Region:Africa

Author(s):Geetanshi

Product Code:KRAB5138

Pages:98

Published On:October 2025

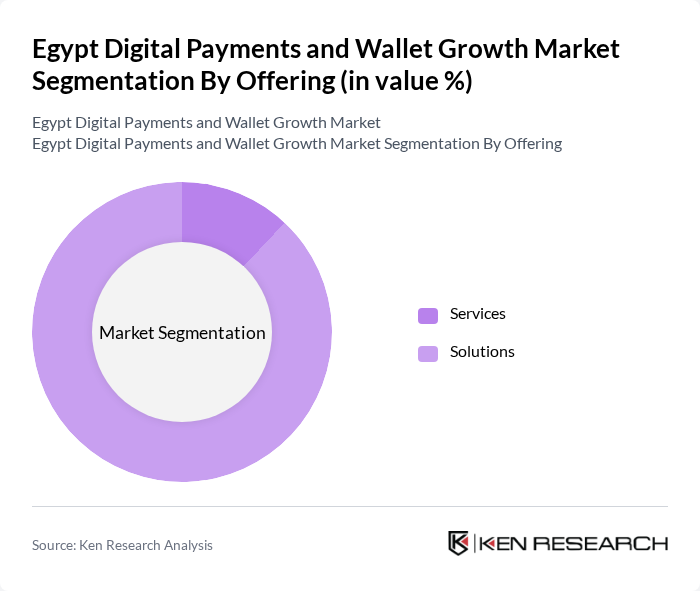

By Offering:The market is segmented into two primary categories: Services and Solutions. The Services segment includes various digital payment services such as mobile wallets and online payment gateways, while the Solutions segment encompasses comprehensive payment processing systems and software tailored for businesses.

The Solutions segment is currently dominating the market, driven by the increasing business demand for comprehensive payment processing systems and software. The rise in e-commerce and the need for robust payment infrastructure have led to a surge in the adoption of these solutions. Businesses are increasingly seeking integrated payment platforms that offer seamless transaction processing, security features, and analytics capabilities.

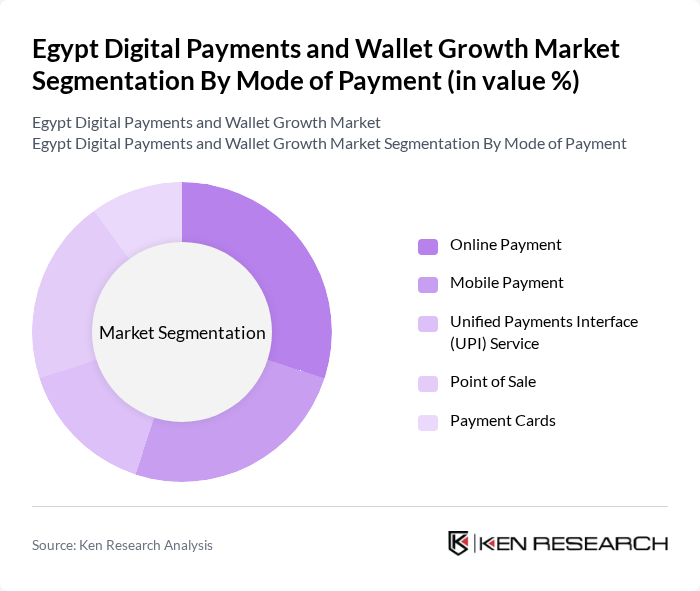

By Mode of Payment:The market is further segmented into Online Payment, Mobile Payment, Unified Payments Interface (UPI) Service, Point of Sale, and Payment Cards. Each of these modes caters to different consumer needs and preferences, reflecting the diverse landscape of digital payments.

Among the modes of payment, Mobile Application is leading the market segment, representing the largest portion of digital payment transactions. This dominance is fueled by the rapid growth of mobile-first payment solutions and the increasing number of consumers adopting smartphone-based payment methods. The convenience and accessibility offered by mobile payment platforms have made them the preferred choice for many consumers, particularly in a mobile-first market like Egypt.

The Egypt Digital Payments and Wallet Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology Services S.A.E., Vodafone Cash (Vodafone Egypt), Orange Money (Orange Egypt), EFG Hermes Holding S.A.E., Paymob Solutions, Aman for E-Payment (Raya Holding), Masary for Electronic Payments, Bee Smart Payment Solutions, Commercial International Bank (CIB) Egypt, Banque Misr, National Bank of Egypt (NBE), QNB Alahli, Arab African International Bank (AAIB), Banque du Caire, E-Payments Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital payments market appears promising, driven by technological advancements and increasing consumer acceptance. With the anticipated rise in smartphone usage and government support for cashless transactions, the market is set to expand significantly. Additionally, the integration of artificial intelligence in payment processing is expected to enhance user experience and security. As e-commerce continues to flourish, digital payment solutions will become increasingly vital, paving the way for a more inclusive financial ecosystem in Egypt.

| Segment | Sub-Segments |

|---|---|

| By Offering | Services Solutions |

| By Mode of Payment | Online Payment Mobile Payment Unified Payments Interface (UPI) Service Point of Sale Payment Cards |

| By Organization Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By Deployment Model | Cloud On Premise |

| By End User | Consumer Commercial |

| By Technology | Biometric Authentication AI and IoT Digital Ledger Technology (DLT) Data Analytics and ML Application Programming Interface (API) |

| By Mode of Usage | Desktop/Web Browser Mobile Application |

| By Use Case | Government Merchant/Business Person (P/C) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users |

| Merchant Acceptance of Digital Payments | 85 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 65 | Product Managers, Business Development Executives |

| Regulatory Impact Assessment | 45 | Policy Makers, Financial Regulators |

| Consumer Attitudes Towards Cashless Transactions | 95 | General Public, Tech-Savvy Consumers |

The Egypt Digital Payments and Wallet Growth Market is valued at approximately USD 2 billion, driven by increased adoption of digital payment solutions, smartphone penetration, and a shift towards cashless transactions among consumers and businesses.