Region:Europe

Author(s):Rebecca

Product Code:KRAC0227

Pages:84

Published On:August 2025

By Type:The vehicle rental market can be segmented into various types, including Economy/Budget Cars, Luxury/Premium Cars, SUVs, MUVs, Electric Vehicles, Hybrid Vehicles, and Others (including vans, specialty vehicles). Each of these subsegments caters to different consumer needs and preferences, with varying price points and features. The segmentation reflects the diversity of consumer demand, with economy cars favored for affordability, luxury cars for premium experiences, SUVs and MUVs for versatility, and electric/hybrid vehicles for sustainability .

The Economy/Budget Cars segment is currently dominating the market due to their affordability and practicality for a wide range of consumers, particularly tourists and business travelers seeking cost-effective solutions. The increasing trend of budget travel and the rise of low-cost airlines have further fueled the demand for this segment. Additionally, the availability of various models and competitive pricing strategies have made economy cars a preferred choice for many .

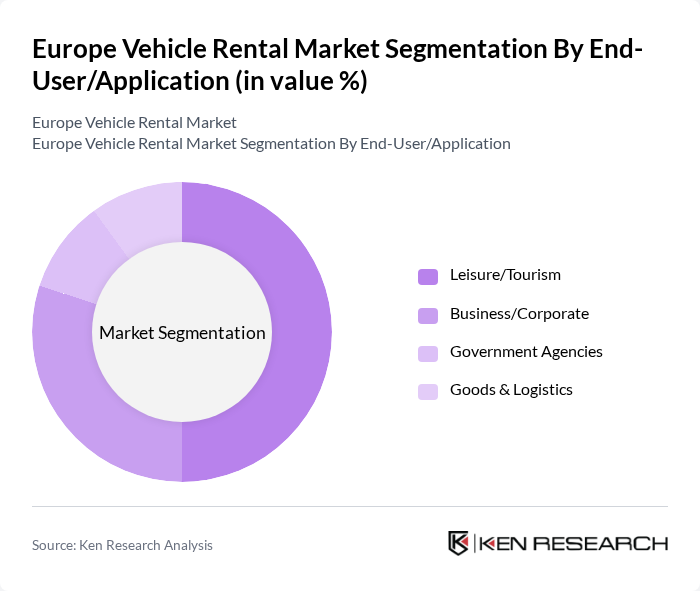

By End-User/Application:The market can also be segmented based on end-users, including Leisure/Tourism, Business/Corporate, Government Agencies, and Goods & Logistics. Each application has distinct requirements and influences the demand for vehicle rentals differently. Leisure/tourism drives the largest share, supported by Europe's strong inbound tourism, while business/corporate rentals benefit from increasing corporate travel and mobility needs .

The Leisure/Tourism segment is the largest contributor to the vehicle rental market, driven by the increasing number of tourists visiting Europe each year. The convenience of renting a vehicle for sightseeing and travel has made it a popular choice among tourists. Additionally, the growth of travel packages that include vehicle rentals has further solidified this segment's dominance .

The Europe Vehicle Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enterprise Holdings, Inc., Hertz Global Holdings, Inc., Avis Budget Group, Inc., Sixt SE, Europcar Mobility Group, National Car Rental, Alamo Rent A Car, Thrifty Car Rental, Dollar Rent A Car, Green Motion International, Goldcar, Keddy by Europcar, Firefly Car Rental, Zipcar, TUI Cars contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European vehicle rental market appears promising, driven by technological innovations and a growing emphasis on sustainability. As consumer preferences shift towards eco-friendly options, rental companies are likely to expand their electric vehicle offerings significantly. Additionally, the rise of digital platforms for seamless booking experiences will enhance customer engagement. Companies that adapt to these trends and invest in sustainable practices are expected to thrive in this evolving landscape, positioning themselves for long-term success in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy/Budget Cars Luxury/Premium Cars SUVs MUVs Electric Vehicles Hybrid Vehicles Others (including vans, specialty vehicles) |

| By End-User/Application | Leisure/Tourism Business/Corporate Government Agencies Goods & Logistics |

| By Rental Duration | Short-Term Rentals Long-Term Rentals |

| By Booking Channel | Online Platforms Offline/Travel Agencies Direct Rentals |

| By Country/Region | Germany United Kingdom France Italy Spain Rest of Europe |

| By Vehicle Class | Compact Midsize Full-size Luxury |

| By Payment Method | Credit/Debit Cards Mobile Payments/Digital Wallets Cash Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Vehicle Rentals | 120 | Vacationers, Family Travelers |

| Corporate Vehicle Rentals | 90 | Business Travelers, Corporate Travel Managers |

| Long-term Rentals | 60 | Expats, Long-term Travelers |

| Luxury Vehicle Rentals | 40 | High-net-worth Individuals, Event Planners |

| Electric Vehicle Rentals | 50 | Eco-conscious Travelers, Tech Enthusiasts |

The Europe Vehicle Rental Market is valued at approximately USD 15 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for flexible transportation solutions and a rise in tourism across the continent.