Region:Asia

Author(s):Shubham

Product Code:KRAC0646

Pages:100

Published On:August 2025

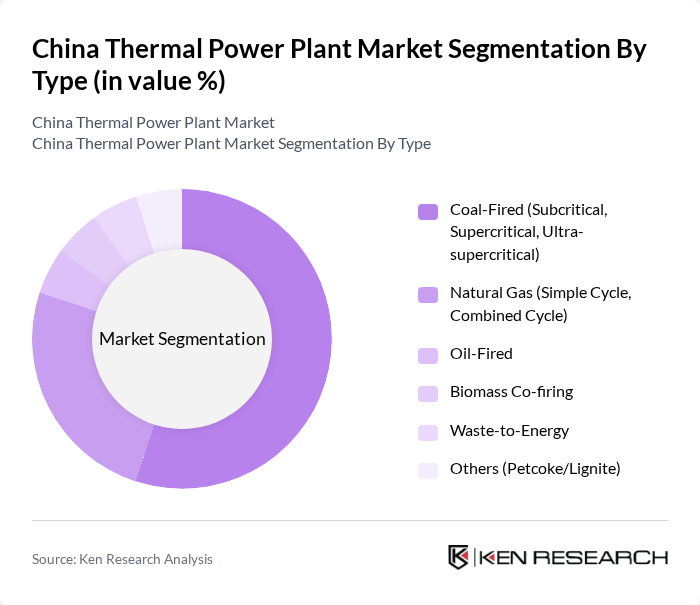

By Type:The thermal power plant market includes coal?fired, natural gas, oil?fired, biomass co?firing, waste?to?energy, and others. Coal?fired plants—particularly supercritical and ultra?supercritical—continue to dominate due to mature supply chains and cost competitiveness, while gas?fired capacity is expanding for lower emissions, faster ramping, and grid balancing alongside renewables.

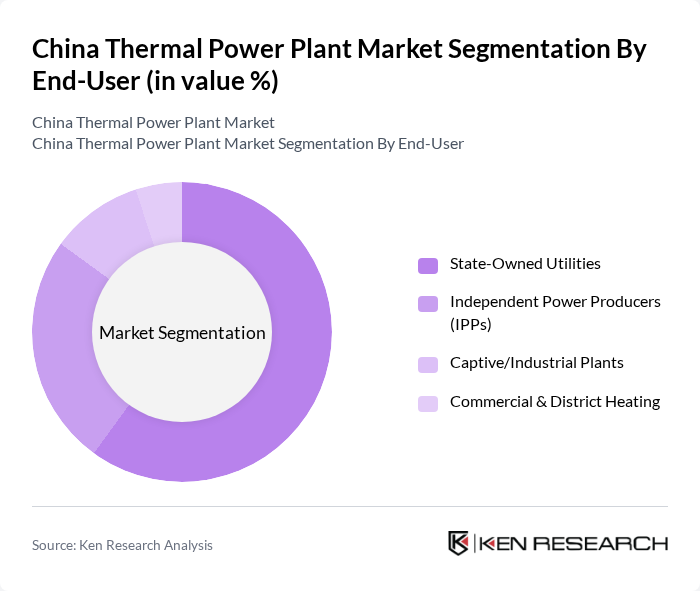

By End-User:The end?user segmentation includes state?owned utilities, independent power producers (IPPs), captive/industrial plants, and commercial & district heating. State?owned utilities dominate due to control of most installed capacity and grid access, while IPPs contribute through incremental capacity additions and efficiency?focused projects.

The China Thermal Power Plant Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Huaneng Group Co., Ltd., China Datang Corporation Ltd., China Guodian Corporation (now part of China Energy Investment Corporation), State Power Investment Corporation Limited (SPIC), China Resources Power Holdings Company Limited, Shanghai Electric Group Co., Ltd., Harbin Electric International Company Limited, Dongfang Electric Corporation Limited, China National Petroleum Corporation (CNPC), China National Offshore Oil Corporation (CNOOC), China Shenhua Energy Company Limited (part of China Energy Investment Corporation), China Energy Engineering Corporation Limited (CEEC), China Huadian Corporation Ltd., China Energy Investment Corporation (CHN Energy), China Power International Development Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermal power sector in China is poised for transformation, driven by a shift towards cleaner energy sources and increased automation. In future, the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies is expected to enhance operational efficiency and reduce emissions. Additionally, the government’s commitment to achieving renewable energy targets will likely spur investments in hybrid systems that combine thermal and renewable sources, ensuring a balanced energy mix and sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal-Fired (Subcritical, Supercritical, Ultra-supercritical) Natural Gas (Simple Cycle, Combined Cycle) Oil-Fired Biomass Co-firing Waste-to-Energy Others (Petcoke/Lignite) |

| By End-User | State-Owned Utilities Independent Power Producers (IPPs) Captive/Industrial Plants Commercial & District Heating |

| By Region | North China (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia) East China (Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong) South Central China (Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan) Northeast China (Liaoning, Jilin, Heilongjiang) Southwest China (Chongqing, Sichuan, Guizhou, Yunnan, Tibet) |

| By Technology | Conventional Steam (Subcritical) Supercritical & Ultra-supercritical Combined Cycle Gas Turbine (CCGT) Cogeneration/CHP Emissions Control Retrofits (FGD/DeNOx/CCS-ready) |

| By Application | Base Load Generation Mid-Merit/Load Following Peak Load Generation Backup & Reserve |

| By Investment Source | Central SOE Investment Provincial/Municipal Investment Foreign Direct Investment (FDI)/Joint Ventures Public-Private Partnerships (PPP) |

| By Policy Support | Capacity Payment/Ancillary Services Revenues Ultra-low Emission Retrofit Subsidies Tax Incentives & Green Credit Grid Dispatch & Flexibility Compensation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Thermal Power Plant Operations | 120 | Plant Managers, Operations Directors |

| Energy Policy and Regulation | 80 | Government Officials, Regulatory Analysts |

| Fuel Supply Chain Management | 70 | Procurement Managers, Supply Chain Coordinators |

| Environmental Compliance and Sustainability | 60 | Environmental Managers, Compliance Officers |

| Investment and Financing in Thermal Power | 90 | Financial Analysts, Investment Managers |

The China Thermal Power Plant Market is valued at approximately USD 340 billion, driven by increasing electricity demand from urbanization, industrial production, and data center expansion, with thermal generation remaining crucial for baseload and peak-shaving needs.