Region:Asia

Author(s):Dev

Product Code:KRAB0388

Pages:97

Published On:August 2025

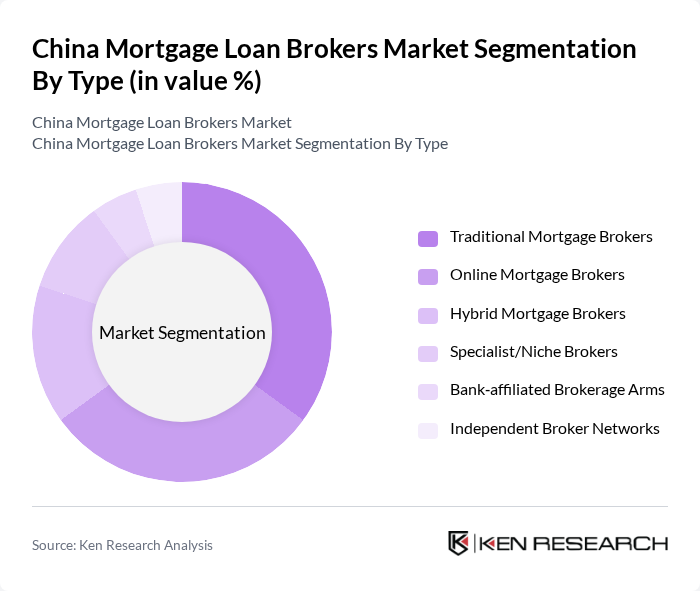

By Type:The market is segmented into various types of mortgage brokers, including traditional, online, hybrid, specialist/niche brokers, bank-affiliated brokerage arms, and independent broker networks. Traditional mortgage brokers remain important where in?person advisory and lender relationships are critical, while online channels are expanding quickly as fintech platforms digitize pre?qualification, document collection, and lender matching. Hybrid brokers combining offline advisory with online workflow are gaining adoption as consumers seek convenience with human guidance.

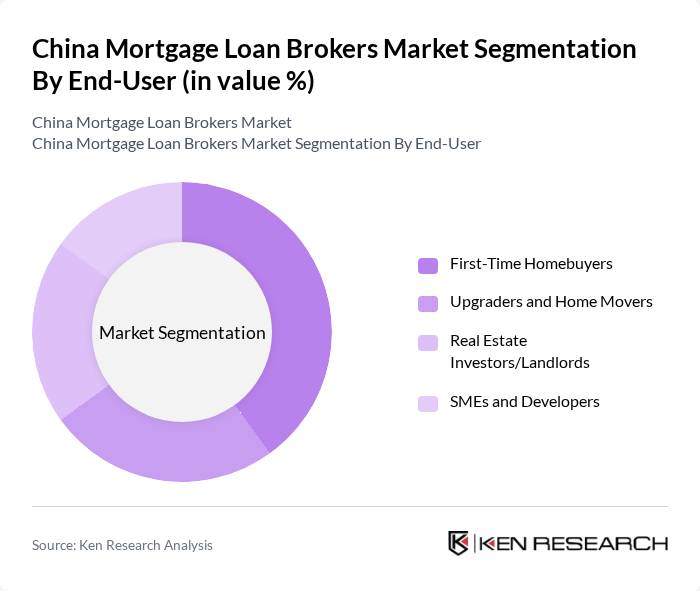

By End-User:The end?user segmentation includes first-time homebuyers, upgraders and home movers, real estate investors/landlords, and SMEs and developers. First?time homebuyers constitute the largest demand driver due to policy incentives and relaxed first?home criteria; upgraders/home movers contribute as households seek better locations and amenities; investors use brokers to compare loan terms amid tighter developer conditions; SMEs and developers access broker channels for collateralized and project?linked financing.

The China Mortgage Loan Brokers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lianjia (Beijing) Technology Co., Ltd. (????/??), E-House (China) Enterprise Holdings Limited (??????), Ke Holdings Inc. (Beike Zhaofang, ????), 58.com Inc. (58??, Anjuke ???), Ping An Bank Co., Ltd. – Mortgage Brokerage/Partnership Channels, China Merchants Bank Co., Ltd. – Retail Mortgage Partnership Channels, Industrial and Commercial Bank of China – Third-party Broker Partnerships, China Construction Bank – Broker and Agency Collaboration Programs, Bank of China – Retail Mortgage Collaboration Networks, China CITIC Bank – Consumer Mortgage Channels, China Minsheng Bank – Retail Mortgage Partnerships, Shanghai Pudong Development Bank – Mortgage Channel Partnerships, ZhongAn Online P&C Insurance Co., Ltd. – Digital Credit Facilitation, Lufax Holding Ltd. (???) – Online Lending & Mortgage Facilitation, Yixin Group Limited (????) – Auto/Collateral Finance Platform with Brokerage Tie?ins contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China mortgage loan brokers market appears promising, driven by ongoing urbanization and rising incomes. As digital platforms continue to expand, brokers will increasingly leverage technology to streamline processes and enhance customer experiences. Additionally, the integration of artificial intelligence in loan processing is expected to improve efficiency and reduce turnaround times. These trends indicate a shift towards more innovative and customer-centric services, positioning brokers to capitalize on emerging opportunities in the evolving housing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Mortgage Brokers Online Mortgage Brokers Hybrid Mortgage Brokers Specialist/Niche Brokers (e.g., self-employed, foreign buyers) Bank?affiliated Brokerage Arms Independent Broker Networks |

| By End-User | First-Time Homebuyers Upgraders and Home Movers Real Estate Investors/Landlords SMEs and Developers (Commercial/Mixed?use) |

| By Loan Type | Residential Mortgages (Purchase) Commercial Mortgages Refinancing/Rate?Switch Mortgages Home Equity/Second?lien Loans |

| By Service Model | Full?Service Advisory (end?to?end) Execution?Only/Comparison?Led Online?Only/Digital Brokerage |

| By Distribution Channel | Direct?to?Consumer (D2C) Partnerships with Real Estate Agencies/Developers Online Marketplaces & Aggregators |

| By Customer Demographics | Millennials/Gen Y Gen X Affluent/HNW Individuals |

| By Policy Support | First?home Buyer Support Policies LPR?linked Rate Adjustments/Refinancing Windows Government?Backed Loan Programs (e.g., provident fund) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Mortgage Brokers | 120 | Mortgage Brokers, Loan Officers |

| Commercial Mortgage Brokers | 90 | Commercial Loan Specialists, Financial Advisors |

| First-time Homebuyers | 110 | Recent Homebuyers, Financial Planners |

| Real Estate Agents | 80 | Real Estate Brokers, Property Managers |

| Financial Institutions | 80 | Bank Managers, Risk Assessment Officers |

The China Mortgage Loan Brokers Market is valued at approximately USD 35 billion, driven by urban housing demand, a growing middle class, and supportive government policies aimed at stabilizing housing and improving mortgage access.