Region:Africa

Author(s):Shubham

Product Code:KRAB5003

Pages:80

Published On:October 2025

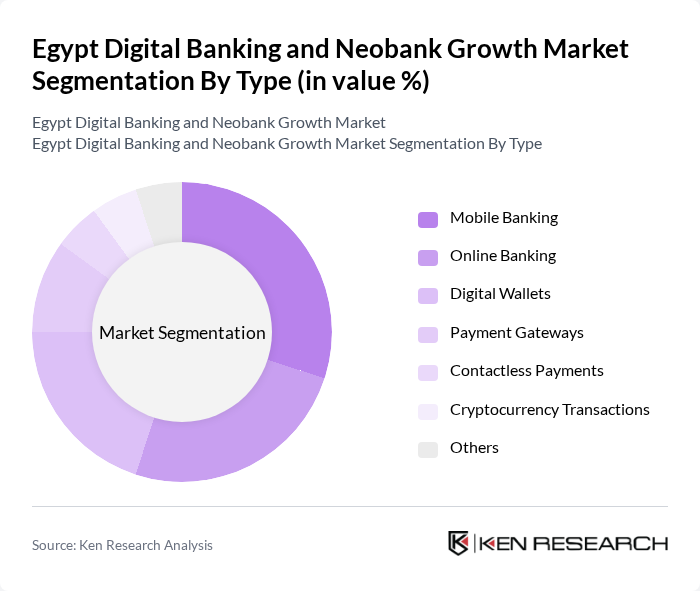

By Type:The market can be segmented into various types, including Mobile Banking, Online Banking, Digital Wallets, Payment Gateways, Contactless Payments, Cryptocurrency Transactions, and Others. Each of these segments plays a crucial role in shaping the digital banking landscape in Egypt, with digital wallets and mobile banking experiencing rapid growth due to their convenience and integration with e-commerce and daily transactions .

TheMobile Bankingsegment is currently dominating the market due to the widespread use of smartphones and the convenience it offers to users. Consumers prefer mobile banking for its ease of access, allowing them to perform transactions anytime and anywhere. The increasing number of mobile banking applications and the integration of advanced features such as biometric authentication and AI-driven customer support further enhance user experience, driving growth in this segment .

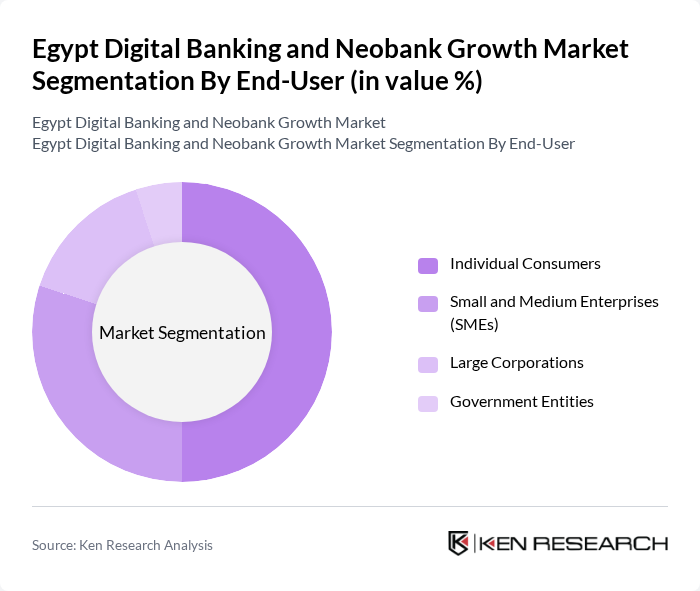

By End-User:The market can also be segmented by end-user categories, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each of these segments has unique needs and preferences that influence their adoption of digital banking services. SMEs and individual consumers are rapidly increasing their adoption of digital banking, driven by the need for efficient payment solutions and access to credit .

TheIndividual Consumerssegment is the largest in the market, driven by the increasing adoption of smartphones and the growing preference for digital financial services. This segment benefits from the convenience and accessibility of mobile banking and digital wallets, allowing users to manage their finances efficiently. The rise of e-commerce and online shopping has also contributed to the growth of this segment, as consumers seek seamless payment solutions .

The Egypt Digital Banking and Neobank Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology Services, EFG Hermes, CIB (Commercial International Bank), Banque Misr, National Bank of Egypt, QNB ALAHLI, Arab African International Bank, Banque du Caire, Misr Digital Innovation (onebank), Paymob, valU, Aman for Financial Services, Bee, Vodafone Cash, and InstaPay contribute to innovation, geographic expansion, and service delivery in this space .

The future of Egypt's digital banking and neobank sector appears promising, driven by technological advancements and increasing consumer acceptance. By future, the market is expected to witness a surge in mobile banking adoption, with an estimated40 million usersengaging in digital transactions. Additionally, the rise of personalized financial products tailored to consumer needs will enhance customer engagement. Collaborations with fintech companies will further innovate service offerings, ensuring that digital banking remains competitive and aligned with global trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Online Banking Digital Wallets Payment Gateways Contactless Payments Cryptocurrency Transactions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cash on Delivery |

| By Service Type | Fund Transfers Bill Payments E-commerce Transactions Remittances |

| By Distribution Channel | Online Platforms Mobile Applications Physical Bank Branches ATMs |

| By Customer Segment | Retail Customers Corporate Clients Government Agencies |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public Awareness Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 120 | Retail Banking Customers, Digital Banking Users |

| Neobank Adoption Trends | 80 | Young Professionals, Tech-Savvy Consumers |

| Small Business Banking Needs | 60 | Small Business Owners, Entrepreneurs |

| Regulatory Impact on Digital Banking | 40 | Regulatory Officials, Compliance Officers |

| Fintech Expert Insights | 40 | Industry Analysts, Fintech Consultants |

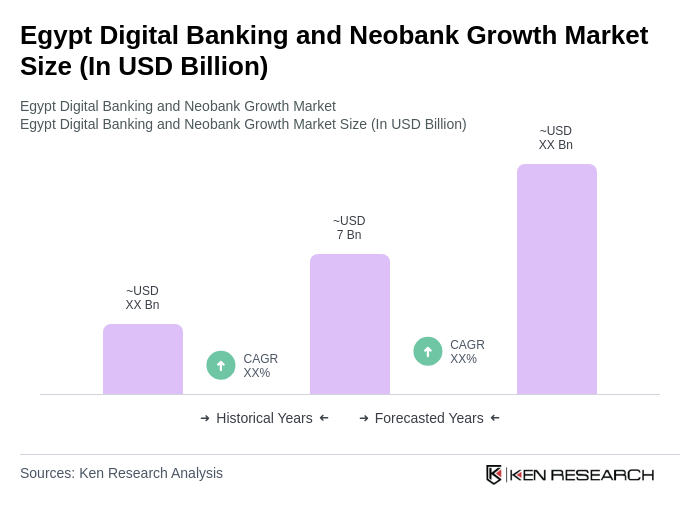

The Egypt Digital Banking and Neobank Growth Market is valued at approximately USD 7 billion, driven by the increasing adoption of digital financial services, smartphone penetration, and a preference for cashless transactions among consumers.