Region:Asia

Author(s):Dev

Product Code:KRAB6031

Pages:83

Published On:October 2025

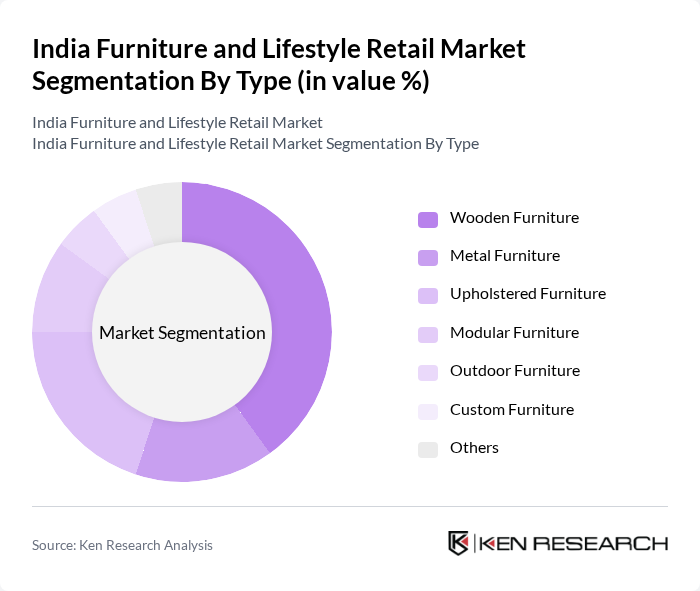

By Type:The furniture market is segmented into various types, including wooden, metal, upholstered, modular, outdoor, custom, and others. Among these, wooden furniture is the most dominant segment due to its traditional appeal and durability. Consumers often prefer wooden furniture for its aesthetic value and longevity, making it a staple in both residential and commercial spaces. The increasing trend of customization and modular designs is also gaining traction, catering to the evolving preferences of modern consumers.

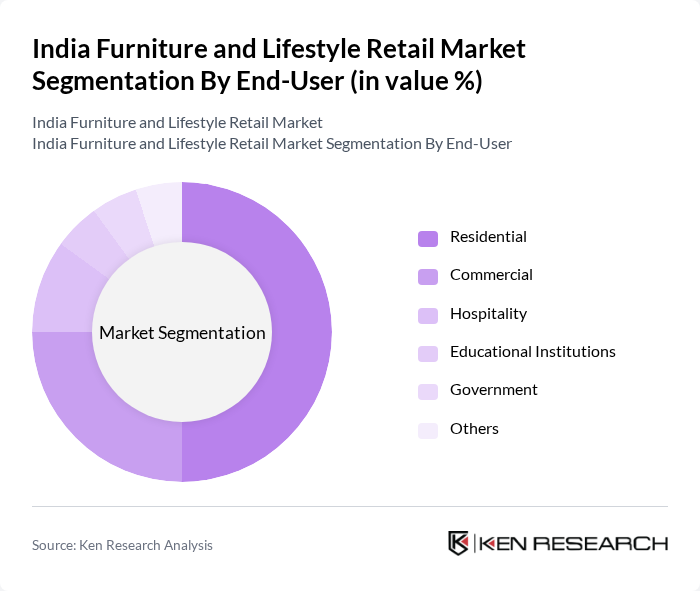

By End-User:The end-user segmentation includes residential, commercial, hospitality, educational institutions, government, and others. The residential segment is the largest, driven by the increasing number of households and the trend of home renovations. Consumers are investing in stylish and functional furniture to enhance their living spaces. The commercial segment is also growing, fueled by the expansion of office spaces and retail establishments, which require modern and ergonomic furniture solutions.

The India Furniture and Lifestyle Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godrej Interio, IKEA India, Urban Ladder, Pepperfry, Nilkamal, Durian, Hometown, Style Spa, Wipro Furniture, Spacewood, Royal Oak, Cosh Living, Fabindia, Duroflex, Home Centre contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India furniture and lifestyle retail market appears promising, driven by technological advancements and evolving consumer preferences. As smart furniture gains traction, companies are likely to invest in innovative designs that integrate technology. Furthermore, the increasing focus on sustainability will push brands to adopt eco-friendly materials and practices. With the expansion of online retail and customization options, the market is set to witness significant transformations, catering to diverse consumer needs and preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Modular Furniture Outdoor Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Educational Institutions Government Others |

| By Sales Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Wood Metal Plastic Glass Others |

| By Design Style | Contemporary Traditional Rustic Industrial Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Furniture Retailers | 150 | Store Managers, Regional Sales Directors |

| Lifestyle Product Manufacturers | 100 | Product Development Managers, Marketing Heads |

| Consumer Insights on Furniture Purchases | 200 | Homeowners, Renters, Interior Design Enthusiasts |

| Online Furniture Retail Platforms | 80 | E-commerce Managers, Digital Marketing Specialists |

| Furniture Exporters | 70 | Export Managers, Business Development Executives |

The India Furniture and Lifestyle Retail Market is valued at approximately INR 1,200 billion, driven by factors such as increasing disposable incomes, urbanization, and a growing trend towards home improvement and interior design.