Region:Africa

Author(s):Dev

Product Code:KRAB6113

Pages:83

Published On:October 2025

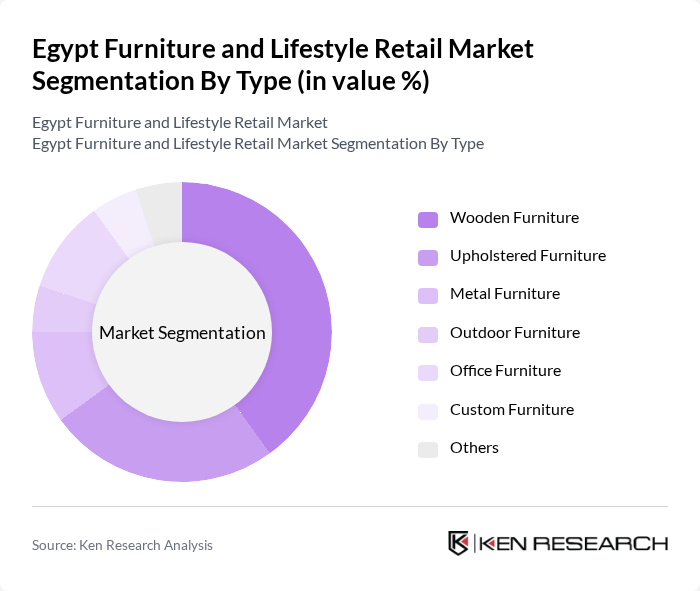

By Type:The furniture market in Egypt is segmented into various types, including Wooden Furniture, Upholstered Furniture, Metal Furniture, Outdoor Furniture, Office Furniture, Custom Furniture, and Others. Among these, Wooden Furniture is the most dominant segment due to its traditional appeal and durability, which resonates well with Egyptian consumers. The preference for wooden furniture is driven by cultural factors and the perception of quality associated with wood. Upholstered Furniture is also gaining traction, particularly in urban areas where modern aesthetics are favored. The market is witnessing a trend towards customization, with consumers increasingly seeking unique designs that reflect their personal style.

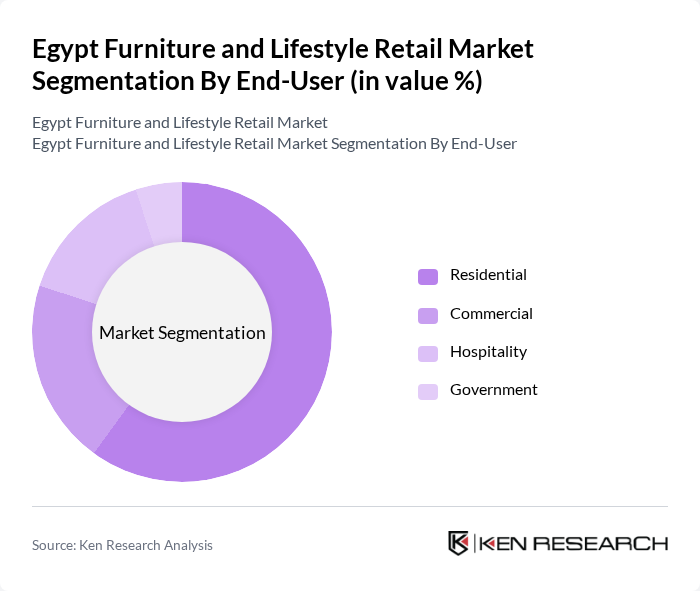

By End-User:The end-user segmentation of the furniture market includes Residential, Commercial, Hospitality, and Government sectors. The Residential segment holds the largest share, driven by the increasing demand for home furnishings as urbanization continues to rise. Consumers are investing in their living spaces, leading to a surge in demand for stylish and functional furniture. The Commercial segment is also significant, with businesses seeking quality office furniture to enhance their work environments. The Hospitality sector is growing, particularly with the rise of tourism, which necessitates the furnishing of hotels and restaurants.

The Egypt Furniture and Lifestyle Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Jumia, Al-Futtaim Group, Elaraby Group, Mobica, El-Mohandes Furniture, Al-Hazek Group, Al-Masria Furniture, Al-Ahram Furniture, Al-Mansour Group, Al-Masrya Furniture, Al-Nasr Furniture, Al-Salam Furniture, Al-Watania Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt furniture and lifestyle retail market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics, the demand for innovative and sustainable furniture solutions is expected to grow. Additionally, the expansion of e-commerce will likely enhance market accessibility, allowing consumers to explore diverse product offerings. However, businesses must navigate economic challenges and supply chain issues to capitalize on these opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Upholstered Furniture Metal Furniture Outdoor Furniture Office Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Functionality | Multi-functional Furniture Space-saving Solutions Luxury Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Furniture Retailers | 150 | Store Owners, Retail Managers |

| Consumer Insights | 200 | Homeowners, Renters, Interior Design Enthusiasts |

| Lifestyle Product Retailers | 100 | Brand Managers, Marketing Directors |

| Interior Designers | 80 | Freelance Designers, Design Firm Representatives |

| Market Analysts | 50 | Industry Analysts, Economic Researchers |

The Egypt Furniture and Lifestyle Retail Market is valued at approximately USD 3.5 billion, driven by factors such as urbanization, rising disposable incomes, and a growing middle class seeking quality furniture options.