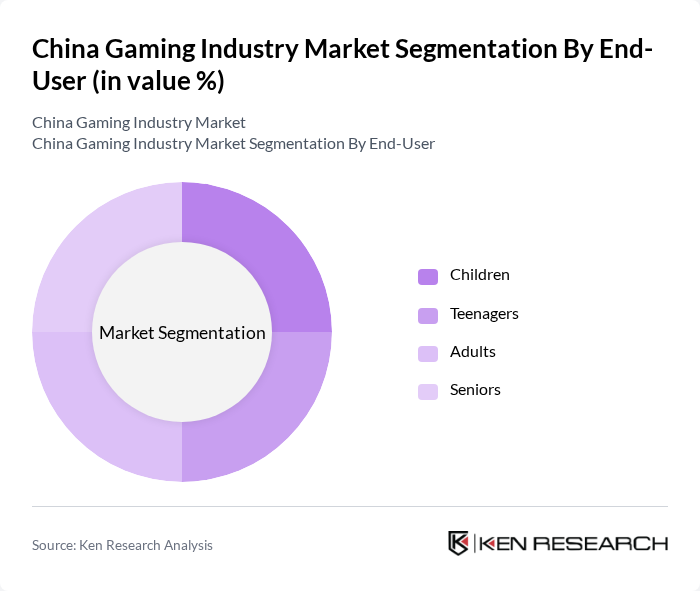

By End-User:The gaming market can also be segmented by end-user demographics, including Children, Teenagers, Adults, and Seniors. The segment of teenagers is particularly dominant, as this age group is highly engaged with gaming, often driven by social interactions and competitive gaming. The increasing availability of online platforms and social media integration has further fueled this trend, making gaming a popular pastime among teenagers.

The China Gaming Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Holdings Limited, NetEase Inc., Perfect World Co., Ltd., miHoYo Co., Ltd., 37 Interactive Entertainment Co., Ltd., Lilith Games, Bilibili Inc., Snail Games, FunPlus, IGG Inc., YOOZOO Games, Game Science Interactive Technology Co., Ltd., CMGE Technology Group Limited, Zhejiang Century Huatong Group Co., Ltd., and Giant Network Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China gaming industry appears promising, driven by technological advancements and evolving consumer preferences. With the anticipated growth in cloud gaming and the integration of AI technologies, developers are expected to create more immersive experiences. Additionally, the increasing popularity of subscription-based models will likely reshape revenue streams. As the market continues to adapt to regulatory changes, companies that embrace innovation and collaboration will be well-positioned to capitalize on emerging trends and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Games PC Games Console Games Online Games E-sports Cloud Gaming VR/AR Games Casual Games Others |

| By End-User | Children Teenagers Adults Seniors |

| By Distribution Channel | Online Platforms Mobile App Stores Retail Stores Subscription Services Third-Party Game Distributors |

| By Genre | Action Adventure Strategy Simulation Sports Role-Playing (RPG) Puzzle Card & Board Games |

| By Payment Model | Free-to-Play Pay-to-Play Subscription-Based In-App Purchases |

| By Game Development Stage | Pre-Production Production Post-Production |

| By User Engagement | Single-Player Multiplayer Co-op Competitive |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 150 | Casual Gamers, Mobile Game Developers |

| PC Gaming Community | 100 | Hardcore Gamers, eSports Participants |

| Console Gaming Enthusiasts | 80 | Console Game Developers, Retail Managers |

| Game Streaming Audience | 70 | Content Creators, Viewers of Gaming Streams |

| VR/AR Gaming Users | 60 | Tech Enthusiasts, VR Game Developers |

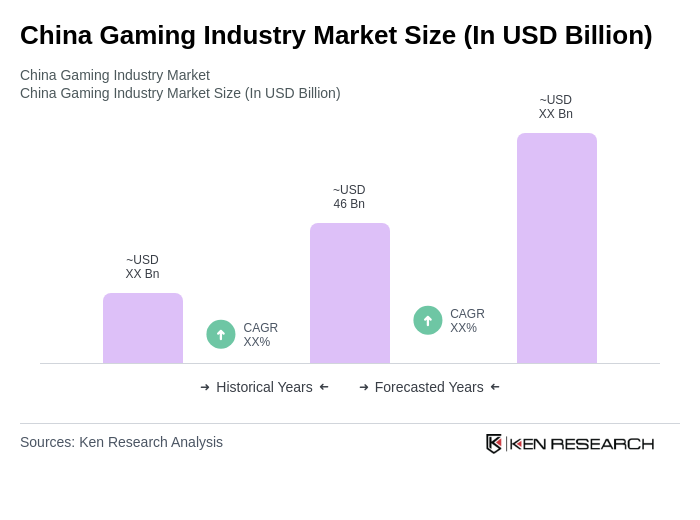

The China Gaming Industry Market is valued at approximately USD 46 billion, driven by factors such as smartphone penetration, 5G connectivity, and the rise of e-sports and online gaming platforms.