Region:Middle East

Author(s):Rebecca

Product Code:KRAC9854

Pages:87

Published On:November 2025

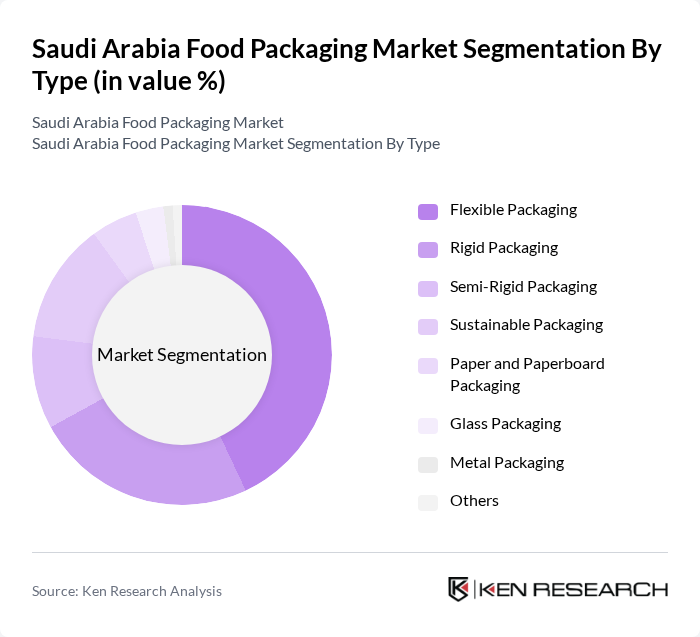

By Type:The food packaging market can be segmented into various types, including flexible packaging, rigid packaging, semi-rigid packaging, sustainable packaging, paper and paperboard packaging, glass packaging, metal packaging, and others. Among these, flexible packaging is currently the most dominant segment due to its versatility, lightweight nature, and cost-effectiveness. The increasing consumer preference for ready-to-eat meals and snacks has further propelled the demand for flexible packaging solutions, which offer convenience and extended shelf life. Flexible packaging accounted for approximately 43% of market share in the latest industry assessment, reflecting its continued leadership in the segment.

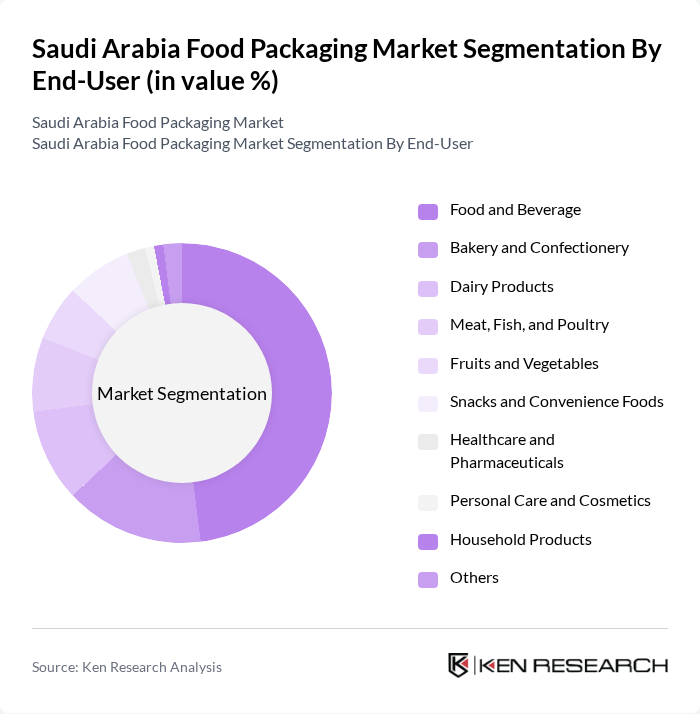

By End-User:The end-user segmentation of the food packaging market includes food and beverage, bakery and confectionery, dairy products, meat, fish, and poultry, fruits and vegetables, snacks and convenience foods, healthcare and pharmaceuticals, personal care and cosmetics, household products, and others. The food and beverage segment is the largest contributor to the market, driven by the rising consumption of packaged foods and beverages, along with the growing trend of on-the-go eating among consumers. Food and beverage applications represent nearly half of total demand, with bakery, dairy, and meat segments also showing robust growth due to increased consumption of processed and convenience foods.

The Saudi Arabia Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Packaging Industry, Al Bayader International, National Factory for Foodstuff Packaging, Obeikan Packaging Company, Napco National, Al Watania Plastics, Takween Advanced Industries, Savola Packaging Systems, Almarai Company, Al Jazeera Factory for Food Packaging, Al Faisaliah Group, Al Suwaidi Industrial Services, Al Fahad Group, Al Rajhi Group, Al Safi Danone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian food packaging market is poised for transformation, driven by technological advancements and a shift towards sustainability. As consumers increasingly demand eco-friendly packaging solutions, companies are likely to invest in biodegradable materials and smart packaging technologies. Additionally, the expansion of the food and beverage sector, projected to grow by SAR 15 billion in future, will create new opportunities for innovative packaging solutions that cater to evolving consumer preferences and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Semi-Rigid Packaging Sustainable Packaging Paper and Paperboard Packaging Glass Packaging Metal Packaging Others |

| By End-User | Food and Beverage Bakery and Confectionery Dairy Products Meat, Fish, and Poultry Fruits and Vegetables Snacks and Convenience Foods Healthcare and Pharmaceuticals Personal Care and Cosmetics Household Products Others |

| By Material | Plastic (Polyethylene, Polypropylene, PET, etc.) Paper and Paperboard Glass Metal (Aluminum, Tinplate, etc.) Bioplastics and Plant-Fiber Bagasse and Moulded Fiber Others |

| By Application | Bakery, Confectionery, Pasta, and Noodles Dairy Products Sauces, Dressings, and Condiments Snacks and Side Dishes Convenience Foods Meat, Fish, and Poultry Fruits and Vegetables Beverages Industrial Packaging Retail Packaging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies for sustainable packaging Tax incentives for local manufacturers Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Food and Beverage Companies | 80 | Procurement Officers, Product Development Managers |

| Retail Sector Packaging Needs | 70 | Supply Chain Managers, Category Managers |

| Consumer Preferences in Packaging | 120 | General Consumers, Health-Conscious Shoppers |

| Sustainability Initiatives in Packaging | 60 | Sustainability Officers, Environmental Compliance Managers |

The Saudi Arabia Food Packaging Market is valued at approximately USD 1.75 billion, driven by increasing demand for packaged and ready-to-eat food products, urbanization, and a shift towards convenience foods among consumers.