Region:Africa

Author(s):Geetanshi

Product Code:KRAB4035

Pages:98

Published On:October 2025

By Type:The market is segmented into various types, including K-12 E-Learning, Higher Education E-Learning, Corporate Training Solutions, Language and Casual E-Learning, Learning Management Systems, Mobile Learning Applications, Educational Content Development, and Others. Among these, Corporate Training Solutions are gaining traction due to the increasing need for upskilling and reskilling in the workforce. Companies are investing in tailored training programs to enhance employee productivity and adapt to technological advancements. The adoption of learning management systems and mobile learning applications is also accelerating, driven by the need for flexible, scalable, and interactive training environments .

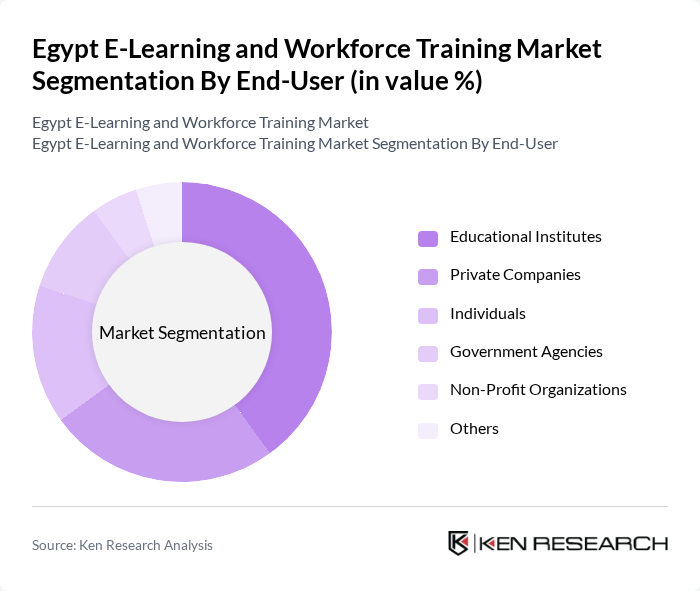

By End-User:The end-user segmentation includes Educational Institutes, Private Companies, Individuals, Government Agencies, Non-Profit Organizations, and Others. Educational Institutes are the leading end-users, as they are increasingly adopting e-learning solutions to enhance their teaching methodologies and reach a broader audience. The shift towards blended learning models and the integration of digital platforms in curricula have further propelled the demand for e-learning resources in schools and universities .

The Egypt E-Learning and Workforce Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almentor, Nafham, Akhdar, Zedny, Abwaab, Noon Academy, Edraak, Meduo, Ideasgym, Darisni, Selah Wltelmeez, Learn Khana, Waza Academy, Korras, Smart Art contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning and workforce training market in Egypt appears promising, driven by technological advancements and increasing acceptance of digital education. As more institutions embrace hybrid learning models, the integration of artificial intelligence and personalized learning experiences will enhance educational outcomes. Additionally, the focus on soft skills development and corporate training programs will create new avenues for growth, positioning Egypt as a regional leader in innovative educational solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Type | K-12 E-Learning Higher Education E-Learning Corporate Training Solutions Language and Casual E-Learning Learning Management Systems Mobile Learning Applications Educational Content Development Others |

| By End-User | Educational Institutes Private Companies Individuals Government Agencies Non-Profit Organizations Others |

| By Application | Professional Development Compliance Training Technical Skills Training Soft Skills Training Language Learning Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Others |

| By Content Type | Video Content Text-Based Content Interactive Content Assessments and Quizzes Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-Learning Platform Users | 100 | Students, Professionals, Lifelong Learners |

| Corporate Training Programs | 50 | HR Managers, Training Coordinators |

| Vocational Training Institutions | 40 | Institution Administrators, Instructors |

| Government Education Officials | 40 | Policy Makers, Education Planners |

| EdTech Startups | 50 | Founders, Product Managers |

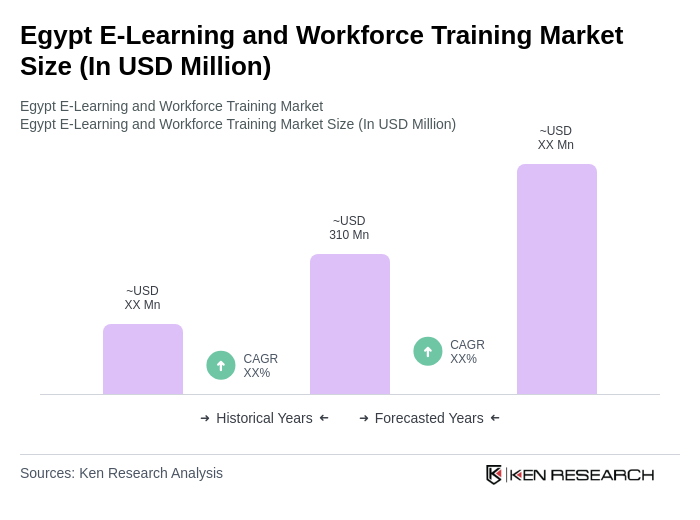

The Egypt E-Learning and Workforce Training Market is valued at approximately USD 310 million, reflecting significant growth driven by digital technology adoption, a young population, and government educational reforms, particularly accelerated by the COVID-19 pandemic.