Region:Asia

Author(s):Rebecca

Product Code:KRAC0230

Pages:86

Published On:August 2025

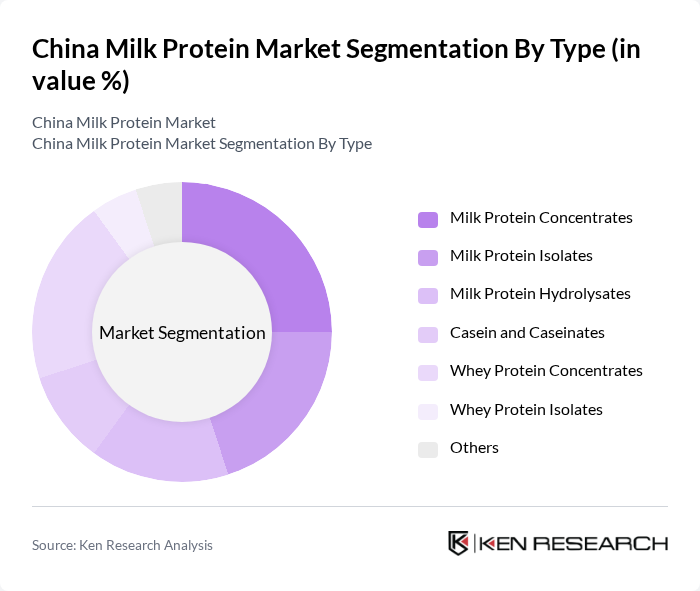

By Type:The market is segmented into various types of milk proteins, including Milk Protein Concentrates, Milk Protein Isolates, Milk Protein Hydrolysates, Casein and Caseinates, Whey Protein Concentrates, Whey Protein Isolates, and Others. Each of these subsegments caters to different consumer needs and applications, with specific nutritional benefits and functional properties. Milk protein concentrates and isolates are favored for their high protein content and functional versatility in sports nutrition, infant formula, and clinical nutrition. Casein and caseinates are widely used in cheese and processed foods for their slow-digesting properties, while whey proteins are popular in beverages and supplements for rapid absorption and muscle recovery benefits .

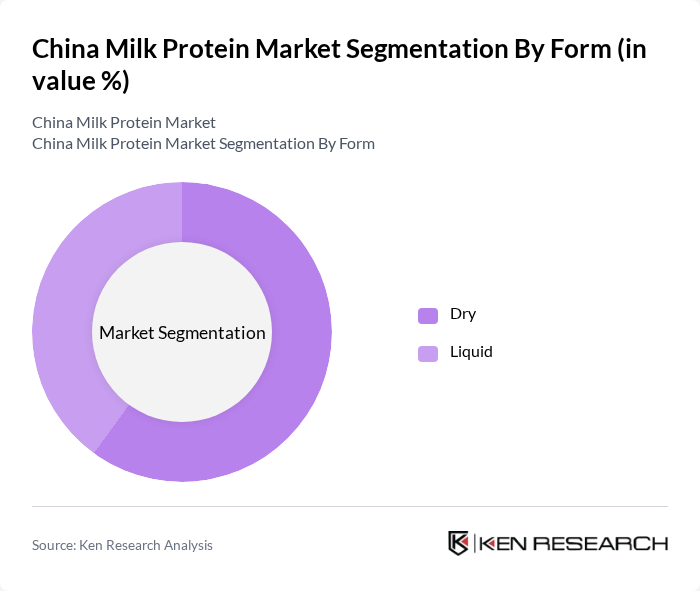

By Form:The milk protein market is also categorized by form, which includes Dry and Liquid forms. The choice between these forms often depends on the end-use application, with dry forms being preferred for longer shelf life and convenience, while liquid forms are favored for immediate consumption and specific applications. Dry forms dominate the market due to their stability, ease of transport, and suitability for large-scale food processing, while liquid forms are primarily used in ready-to-drink products and specialized nutrition solutions .

The China Milk Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Inner Mongolia Yili Industrial Group Co., Ltd., China Mengniu Dairy Company Limited, Fonterra Co-operative Group Limited, Royal FrieslandCampina N.V., Lactalis Ingredients, Arla Foods amba, Danone S.A., Glanbia Nutritionals, Milk Specialties Global, Saputo Inc., Agropur Cooperative, Olam International, The Kraft Heinz Company, Kerry Group plc, DSM-Firmenich contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China milk protein market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for high-quality, protein-rich products is expected to grow. Additionally, innovations in dairy processing and product development will likely enhance the market's appeal. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Protein Concentrates Milk Protein Isolates Milk Protein Hydrolysates Casein and Caseinates Whey Protein Concentrates Whey Protein Isolates Others |

| By Form | Dry Liquid |

| By Application | Dairy Products Infant Formula Dietary Supplements Beverages Sweet & Savory Bakery & Confectionery Animal Feed Personal Care and Cosmetics Others |

| By End-User | Food and Beverage Manufacturers Health and Fitness Enthusiasts Athletes General Consumers Animal Nutrition Companies |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Powder Liquid Granules |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Milk Protein Consumption Trends | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Dairy Industry Stakeholders | 80 | Dairy Farmers, Milk Processors |

| Retail Market Insights | 60 | Retail Managers, Category Buyers |

| Nutrition and Health Perspectives | 50 | Nutritionists, Dieticians |

| Consumer Awareness and Preferences | 70 | General Consumers, Parents of Young Children |

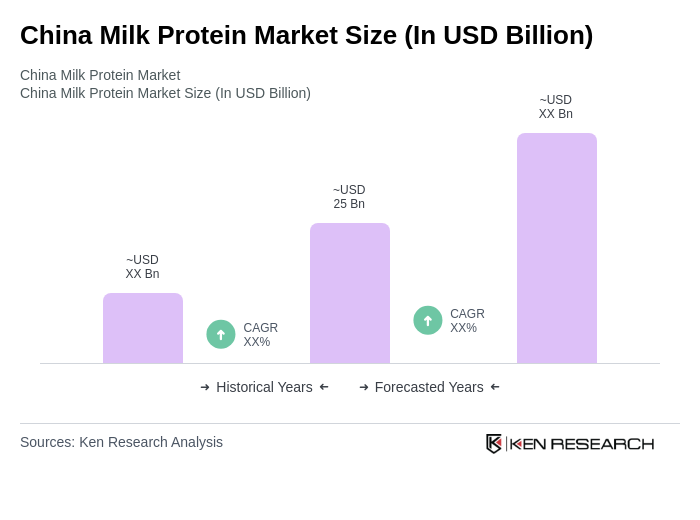

The China Milk Protein Market is valued at approximately USD 25 billion, driven by increasing demand for high-protein diets, health consciousness, and the growth of the infant formula sector, among other factors.