Region:Asia

Author(s):Geetanshi

Product Code:KRAA3291

Pages:84

Published On:September 2025

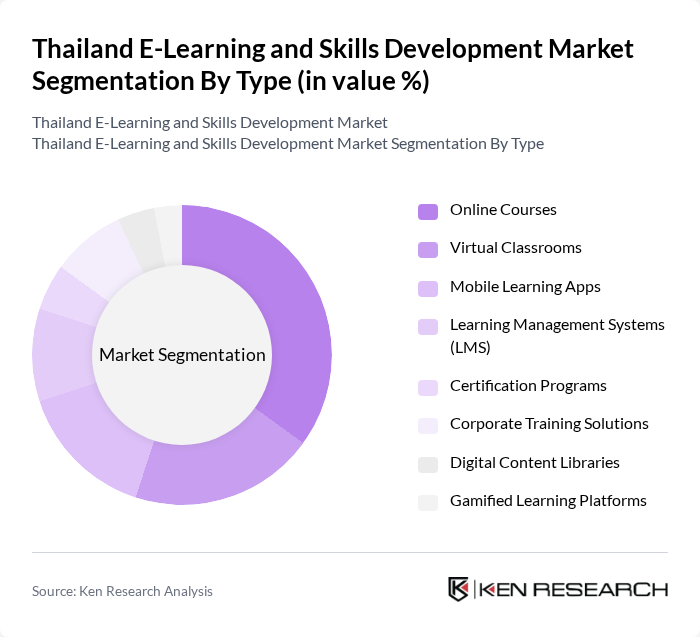

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Apps, Learning Management Systems (LMS), Certification Programs, Corporate Training Solutions, Digital Content Libraries, and Gamified Learning Platforms. Among these, Online Courses have emerged as the leading sub-segment due to their flexibility and accessibility, catering to a wide range of learners from students to professionals seeking to enhance their skills. The increasing trend of self-paced learning and the availability of diverse course offerings have significantly contributed to the popularity of this segment. The adoption of mobile learning and gamified platforms is also accelerating, driven by the need for engaging and interactive educational experiences .

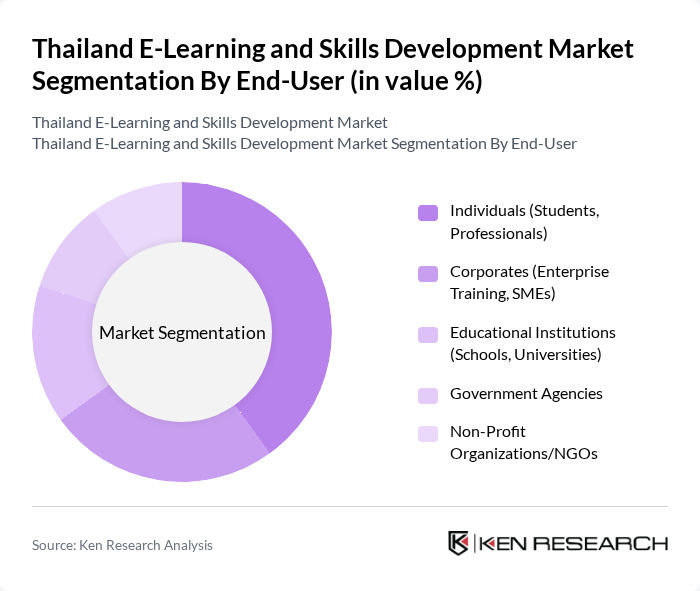

By End-User:The market is segmented by end-users, including Individuals (Students, Professionals), Corporates (Enterprise Training, SMEs), Educational Institutions (Schools, Universities), Government Agencies, and Non-Profit Organizations/NGOs. The Individuals segment is currently the most dominant, driven by the increasing number of professionals seeking to upskill and adapt to the rapidly changing job market. The convenience of online learning and the variety of available courses have made it an attractive option for personal and professional development. Corporate and institutional adoption is also increasing, with organizations leveraging e-learning for workforce development and compliance training .

The Thailand E-Learning and Skills Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as SkillLane, Coursera, Udemy, edX, Learn Corporation, Thai MOOC, Aksorn Education, Chula MOOC, SEAC (Southeast Asia Center), TQF (Thai Qualifications Framework), KMITL (King Mongkut's Institute of Technology Ladkrabang), TNI (Thai-Nichi Institute of Technology), TCDC (Thailand Creative & Design Center), Sasin School of Management, Thai Digital Academy, Vonder, LearnBig, ClassOnline, OpenDurian, Dek-D Interactive contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's e-learning and skills development market appears promising, driven by technological advancements and increasing acceptance of digital education. As the government continues to invest in digital infrastructure and educational initiatives, the market is likely to witness significant growth. Additionally, the integration of artificial intelligence and data analytics into learning platforms will enhance personalization, making e-learning more effective. The focus on soft skills development will further align educational offerings with industry needs, ensuring a skilled workforce ready for future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Mobile Learning Apps Learning Management Systems (LMS) Certification Programs Corporate Training Solutions Digital Content Libraries Gamified Learning Platforms |

| By End-User | Individuals (Students, Professionals) Corporates (Enterprise Training, SMEs) Educational Institutions (Schools, Universities) Government Agencies Non-Profit Organizations/NGOs |

| By Application | Professional Development & Upskilling Academic Learning (K-12, Higher Education) Vocational & Technical Training Language Learning Digital Literacy & ICT Skills Sustainability & Green Skills |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Institutional Licensing |

| By Content Type | Video-Based Content Text-Based Content Interactive Content AI-Driven Adaptive Content |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Adoption | 60 | Teachers, School Administrators, Parents |

| Higher Education Online Courses | 50 | University Professors, Students, Educational Planners |

| Corporate Training Programs | 40 | HR Managers, Training Coordinators, Employees |

| Skills Development Initiatives | 45 | Vocational Trainers, Industry Experts, Policy Makers |

| EdTech Platform User Experience | 55 | End Users, Product Managers, Customer Support Teams |

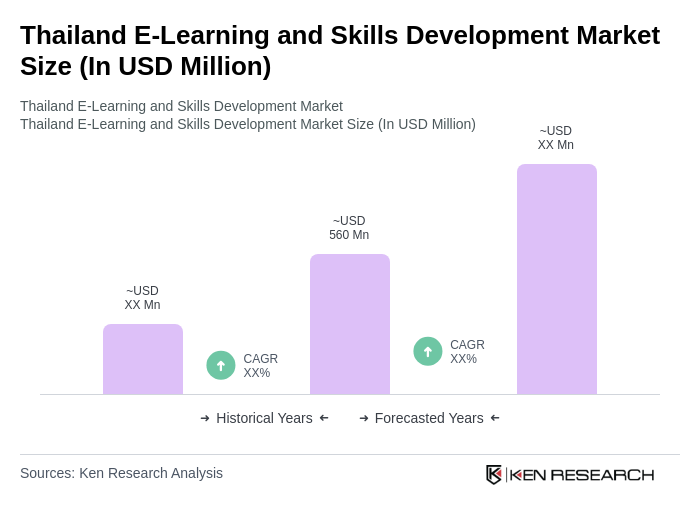

The Thailand E-Learning and Skills Development Market is valued at approximately USD 560 million, reflecting significant growth driven by digital learning adoption, government initiatives, and workforce upskilling demands.