Region:Middle East

Author(s):Shubham

Product Code:KRAA8839

Pages:80

Published On:November 2025

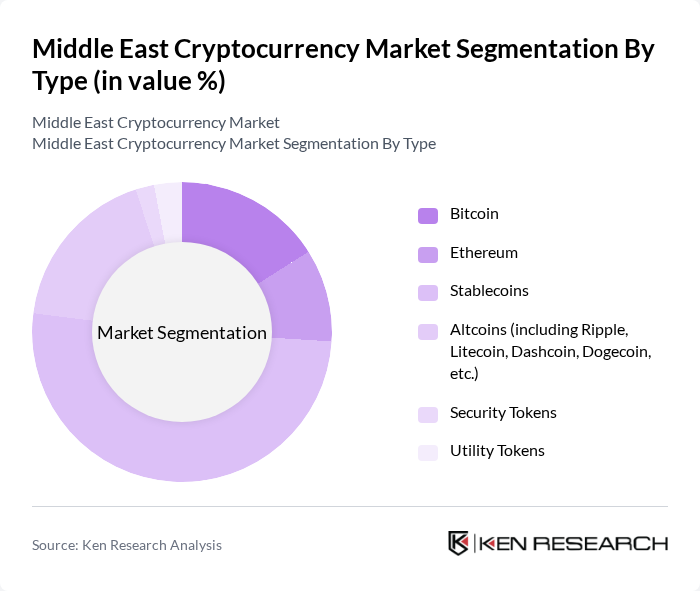

By Type:The cryptocurrency market in the Middle East is segmented into Bitcoin, Ethereum, Stablecoins, Altcoins, Security Tokens, and Utility Tokens. Bitcoin remains the most recognized and widely used cryptocurrency, while Ethereum continues to gain traction due to its smart contract and decentralized finance (DeFi) capabilities. Stablecoins are increasingly favored for remittances and everyday transactions due to their price stability, while Altcoins such as Ripple and Litecoin are diversifying the market with innovative solutions. Security and Utility Tokens are emerging to address specific investment and operational use cases .

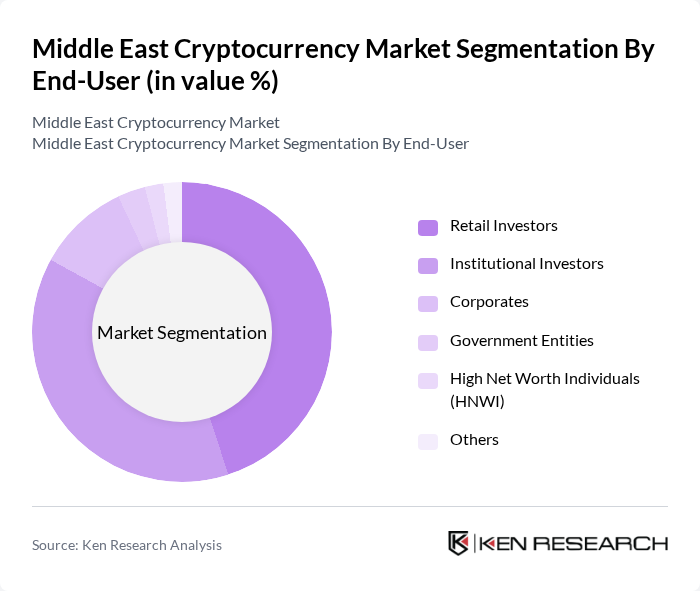

By End-User:The end-user segmentation of the cryptocurrency market includes Retail Investors, Institutional Investors, Corporates, Government Entities, High Net Worth Individuals (HNWI), and Others. Retail investors drive a significant portion of the market, supported by the proliferation of user-friendly trading platforms and mobile apps. Institutional investors are increasingly active, particularly in Saudi Arabia and the UAE, attracted by regulatory clarity and the potential for portfolio diversification. Corporates are leveraging blockchain for remittances and supply chain solutions, while government entities are focused on regulatory oversight and digital asset innovation .

The Middle East Cryptocurrency Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, BitOasis, Rain Financial, eToro, Kraken, CoinMENA, Huobi, OKX, Bitstamp, Bittrex Global, Gemini, KuCoin, Bybit, Crypto.com, Nobitex, Wallex, Bitpin, Ramzinex contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East cryptocurrency market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As governments increasingly recognize the potential of digital currencies, regulatory frameworks are expected to become more defined, fostering a safer investment environment. Additionally, the integration of cryptocurrencies into mainstream financial services and e-commerce platforms will likely enhance accessibility, driving further adoption. The region's focus on innovation and digital transformation will position it as a key player in the global cryptocurrency landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bitcoin Ethereum Stablecoins Altcoins (including Ripple, Litecoin, Dashcoin, Dogecoin, etc.) Security Tokens Utility Tokens |

| By End-User | Retail Investors Institutional Investors Corporates Government Entities High Net Worth Individuals (HNWI) Others |

| By Transaction Type | Spot Trading Derivatives Trading Over-the-Counter (OTC) Transactions Remittance/Payment Others |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash Payments E-wallets Others |

| By Geographic Presence | United Arab Emirates (UAE) Saudi Arabia Turkey Israel Iran Bahrain Qatar Kuwait Oman Jordan Others |

| By Industry Application | Financial Services Retail Gaming Supply Chain Management Real Estate Remittance & Payments Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cryptocurrency Exchange Users | 120 | Retail Investors, Day Traders |

| Blockchain Startups | 60 | Founders, CTOs, Product Managers |

| Financial Institutions | 50 | Investment Analysts, Risk Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Cryptocurrency Enthusiasts | 80 | Community Leaders, Influencers |

The Middle East Cryptocurrency Market is valued at approximately USD 110 billion, driven by increased adoption of digital currencies, blockchain solutions, and participation from both retail and institutional investors.