Region:Asia

Author(s):Shubham

Product Code:KRAC0602

Pages:100

Published On:August 2025

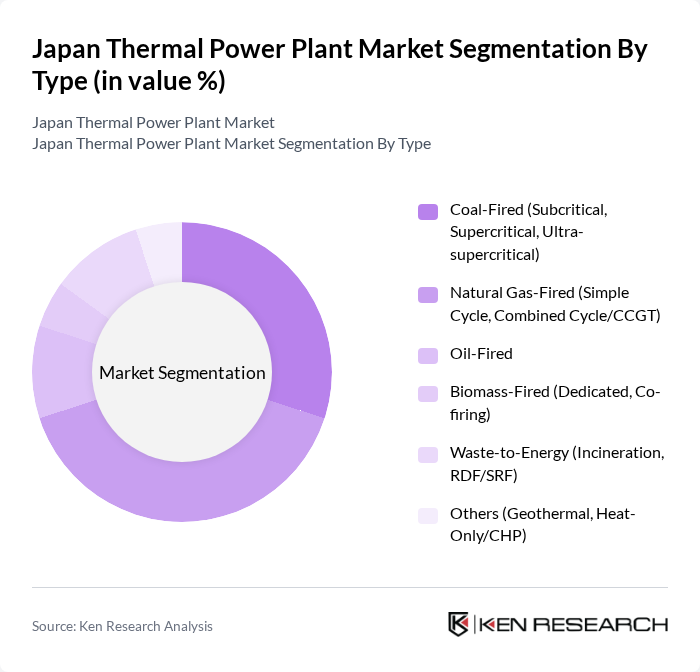

By Type:The thermal power plant market in Japan can be segmented into various types, including coal-fired, natural gas-fired, oil-fired, biomass-fired, waste-to-energy, and others. Each type has its unique characteristics and applications, catering to different energy needs and regulatory requirements. Natural gas-fired plants hold a leading role in Japan’s thermal mix, supported by large LNG imports and policy-driven shifts away from inefficient coal units; coal remains material but under pressure from retirements and efficiency standards; oil-fired serves peaking and backup roles; biomass and waste-to-energy contribute niche and compliance-driven capacity .

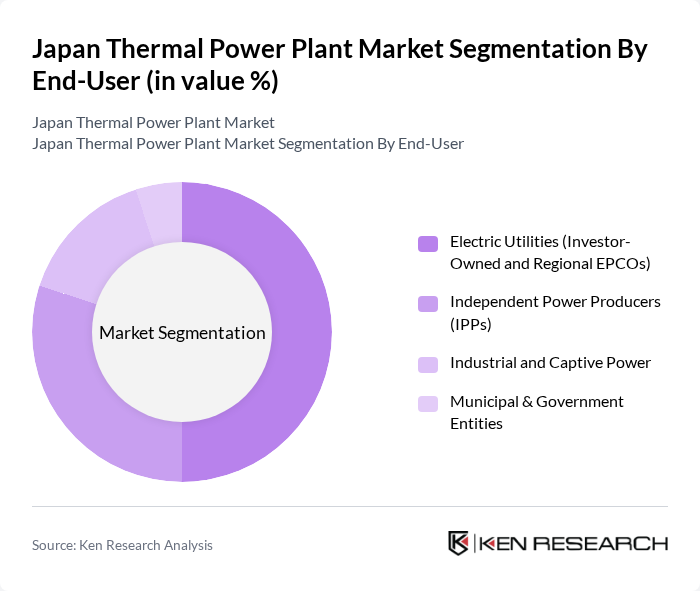

By End-User:The end-user segmentation of the thermal power plant market includes electric utilities, independent power producers, industrial and captive power users, and municipal & government entities. Each end-user category has distinct energy requirements and operational frameworks, influencing their choice of thermal power generation technology. Regional EPCOs and major utilities procure significant LNG volumes and manage system balancing; IPPs operate contracted and merchant CCGTs and coal assets; industrials use captive thermal for reliability and cost; municipalities support waste-to-energy facilities for combined waste management and power .

The Japan Thermal Power Plant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokyo Electric Power Company Holdings, Inc. (TEPCO), Chubu Electric Power Co., Inc. (Chubu Electric), The Kansai Electric Power Co., Inc. (KEPCO Kansai), Tohoku Electric Power Co., Inc., Hokkaido Electric Power Co., Inc., Shikoku Electric Power Co., Inc., Kyushu Electric Power Co., Inc., J-POWER (Electric Power Development Co., Ltd.), Mitsubishi Heavy Industries, Ltd. (MHI), Hitachi, Ltd., Toshiba Energy Systems & Solutions Corporation, Sumitomo Corporation, Marubeni Corporation, IHI Corporation, JGC Holdings Corporation, The Chugoku Electric Power Co., Inc., Tokyo Gas Co., Ltd. (Power & Fuel Trading), INPEX Corporation (LNG supply chain), Cosmo Oil Co., Ltd. (Thermal/Oil-fired assets), Idemitsu Kosan Co., Ltd. (Fuel supply & IPP interests) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan thermal power plant market is poised for transformation as it adapts to evolving energy demands and regulatory frameworks. With a focus on integrating renewable energy sources and enhancing operational efficiencies, the sector is likely to see increased investments in hybrid systems and smart grid technologies. Furthermore, the push for carbon neutrality by 2050 will drive innovation in carbon capture and storage solutions, positioning thermal power as a vital component of Japan's energy transition strategy.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal-Fired (Subcritical, Supercritical, Ultra-supercritical) Natural Gas-Fired (Simple Cycle, Combined Cycle/CCGT) Oil-Fired Biomass-Fired (Dedicated, Co-firing) Waste-to-Energy (Incineration, RDF/SRF) Others (Geothermal, Heat-Only/CHP) |

| By End-User | Electric Utilities (Investor-Owned and Regional EPCOs) Independent Power Producers (IPPs) Industrial and Captive Power Municipal & Government Entities |

| By Application | Baseload Generation Mid-merit and Peak Load Generation Backup/Reserve Power Supply Grid Ancillary Services (Frequency/Voltage Support) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding & Subsidy Programs |

| By Policy Support | Emissions Regulations Compliance (GHG, SOx/NOx) Tax Incentives & Accelerated Depreciation Certificates & Trading (J-Credits, Non-FIT Mechanisms) |

| By Operational Scale | Small Scale (<50 MW) Medium Scale (50–300 MW) Large Scale (>300 MW) |

| By Fuel Source | Coal Liquefied Natural Gas (LNG)/Natural Gas Oil Biomass & Refuse-Derived Fuel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal-Fired Power Generation | 110 | Plant Managers, Operations Directors |

| Natural Gas Power Plants | 85 | Technical Engineers, Energy Analysts |

| Regulatory Compliance and Policy Impact | 50 | Regulatory Affairs Specialists, Policy Makers |

| Environmental Impact Assessments | 65 | Environmental Managers, Sustainability Officers |

| Future Energy Transition Strategies | 95 | Strategic Planners, Business Development Managers |

The Japan Thermal Power Plant Market is valued at approximately USD 15 billion, reflecting its significant role in meeting the country's energy demands despite the growth of renewable energy sources.