Region:Europe

Author(s):Shubham

Product Code:KRAA5971

Pages:89

Published On:September 2025

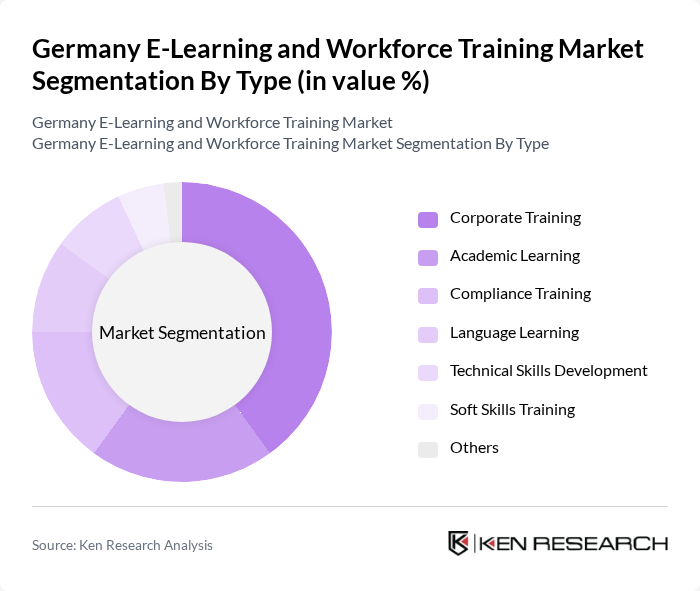

By Type:The market is segmented into various types, including Corporate Training, Academic Learning, Compliance Training, Language Learning, Technical Skills Development, Soft Skills Training, and Others. Among these, Corporate Training is the leading segment, driven by the increasing need for companies to upskill their workforce in response to technological advancements and market demands. Organizations are investing heavily in e-learning solutions to enhance employee productivity and engagement.

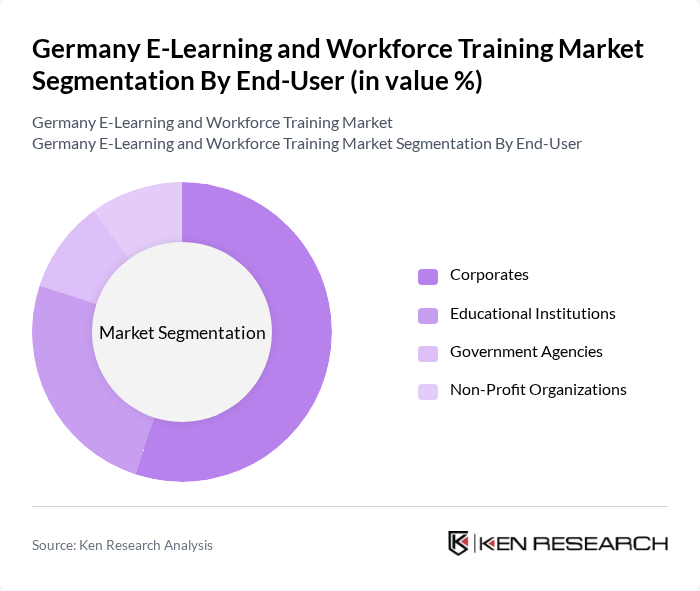

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, and Non-Profit Organizations. Corporates dominate this segment as they increasingly recognize the importance of continuous learning and development for their employees. The shift towards remote work has further accelerated the adoption of e-learning solutions, making it essential for organizations to provide accessible training options.

The Germany E-Learning and Workforce Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Udemy, Inc., LinkedIn Learning, Coursera, Inc., Skillsoft Corporation, Pluralsight, Inc., Iversity GmbH, iversity.org, Xpert Learning, eLearning Industry, Learnship Networks GmbH, Brainshark, Inc., TalentLMS, Moodle Pty Ltd, EdX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning and workforce training market in Germany appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly embrace digital transformation, the integration of AI and personalized learning experiences will likely reshape training methodologies. Furthermore, the collaboration between e-learning providers and educational institutions is expected to enhance course offerings, making training more relevant and accessible. This dynamic environment will foster innovation and adaptability, positioning the market for sustained growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Training Academic Learning Compliance Training Language Learning Technical Skills Development Soft Skills Training Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations |

| By Delivery Mode | Online Learning Blended Learning Mobile Learning |

| By Content Type | Video-Based Learning Interactive Modules Text-Based Resources |

| By Certification Type | Professional Certifications Academic Degrees Short Courses |

| By Industry | IT and Software Healthcare Finance Manufacturing |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate E-Learning Programs | 150 | HR Managers, Training Coordinators |

| Industry-Specific Workforce Training | 100 | Training Managers, Compliance Officers |

| Higher Education E-Learning Solutions | 80 | University Administrators, Faculty Heads |

| Small Business Training Initiatives | 70 | Business Owners, Operations Managers |

| Technology Adoption in E-Learning | 90 | IT Managers, E-Learning Developers |

The Germany E-Learning and Workforce Training Market is valued at approximately USD 7 billion, reflecting significant growth driven by the demand for flexible learning solutions and the rise of remote work, alongside the need for continuous skill development.