Region:Africa

Author(s):Geetanshi

Product Code:KRAA0248

Pages:82

Published On:August 2025

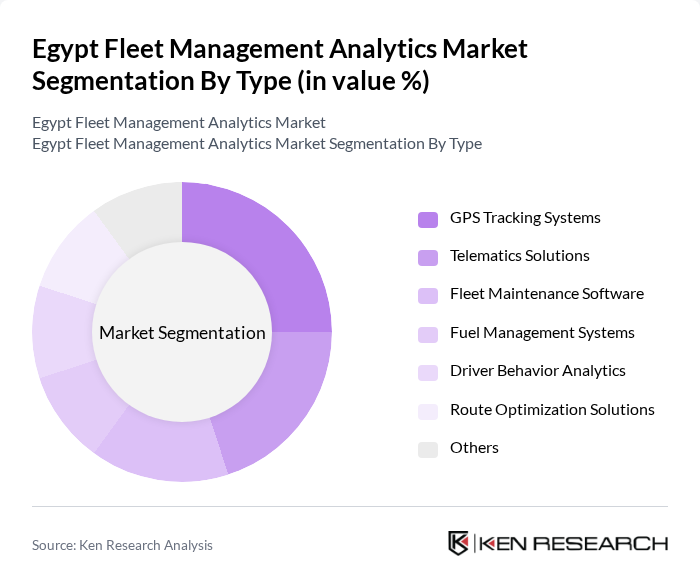

By Type:The market is segmented into various types, including GPS Tracking Systems, Telematics Solutions, Fleet Maintenance Software, Fuel Management Systems, Driver Behavior Analytics, Route Optimization Solutions, and Others. Each of these subsegments plays a crucial role in enhancing fleet efficiency and operational performance .

The GPS Tracking Systems subsegment is currently dominating the market due to the increasing need for real-time vehicle tracking and monitoring. Businesses are increasingly adopting GPS technology to enhance fleet visibility, improve route planning, and ensure timely deliveries. The growing emphasis on safety and compliance with government regulations further drives the demand for GPS tracking solutions. As a result, this subsegment is expected to maintain its leadership position in the market .

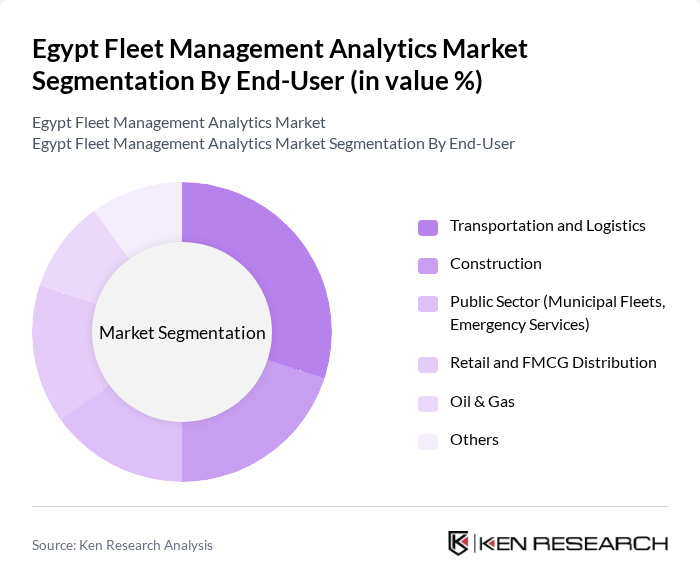

By End-User:The market is segmented by end-users, including Transportation and Logistics, Construction, Public Sector (Municipal Fleets, Emergency Services), Retail and FMCG Distribution, Oil & Gas, and Others. Each end-user segment has unique requirements and contributes to the overall growth of the market .

The Transportation and Logistics segment is the leading end-user in the market, driven by the rapid growth of e-commerce and the need for efficient supply chain management. Companies in this sector are increasingly investing in fleet management analytics to optimize their operations, reduce costs, and enhance customer satisfaction. The demand for timely deliveries and improved fleet visibility further solidifies the Transportation and Logistics segment's dominance in the market .

The Egypt Fleet Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Fleet Complete, Teletrac Navman, Verizon Connect, Omnicomm, Fleetio, Samsara, TomTom Telematics, Gurtam, Microlise, Chevin Fleet Solutions, Navman Wireless, Inseego, Azuga, Masafat (Egypt), FleetRoot (Middle East), Traklink (Egypt/Jordan), Traxion (Egypt) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt fleet management analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to adopt cloud-based solutions and AI technologies, the integration of real-time data analytics will enhance decision-making processes. Furthermore, the government's push for smart transportation and sustainability initiatives will likely create a conducive environment for innovation, fostering growth in the sector and encouraging collaboration among stakeholders to address emerging challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Systems Telematics Solutions Fleet Maintenance Software Fuel Management Systems Driver Behavior Analytics Route Optimization Solutions Others |

| By End-User | Transportation and Logistics Construction Public Sector (Municipal Fleets, Emergency Services) Retail and FMCG Distribution Oil & Gas Others |

| By Vehicle Type | Light Commercial Vehicles Heavy-Duty Trucks Buses & Coaches Vans Electric Vehicles Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Cairo Alexandria Giza Suez Canal Corridor Others |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services Data Analytics & Reporting Services Others |

| By Policy Support | Subsidies for Fleet Management Solutions Tax Incentives for Green Fleets Grants for Technology Adoption Regulatory Mandates for Vehicle Tracking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Construction Vehicle Fleet | 60 | Project Managers, Equipment Supervisors |

| Public Transportation Systems | 50 | Transport Planners, Fleet Coordinators |

| Corporate Fleet Operations | 70 | Procurement Managers, Risk Management Officers |

| Technology Providers in Fleet Management | 40 | Product Managers, Business Development Executives |

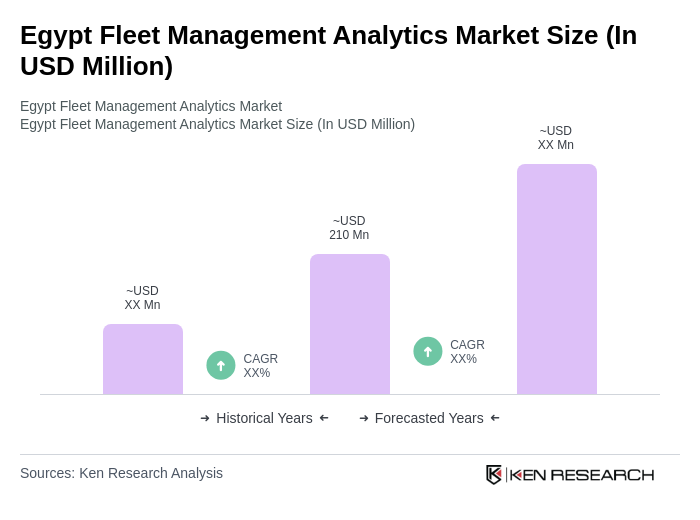

The Egypt Fleet Management Analytics Market is valued at approximately USD 210 million, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations, particularly in logistics and e-commerce sectors.