Region:Europe

Author(s):Dev

Product Code:KRAD0595

Pages:99

Published On:August 2025

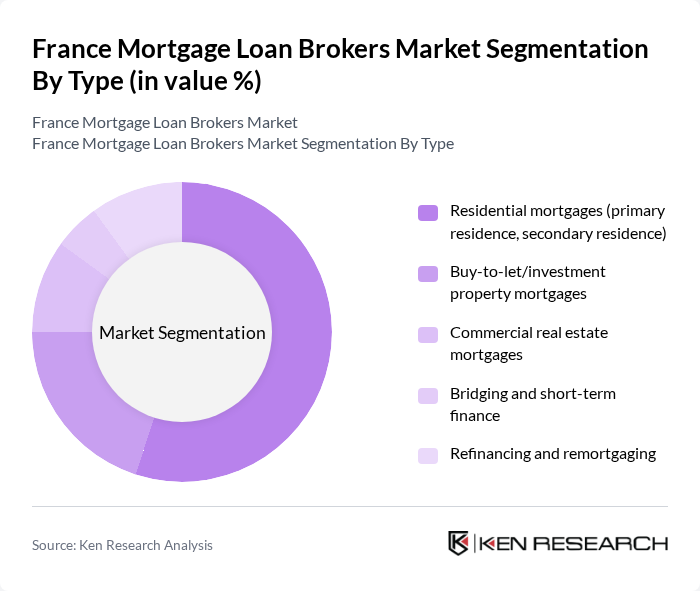

By Type:The market can be segmented into various types of mortgage products, including residential mortgages, buy-to-let mortgages, commercial real estate mortgages, bridging and short-term finance, and refinancing options. Among these, residential mortgages, which encompass both primary and secondary residences, dominate the market due to the high demand for homeownership and the increasing number of first-time buyers.

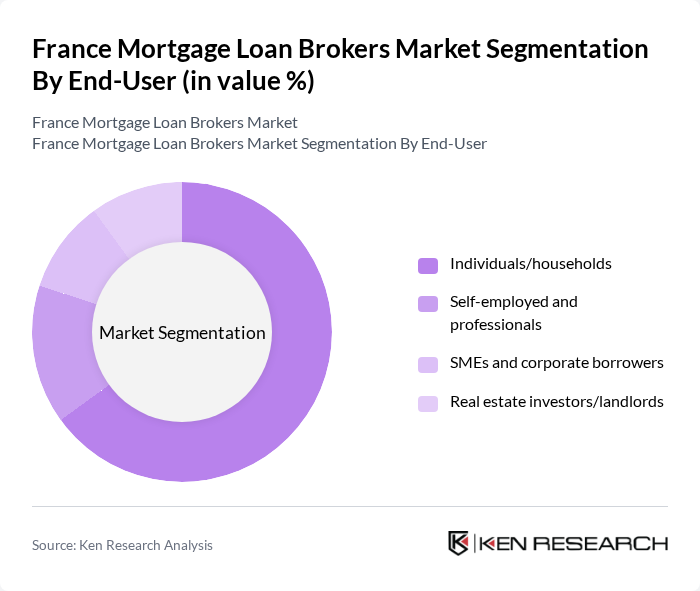

By End-User:The end-user segmentation includes individuals/households, self-employed professionals, SMEs and corporate borrowers, and real estate investors/landlords. Individuals and households represent the largest segment, driven by the increasing number of first-time homebuyers and the growing trend of families seeking to purchase homes in urban areas.

The France Mortgage Loan Brokers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meilleurtaux, Empruntis, CAFPI, Pretto, MeilleurTaux Credit (Meilleurtaux network specialty unit), Vousfinancer, AB Courtage, Immoprêt, Monemprunt.com, Magnolia.fr (courtier en assurance emprunteur), BoursedesCrédits, Ace Crédit, CreditAdvisor by HelloPrêt, HelloPrêt, Nexity Crédit (brokerage arm) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mortgage loan brokerage market in France appears promising, driven by ongoing technological advancements and a sustained demand for home ownership. As digital platforms continue to evolve, brokers will likely enhance their service offerings, improving customer engagement and satisfaction. Additionally, the increasing focus on sustainable financing options will create new avenues for growth, allowing brokers to cater to environmentally conscious consumers seeking green mortgage products and services tailored to their needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential mortgages (primary residence, secondary residence) Buy-to-let/investment property mortgages Commercial real estate mortgages Bridging and short-term finance Refinancing and remortgaging |

| By End-User | Individuals/households Self-employed and professionals SMEs and corporate borrowers Real estate investors/landlords |

| By Loan Amount | ? €150,000 €150,001 – €500,000 > €500,000 |

| By Loan Term | ? 10 years – 20 years > 20 years |

| By Customer Segment | First-time buyers Movers and upgraders Refinancers Non-resident/expat buyers |

| By Distribution Channel | Online/digital brokers and marketplaces Physical broker networks/franchises Hybrid (phygital) advisory |

| By Geographic Region | Île-de-France Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Nouvelle-Aquitaine Occitanie Hauts-de-France Grand Est Pays de la Loire Brittany Normandy Bourgogne-Franche-Comté Centre-Val de Loire Corsica |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| First-time Homebuyers | 120 | Individuals aged 25-35, seeking mortgage options |

| Real Estate Agents | 100 | Agents with experience in residential property sales |

| Mortgage Loan Brokers | 80 | Professionals with at least 5 years in the mortgage industry |

| Homeowners Refinancing | 70 | Homeowners looking to refinance existing mortgages |

| Financial Advisors | 60 | Advisors specializing in real estate and mortgage financing |

The France Mortgage Loan Brokers Market is valued at approximately EUR 30 billion, reflecting a robust recovery in the real estate sector driven by increasing housing demand and favorable interest rates.