Region:Middle East

Author(s):Rebecca

Product Code:KRAC4589

Pages:96

Published On:October 2025

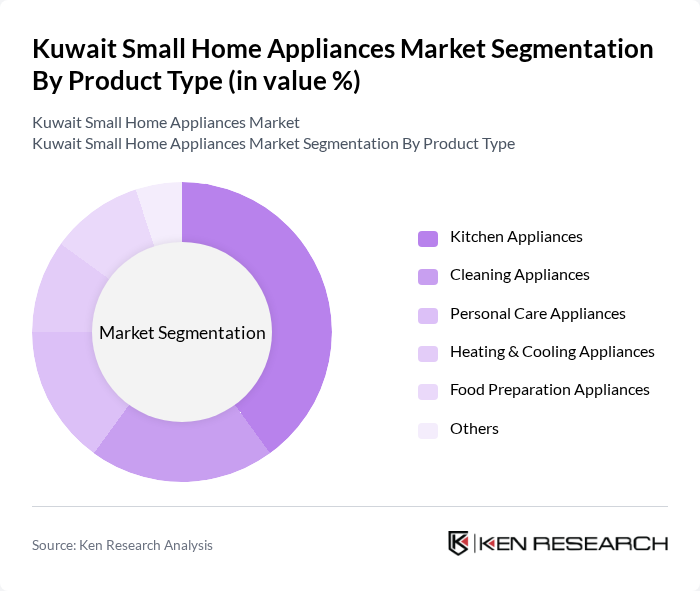

By Product Type:

The product type segmentation includes various categories such as Kitchen Appliances, Cleaning Appliances, Personal Care Appliances, Heating & Cooling Appliances, and Others. Among these, Kitchen Appliances dominate the market due to the increasing trend of home cooking and the demand for convenience in food preparation. Products like blenders, food processors, and coffee machines are particularly popular as consumers seek to enhance their culinary experiences at home. The rise in health consciousness has also led to a surge in demand for appliances that facilitate healthy cooking.

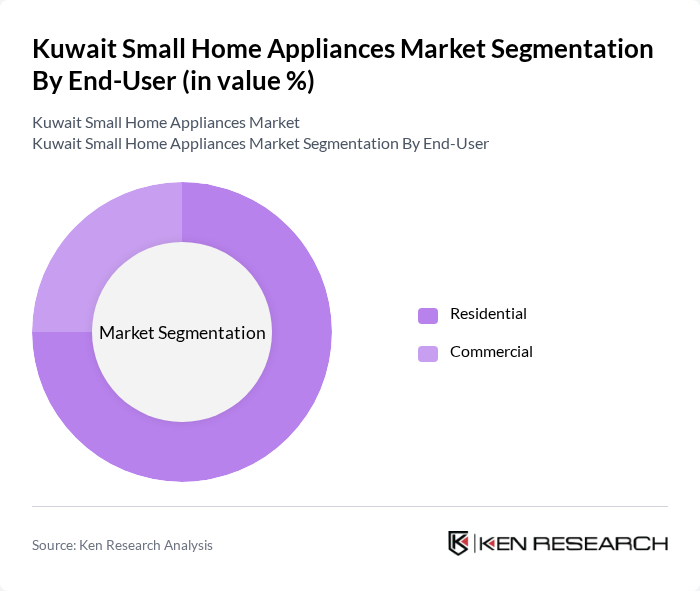

By End-User:

The end-user segmentation comprises Residential and Commercial sectors. The Residential segment holds a significant share of the market, driven by the increasing number of households and the growing trend of home cooking and personal grooming. Consumers are investing in small home appliances to enhance their living standards and improve convenience in daily tasks. The Commercial segment, while smaller, is also growing as businesses in the hospitality and service sectors seek to equip their establishments with modern appliances to improve efficiency and customer satisfaction.

The Kuwait Small Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries (X-cite by Alghanim Electronics), Eureka Electronics, Panasonic Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., Philips Domestic Appliances (Versuni), Whirlpool Corporation, BSH Hausgeräte GmbH (Bosch, Siemens), Haier Group Corporation, AB Electrolux, Midea Group Co., Ltd., Sharp Corporation, Hisense Group Co., Ltd., Arçelik A.?., Groupe SEB (Tefal, Moulinex, Rowenta) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait small home appliances market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies that adapt to these trends by offering innovative solutions and enhancing online shopping experiences will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Kitchen Appliances (e.g., blenders, food processors, coffee machines, toasters) Cleaning Appliances (e.g., vacuum cleaners, steam mops) Personal Care Appliances (e.g., hair dryers, electric shavers, grooming kits) Heating & Cooling Appliances (e.g., space heaters, air purifiers, portable fans) Food Preparation Appliances (e.g., mixers, juicers, sandwich makers) Others (e.g., irons, garment steamers, water dispensers) |

| By End-User | Residential Commercial (e.g., hospitality, offices, small businesses) |

| By Distribution Channel | Multi-Branded Stores Specialty Stores Online Retail Other Distribution Channels |

| By Price Range | Budget Mid-range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Product Features | Energy-efficient Smart Features (IoT-enabled, app control) Multi-functionality |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Household Decision Makers, Young Professionals |

| Product Usage Focus Groups | 50 | Families, Tech-Savvy Consumers |

| Market Trend Analysis | 80 | Market Analysts, Retail Consultants |

| Distribution Channel Feedback | 60 | Logistics Managers, Supply Chain Coordinators |

The Kuwait Small Home Appliances Market is valued at approximately USD 225 million, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a preference for energy-efficient and smart appliances among consumers.