Region:Asia

Author(s):Dev

Product Code:KRAC3346

Pages:89

Published On:October 2025

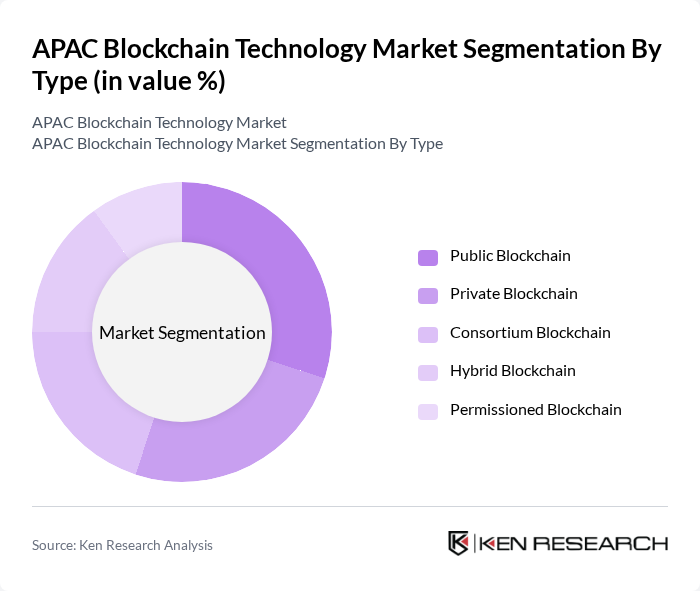

The Public Blockchain segment leads the market, driven by its decentralized architecture, which appeals to industries prioritizing transparency and security. The surge in cryptocurrencies, decentralized finance (DeFi), and non-fungible token (NFT) applications has accelerated demand for public blockchain solutions, while enterprises increasingly explore hybrid and consortium models for secure, scalable deployments .

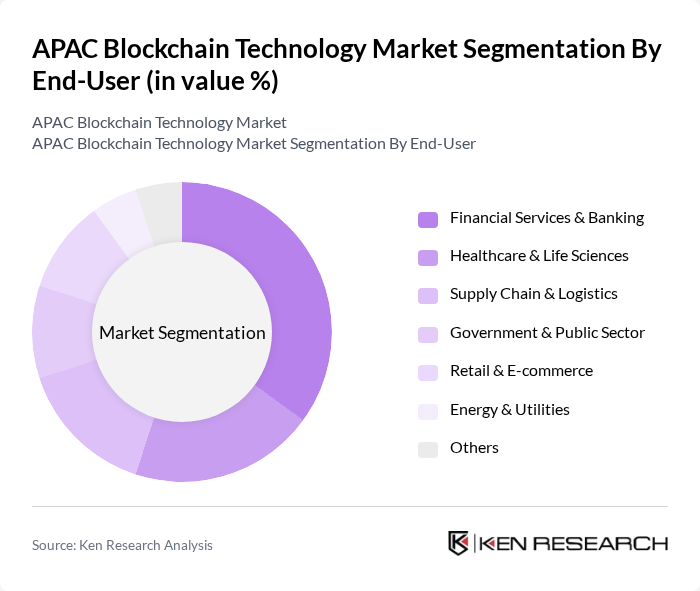

The Financial Services & Banking sector remains the dominant end-user, driven by the need for secure, efficient transaction processing and the rapid adoption of digital assets and DeFi solutions. Healthcare and supply chain sectors are also experiencing strong blockchain adoption for data integrity and transparency, while government initiatives increasingly focus on digital identity and public records management .

The APAC Blockchain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, Accenture PLC, Ripple Labs Inc., ConsenSys AG, R3 CEV LLC, Ant Group (Alibaba Group), Tencent Holdings Ltd., Digital Asset Holdings LLC, VeChain Foundation, Hyperledger Foundation, Bitfury Group, Binance Holdings Limited, Huobi Global Limited, Line Corporation, HashKey Group, SBI Holdings Inc., OneConnect Financial Technology Co., Ltd. (Ping An Group), Wipro Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the APAC blockchain technology market appears promising, driven by increasing investments in digital infrastructure and a growing emphasis on innovation. As governments and private sectors collaborate to create supportive regulatory frameworks, the adoption of blockchain across various industries is expected to accelerate. Additionally, advancements in technology, such as artificial intelligence integration, will further enhance blockchain capabilities, making it a vital component of digital transformation strategies in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain Permissioned Blockchain |

| By End-User | Financial Services & Banking Healthcare & Life Sciences Supply Chain & Logistics Government & Public Sector Retail & E-commerce Energy & Utilities Others |

| By Region | China Japan South Korea India Australia & New Zealand Southeast Asia Rest of APAC |

| By Technology | Smart Contracts Cryptographic Security Distributed Ledger Technology (DLT) Tokenization Others |

| By Application | Payment & Settlement Identity Management & Verification Asset & Wealth Management Trade Finance Compliance & KYC Others |

| By Investment Source | Venture Capital Private Equity Government Grants & Public Funding Corporate Investments Others |

| By Policy Support | Tax Incentives Regulatory Sandboxes & Frameworks Funding & Innovation Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Blockchain Adoption | 100 | Chief Technology Officers, Blockchain Project Managers |

| Supply Chain Management Solutions | 60 | Logistics Managers, Supply Chain Analysts |

| Healthcare Blockchain Applications | 50 | Healthcare IT Directors, Compliance Officers |

| Government Blockchain Initiatives | 40 | Policy Makers, Government IT Officials |

| Blockchain Startups and Innovation | 45 | Founders, Product Development Leads |

The APAC Blockchain Technology Market is valued at approximately USD 20 billion, driven by investments in blockchain solutions across various sectors, including finance, healthcare, and supply chain management, reflecting a significant growth trajectory in the region.