Region:Africa

Author(s):Shubham

Product Code:KRAA4951

Pages:88

Published On:September 2025

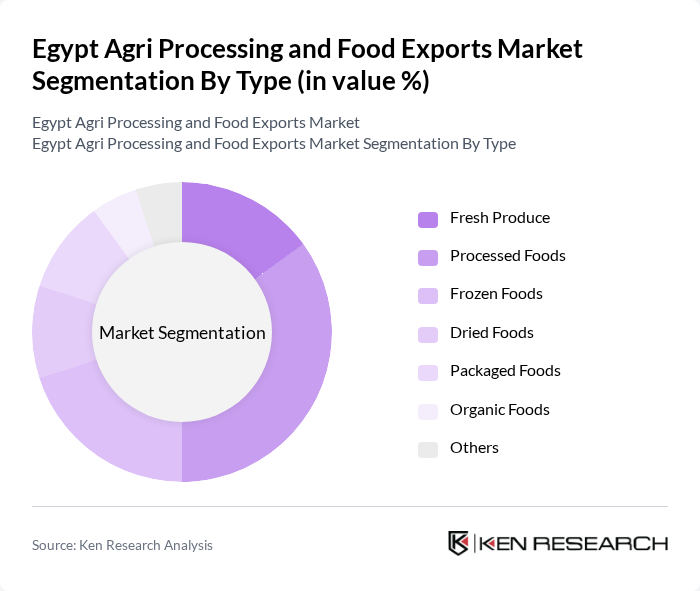

By Type:The market is segmented into various types, including Fresh Produce, Processed Foods, Frozen Foods, Dried Foods, Packaged Foods, Organic Foods, and Others. Each of these segments caters to different consumer preferences and market demands, with processed foods being the most significant due to their convenience and longer shelf life.

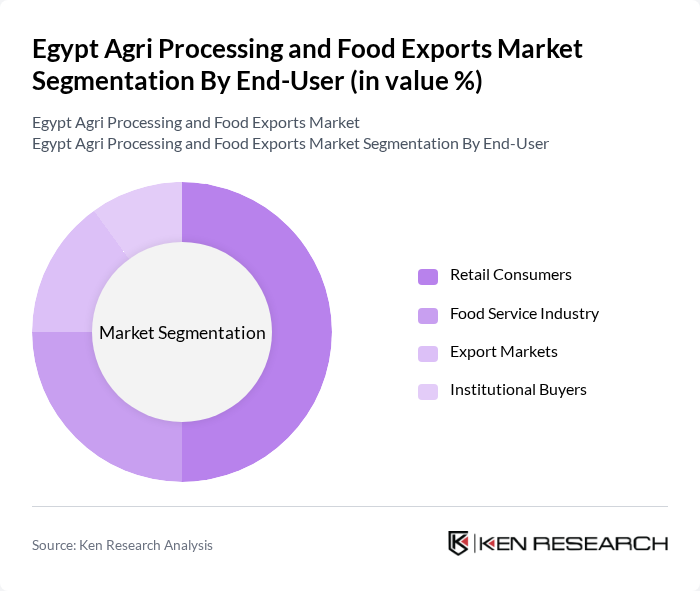

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Export Markets, and Institutional Buyers. The retail consumer segment is the largest, driven by increasing urbanization and changing dietary preferences, leading to a higher demand for convenient food options.

The Egypt Agri Processing and Food Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Juhayna Food Industries, Arab Dairy Products Co. (Panda), Al-Mansour Group, El-Wahy Group, Abo Auf, Fresh Del Monte Produce Inc., Al-Ahram Beverages Company, Al-Fayrouz Group, Nile Fruits, Misr Food Products, Al-Masria for Food Industries, Al-Mansour International Distribution Company, Sphinx Food Industries, Delta Food Industries, Egyptian Company for Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's agri-processing and food exports market appears promising, driven by increasing global demand and government initiatives aimed at enhancing agricultural productivity. As the sector embraces digital transformation, including e-commerce platforms for food exports, it is likely to attract more investments. Additionally, the focus on sustainable practices and organic products will cater to evolving consumer preferences, positioning Egypt as a key player in the global agri-food market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Processed Foods Frozen Foods Dried Foods Packaged Foods Organic Foods Others |

| By End-User | Retail Consumers Food Service Industry Export Markets Institutional Buyers |

| By Distribution Channel | Direct Sales Online Retail Supermarkets and Hypermarkets Wholesale Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Product Shelf Life | Short Shelf Life Long Shelf Life |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Certification | Organic Certification ISO Certification HACCP Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fruits and Vegetables Exporters | 100 | Export Managers, Quality Control Supervisors |

| Processed Food Manufacturers | 80 | Production Managers, R&D Heads |

| Agricultural Cooperatives | 70 | Cooperative Leaders, Supply Chain Coordinators |

| Logistics Providers for Food Exports | 60 | Logistics Managers, Operations Directors |

| Regulatory Bodies and Trade Associations | 50 | Policy Makers, Industry Analysts |

The Egypt Agri Processing and Food Exports Market is valued at approximately USD 5 billion, reflecting significant growth driven by rising demand for processed foods, increased export activities, and government initiatives to enhance agricultural productivity.