Region:Asia

Author(s):Dev

Product Code:KRAB0666

Pages:96

Published On:August 2025

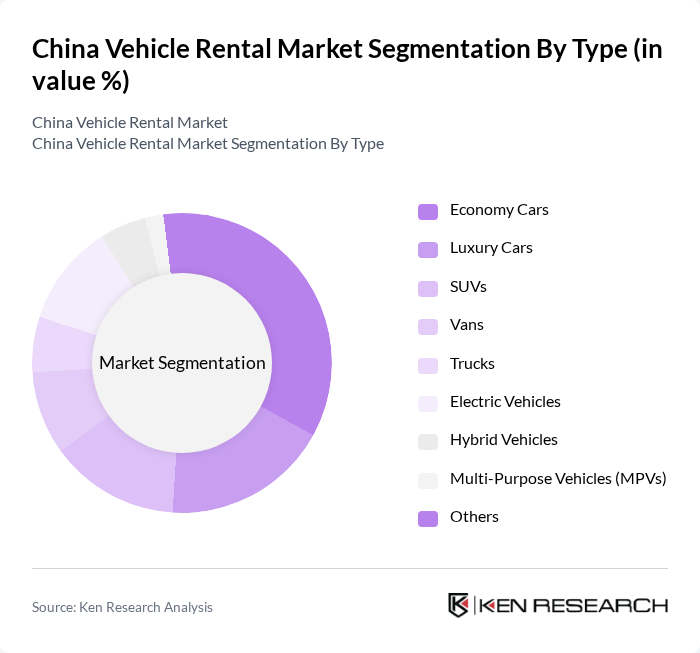

By Type:The vehicle rental market can be segmented into various types, including Economy Cars, Luxury Cars, SUVs, Vans, Trucks, Electric Vehicles, Hybrid Vehicles, Multi-Purpose Vehicles (MPVs), and Others. Each sub-segment caters to different consumer preferences and needs, with Economy Cars being popular for budget-conscious renters, while Luxury Cars attract those seeking premium experiences. The growing interest in sustainability and government mandates have led to a marked increase in the demand for Electric and Hybrid Vehicles.

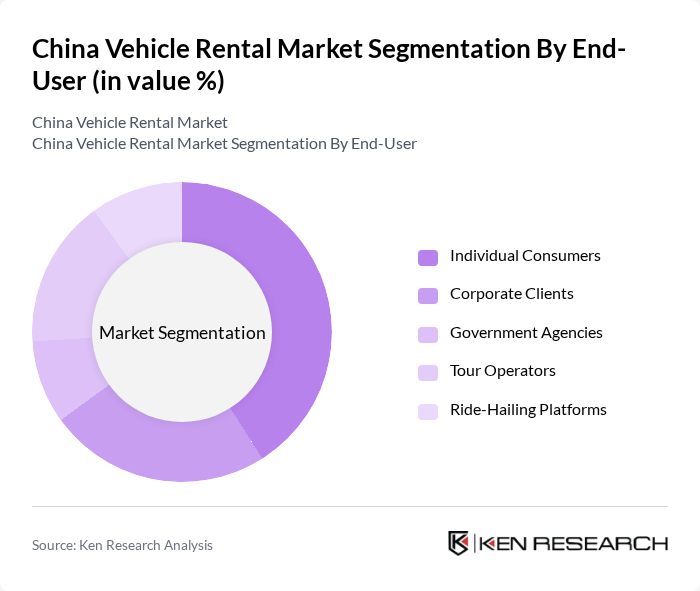

By End-User:The market can also be segmented based on end-users, which include Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, and Ride-Hailing Platforms. Individual consumers often seek short-term rentals for personal use, while corporate clients typically require vehicles for business travel. Government agencies and tour operators utilize rentals for official purposes and tourism, respectively, while ride-hailing platforms integrate rental services to enhance their offerings. The rise of online booking and mobile app integration has further diversified end-user demand.

The China Vehicle Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as CAR Inc. , eHi Car Services Limited , Shouqi Car Rental , Avis China , Hertz China , Didi Chuxing , Yongche , UCAR , Zuzuche, GoFun, Panda Auto, Caocao Mobility, Xiangdao Chuxing, T3 Mobility, Shenzhou Zhuanche contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vehicle rental market in China appears promising, driven by technological advancements and a growing emphasis on sustainability. As electric vehicle (EV) adoption increases, rental companies are likely to expand their EV fleets, catering to environmentally conscious consumers. Additionally, the integration of digital platforms for seamless booking and payment processes will enhance customer experiences, making rentals more accessible and efficient. These trends indicate a dynamic market poised for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy Cars Luxury Cars SUVs Vans Trucks Electric Vehicles Hybrid Vehicles Multi-Purpose Vehicles (MPVs) Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Ride-Hailing Platforms |

| By Rental Duration | Short-Term Rentals (Daily/Weekly) Long-Term Rentals (Monthly/Yearly) One-Way Rentals |

| By Booking Channel | Online Platforms (Web/App) Offline Agencies Aggregator Platforms |

| By Payment Model | Pay-Per-Use Subscription-Based Corporate Leasing |

| By Vehicle Age | New Vehicles (<2 Years) Used Vehicles (>2 Years) |

| By Region | Eastern China Southern China Northern China Western China South-Central China |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Vehicle Rental Users | 120 | Frequent Renters, Business Travelers |

| Corporate Fleet Managers | 60 | Corporate Procurement Officers, Fleet Operations Managers |

| Tourism Sector Vehicle Rentals | 50 | Travel Agency Managers, Tour Operators |

| Long-term Rental Customers | 40 | Individuals, Small Business Owners |

| Vehicle Rental Service Providers | 40 | Business Owners, Operations Managers |

The China Vehicle Rental Market is valued at approximately USD 15 billion, driven by factors such as urbanization, rising disposable incomes, and the increasing trend of shared mobility among consumers. This market is expected to continue growing in the coming years.