Region:Asia

Author(s):Dev

Product Code:KRAA1688

Pages:82

Published On:August 2025

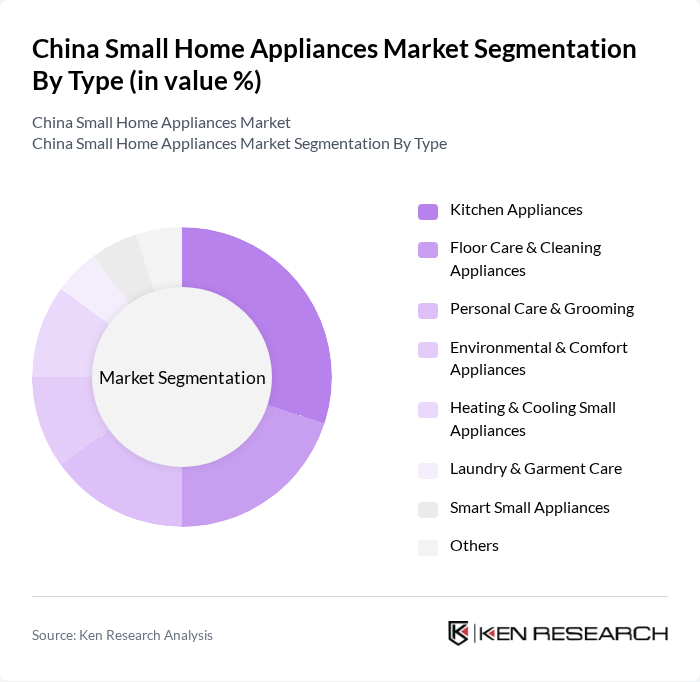

By Type:The small home appliances market can be segmented into various types, including kitchen appliances, floor care and cleaning appliances, personal care and grooming devices, environmental and comfort appliances, heating and cooling small appliances, laundry and garment care products, smart small appliances, and others. Each of these segments caters to specific consumer needs and preferences, reflecting the diverse functionalities and innovations in the market.

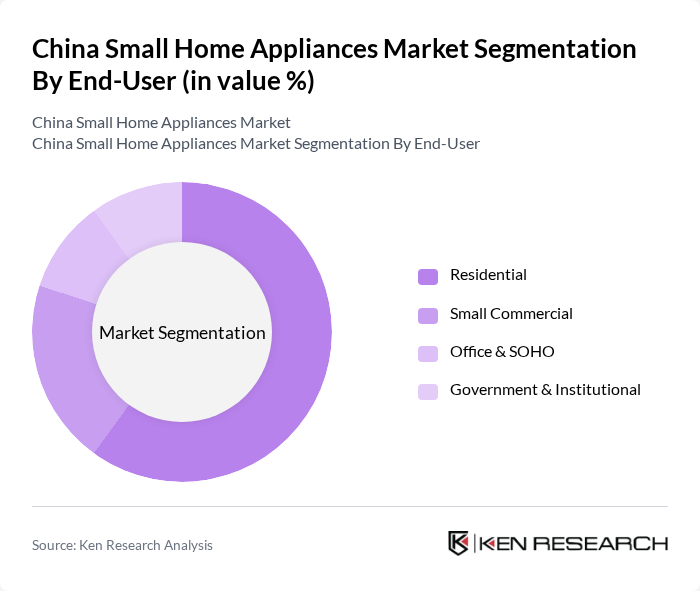

By End-User:The market can also be segmented based on end-users, which include residential consumers, small commercial establishments, office and SOHO users, and government and institutional buyers. Each segment has distinct purchasing behaviors and requirements, influencing the types of appliances that are in demand.

The China Small Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Group, Midea Group, Gree Electric Appliances, Inc. of Zhuhai, TCL Electronics, Hisense Home Appliances Group, Zhejiang Supor Co., Ltd., Joyoung Co., Ltd., Koninklijke Philips N.V. (Philips Domestic Appliances/Versuni China), Xiaomi Corporation, Panasonic Corporation of China, Electrolux China, BSH Home Appliances (Bosch & Siemens) China, SharkNinja (including Ninja, Shark) China, Whirlpool (China) Co., Ltd., LG Electronics (China) Co., Ltd., Dyson Technology (China), Roborock Technology Co., Ltd., Ecovacs Robotics Co., Ltd., Bear Electric Appliance Co., Ltd. (Xiaoxiong), AUX Group (small appliances and comfort products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the small home appliances market in China appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative and energy-efficient appliances is expected to rise. Additionally, the integration of smart technology into everyday appliances will likely enhance user convenience and efficiency. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Kitchen Appliances (e.g., rice cookers, air fryers, blenders, food processors, coffee machines) Floor Care & Cleaning Appliances (e.g., robotic vacuums, handheld vacuums, steam mops) Personal Care & Grooming (e.g., hair dryers, shavers, toothbrushes, beauty devices) Environmental & Comfort Appliances (e.g., air purifiers, humidifiers, dehumidifiers) Heating & Cooling Small Appliances (e.g., space heaters, electric fans, portable ACs) Laundry & Garment Care (e.g., garment steamers, irons, mini washers) Smart Small Appliances (IoT-enabled devices across categories) Others (niche and seasonal small appliances) |

| By End-User | Residential Small Commercial (e.g., cafes, salons, hospitality) Office & SOHO Government & Institutional |

| By Sales Channel | Online Retail (e-commerce marketplaces, brand.com, social commerce/live-streaming) Offline Retail (appliance chains, supermarkets, brand stores) Direct Sales Distributors/Dealers |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Features | Energy-Efficient Features Smart Technology Integration Multi-functionality |

| By Distribution Mode | Direct-to-Consumer Retail Partnerships E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Appliance Retailers | 120 | Store Managers, Sales Executives |

| Consumer Electronics Distributors | 90 | Distribution Managers, Product Buyers |

| Home Appliance Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Online Retail Platforms | 70 | eCommerce Managers, Customer Experience Leads |

| Consumer Focus Groups | 60 | End-users, Household Decision Makers |

The China Small Home Appliances Market is valued at approximately USD 24 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and the increasing adoption of smart home technologies.