Region:Africa

Author(s):Rebecca

Product Code:KRAB5369

Pages:81

Published On:October 2025

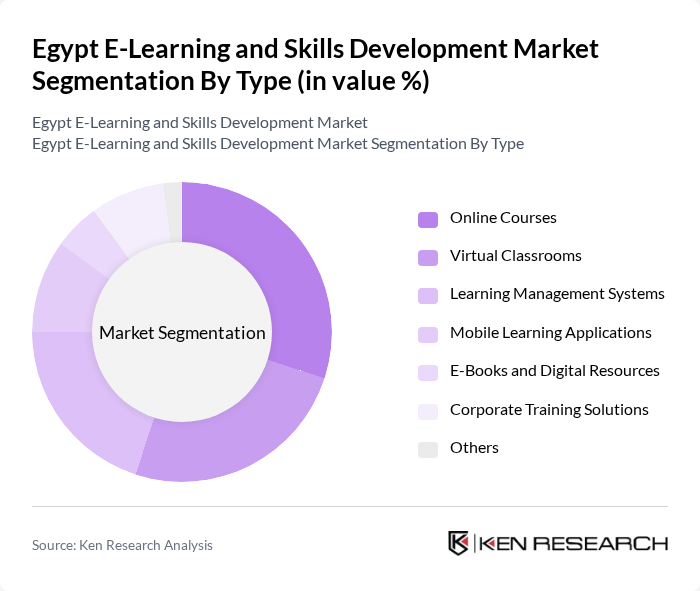

By Type:The market can be segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems, Mobile Learning Applications, E-Books and Digital Resources, Corporate Training Solutions, and Others. Each of these subsegments plays a crucial role in shaping the overall market dynamics.

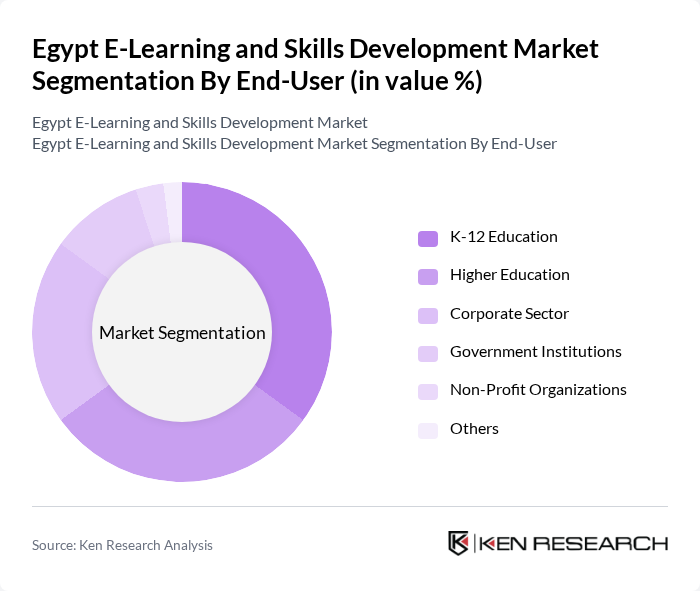

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Sector, Government Institutions, Non-Profit Organizations, and Others. Each segment has unique needs and preferences that influence the types of e-learning solutions adopted.

The Egypt E-Learning and Skills Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Edraak, Rwaq, Skill Academy, Almentor, Udacity, Coursera, FutureLearn, LinkedIn Learning, Khan Academy, EdX, LearnSmart, Pluralsight, Codecademy, Skillshare, Alison contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's e-learning and skills development market appears promising, driven by technological advancements and increasing acceptance of digital education. As the government continues to invest in digital infrastructure, more educational institutions are likely to adopt hybrid learning models. Additionally, the integration of artificial intelligence in personalized learning experiences is expected to enhance engagement and effectiveness, catering to diverse learning needs and preferences across the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems Mobile Learning Applications E-Books and Digital Resources Corporate Training Solutions Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Non-Profit Organizations Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Subject Area | STEM Education Language Learning Professional Development Arts and Humanities Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| By Geographic Reach | National Regional International Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Adoption | 150 | School Administrators, Teachers, Parents |

| Higher Education Online Programs | 100 | University Deans, Faculty Members, Students |

| Vocational Training Platforms | 80 | Training Coordinators, Industry Experts, Trainees |

| Corporate E-Learning Solutions | 70 | HR Managers, Learning & Development Specialists |

| Government Initiatives in E-Learning | 60 | Policy Makers, Educational Consultants, NGO Representatives |

The Egypt E-Learning and Skills Development Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for online education solutions and government initiatives aimed at enhancing educational access and quality.