Region:Global

Author(s):Rebecca

Product Code:KRAB0204

Pages:100

Published On:August 2025

By Type:The gaming industry is segmented into Mobile Games, PC Games, Console Games, Cloud Games, Online Casino Games, Social Games, E-sports, Indie Games, and Others. Among these, Mobile Games have emerged as the dominant segment, driven by the widespread use of smartphones, the increasing availability of high-speed internet, and the integration of advanced technologies such as 5G and cloud gaming. The convenience of mobile gaming allows users to engage in gaming experiences anytime and anywhere, making it particularly appealing to younger audiences. The rapid growth of mobile gaming has also been fueled by innovative game design, social connectivity features, and monetization strategies such as in-app purchases and advertisements.

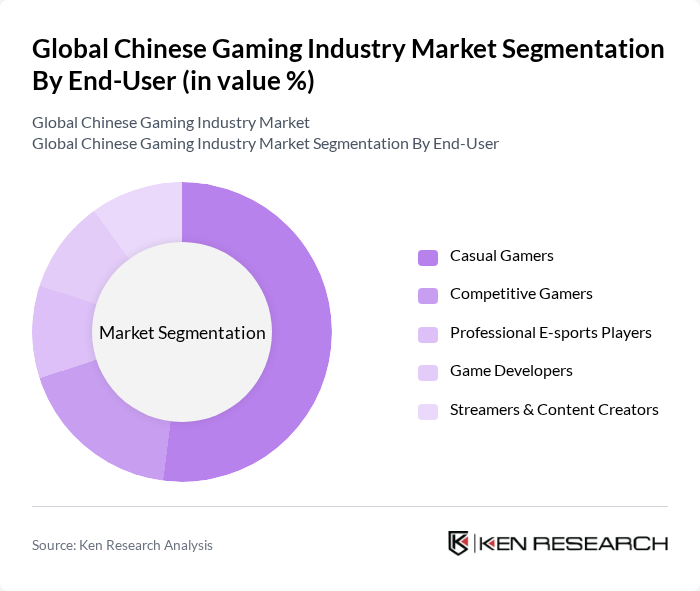

By End-User:The end-user segmentation includes Casual Gamers, Competitive Gamers, Professional E-sports Players, Game Developers, and Streamers & Content Creators. Casual Gamers represent the largest segment, as they engage in gaming primarily for entertainment and relaxation. This group is characterized by a diverse age range and varying levels of gaming experience, leading to a broad demand for accessible and engaging games. The rise of social media, live streaming, and short video platforms has also contributed to the growth of this segment, as casual gamers increasingly share their experiences and connect with others online.

The Global Chinese Gaming Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Holdings Limited, NetEase Inc., miHoYo Co., Ltd., 37 Interactive Entertainment Co., Ltd., Lilith Games, Bilibili Inc., IGG Inc., FunPlus International AG, YOOZOO Games, Perfect World Co., Ltd., Century Huatong Group Co., Ltd., Giant Network Group Co., Ltd., CMGE Technology Group Limited, XD Inc., Game Science Interactive Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Chinese gaming industry appears promising, driven by technological advancements and evolving consumer preferences. The integration of virtual reality (VR) and augmented reality (AR) technologies is expected to enhance gaming experiences, attracting a broader audience. Additionally, the rise of subscription-based models will likely reshape revenue streams, providing developers with stable income. As international markets open up, Chinese gaming companies are poised to expand their reach, capitalizing on global trends and diversifying their offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Games PC Games Console Games Cloud Games Online Casino Games Social Games E-sports Indie Games Others |

| By End-User | Casual Gamers Competitive Gamers Professional E-sports Players Game Developers Streamers & Content Creators |

| By Distribution Channel | Online Platforms (App Stores, Steam, TapTap, etc.) Retail Stores Direct Sales Subscription Services Social Media & Mini-Game Ecosystems (e.g., TikTok, Bilibili) |

| By Genre | Action Adventure Strategy Simulation Role-Playing Games (RPG) Sports Puzzle Casual Others |

| By Age Group | Children (under 12) Teenagers (13-18) Young Adults (19-35) Adults (36-59) Seniors (60+) |

| By Payment Model | Free-to-Play Pay-to-Play Subscription-Based In-App Purchases Advertising-Supported |

| By Platform | Mobile (iOS, Android) PC (Windows, Mac, Linux) Console (PlayStation, Xbox, Switch, local brands) Cloud Gaming Web Browser |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 150 | Casual Gamers, Mobile Game Developers |

| PC Gaming Enthusiasts | 100 | Hardcore Gamers, PC Game Publishers |

| Console Gaming Market | 80 | Console Gamers, Retail Managers |

| Esports Participants | 60 | Esports Athletes, Team Managers |

| Game Development Insights | 40 | Game Designers, Product Managers |

The Global Chinese Gaming Industry Market is valued at approximately USD 50 billion, driven by factors such as smartphone penetration, mobile gaming growth, and improved internet infrastructure, particularly among younger demographics seeking diverse gaming experiences.