Region:Asia

Author(s):Shubham

Product Code:KRAC2237

Pages:90

Published On:October 2025

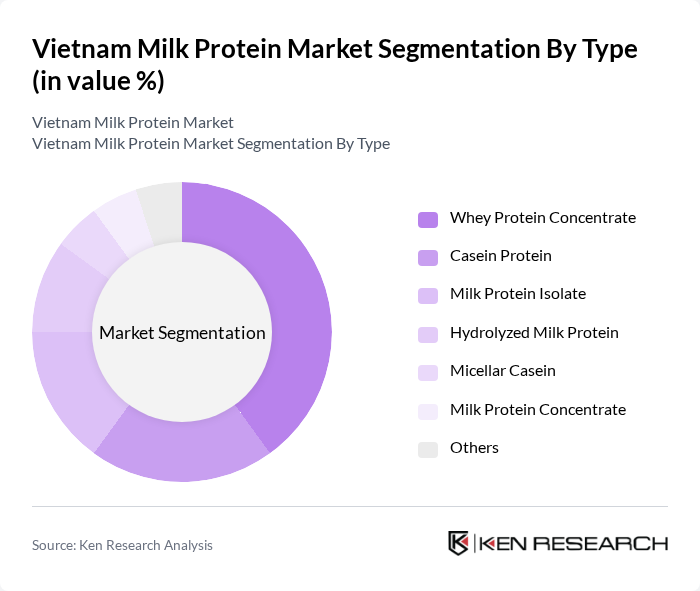

By Type:The market is segmented into various types of milk protein, including Whey Protein Concentrate, Casein Protein, Milk Protein Isolate, Hydrolyzed Milk Protein, Micellar Casein, Milk Protein Concentrate, and Others. Among these, Whey Protein Concentrate is the leading sub-segment due to its high digestibility and popularity in sports nutrition. The increasing trend of fitness and health awareness has significantly boosted the demand for whey protein, making it a preferred choice among consumers. This is supported by the growing fitness culture and recommendations for protein supplementation by healthcare professionals .

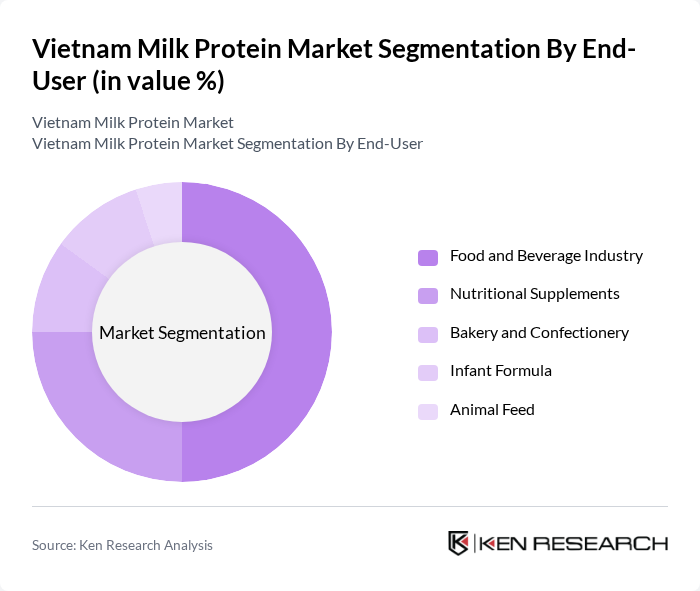

By End-User:The end-user segmentation includes the Food and Beverage Industry, Nutritional Supplements, Bakery and Confectionery, Infant Formula, and Animal Feed. The Food and Beverage Industry is the dominant segment, driven by the increasing incorporation of milk proteins in various food products. The growing trend of healthy eating and the demand for protein-enriched foods have led to a surge in the use of milk proteins in this sector. Urban consumers are especially driving demand for fortified and functional dairy products, aligning with broader dietary shifts .

The Vietnam Milk Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinamilk, Nutifood Nutrition Food JSC, TH True Milk (TH Group), FrieslandCampina Vietnam, Nestlé Vietnam Ltd., M?c Châu Milk (Moc Chau Milk JSC), NutraBlend Vietnam, Fonterra Brands Vietnam, Lactalis Vietnam, International Dairy Products JSC (IDP), Bavi Milk JSC (Bavi Group), S?a B?t Hòa Bình, Cô Gái Hà Lan (Dutch Lady, FrieslandCampina), Abbott Laboratories Vietnam, Mead Johnson Nutrition Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam milk protein market is poised for significant growth, driven by increasing health consciousness and a rising demand for nutritional products. As the dairy processing industry expands, innovations in product offerings will likely cater to evolving consumer preferences. Additionally, the government's support for local dairy farmers will enhance production capabilities. However, challenges such as fluctuating raw material prices and stringent regulations will require strategic management. Overall, the market is expected to thrive, with opportunities for growth in e-commerce and value-added products.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Concentrate Casein Protein Milk Protein Isolate Hydrolyzed Milk Protein Micellar Casein Milk Protein Concentrate Others |

| By End-User | Food and Beverage Industry Nutritional Supplements Bakery and Confectionery Infant Formula Animal Feed |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Direct Sales Pharmacies |

| By Application | Sports Nutrition Weight Management Meal Replacement Functional Foods Clinical Nutrition |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets and Pouches Tetra Packs |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farmers | 100 | Farm Owners, Production Managers |

| Milk Processors | 70 | Operations Managers, Quality Control Supervisors |

| Nutritionists and Dieticians | 50 | Nutritionists, Dieticians |

| Retailers of Dairy Products | 60 | Store Managers, Category Buyers |

| Consumers of Milk Protein Products | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

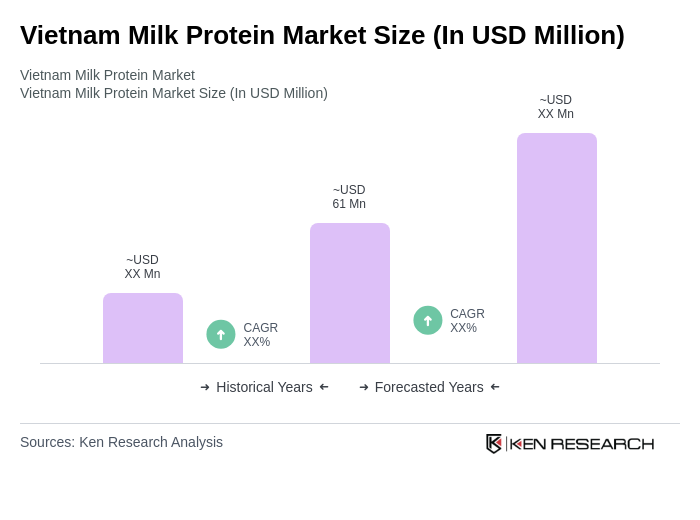

The Vietnam Milk Protein Market is valued at approximately USD 61 million, reflecting a significant growth trend driven by increasing health consciousness and demand for protein-rich diets among consumers.