Region:Africa

Author(s):Rebecca

Product Code:KRAB5917

Pages:87

Published On:October 2025

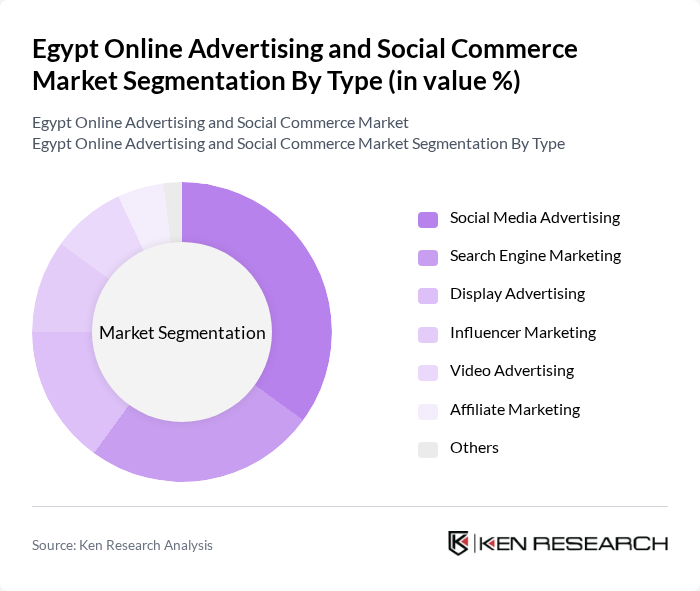

By Type:The market can be segmented into various types of online advertising, including Social Media Advertising, Search Engine Marketing, Display Advertising, Influencer Marketing, Video Advertising, Affiliate Marketing, and Others. Each of these segments plays a crucial role in shaping the overall market dynamics, with programmatic advertising representing 81.6% of the digital advertising market share and experiencing 12.7% growth in platform investments.

The Social Media Advertising segment is currently dominating the market due to the widespread use of platforms like Facebook, Instagram, and TikTok among Egyptian consumers. YouTube alone reaches 50.7 million users in Egypt, representing 43.1% of the total population and 52.7% of the internet user base. Brands are increasingly investing in social media campaigns to reach their target audiences effectively. The interactive nature of social media allows for personalized marketing strategies, which resonate well with users, driving higher engagement rates. Additionally, the rise of influencer marketing within social media platforms has further solidified its leading position.

By End-User:The market can also be segmented by end-users, including Retail, Travel and Tourism, Food and Beverage, Technology, Education, Healthcare, and Others. Each sector utilizes online advertising differently, reflecting their unique consumer engagement strategies, with mobile advertising accounting for USD 278 million in digital advertising spend and representing 22.2% of the market share.

The Retail segment is the largest end-user in the market, driven by the rapid growth of e-commerce in Egypt. Retailers are increasingly adopting online advertising strategies to attract consumers, especially during peak shopping seasons. The convenience of online shopping and the ability to target specific demographics through digital ads have made this segment a key player in the overall market landscape. Digital transformation and enhanced consumer engagement across cities continue to drive growth in this segment.

The Egypt Online Advertising and Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Egypt, Meta (Facebook) Egypt, Google Egypt, TikTok Egypt (ByteDance), AdFalcon, Digital Marketing Egypt, Edfa3ly, Talabat Egypt, Amazon Egypt (formerly Souq.com), Instabug, Fawry, Vezeeta, Wuzzuf, Elmenus, Halan contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's online advertising and social commerce market appears promising, driven by technological advancements and evolving consumer behaviors. As digital literacy improves, more businesses are expected to adopt innovative advertising strategies, including personalized content and interactive campaigns. Additionally, the integration of artificial intelligence in marketing efforts will enhance targeting capabilities, allowing brands to connect more effectively with their audiences. This dynamic environment is likely to foster significant growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Advertising Search Engine Marketing Display Advertising Influencer Marketing Video Advertising Affiliate Marketing Others |

| By End-User | Retail Travel and Tourism Food and Beverage Technology Education Healthcare Others |

| By Sales Channel | Direct Sales Online Marketplaces Social Media Platforms Affiliate Networks Others |

| By Content Format | Image Ads Video Ads Carousel Ads Stories Ads Sponsored Posts Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Campaigns National Campaigns Others |

| By Customer Demographics | Age Groups Gender Income Levels Education Levels Others |

| By Engagement Type | Brand Awareness Campaigns Product Launch Campaigns Seasonal Promotions Engagement Campaigns Retargeting Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers in Fashion | 100 | Marketing Managers, E-commerce Directors |

| Food and Beverage Social Commerce | 80 | Brand Managers, Social Media Coordinators |

| Consumer Electronics Advertisers | 60 | Product Managers, Digital Advertising Specialists |

| Health and Beauty Brands | 50 | Sales Directors, Digital Marketing Executives |

| Travel and Hospitality Sector | 70 | Marketing Analysts, Customer Experience Managers |

The Egypt Online Advertising and Social Commerce Market is valued at approximately USD 1.3 billion, driven by increased internet penetration, mobile device usage, and a surge in e-commerce activities, particularly through social media platforms.