Philippines Online Advertising and Social Commerce Market Overview

- The Philippines Online Advertising and Social Commerce Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, along with the rising popularity of social media platforms among consumers. The shift towards digital marketing strategies by businesses has also significantly contributed to the market's expansion.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines' online advertising and social commerce market. Metro Manila, being the capital, has a high concentration of businesses and consumers, making it a hub for digital marketing activities. Cebu and Davao follow closely due to their growing urbanization and increasing internet accessibility, which attract more advertisers and social commerce activities.

- In 2023, the Philippines government implemented the E-Commerce Act, which aims to promote and regulate online transactions. This legislation provides a legal framework for electronic contracts, digital signatures, and consumer protection, thereby enhancing trust in online commerce. The act is expected to facilitate the growth of the online advertising and social commerce market by ensuring a secure environment for both businesses and consumers.

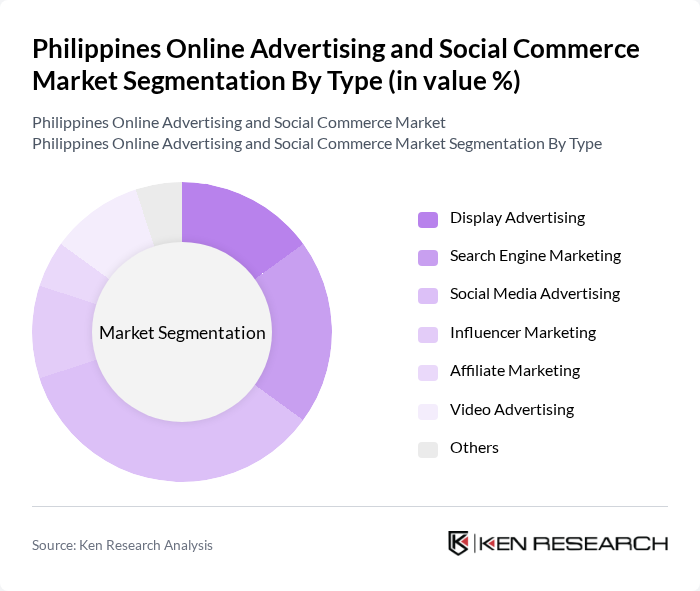

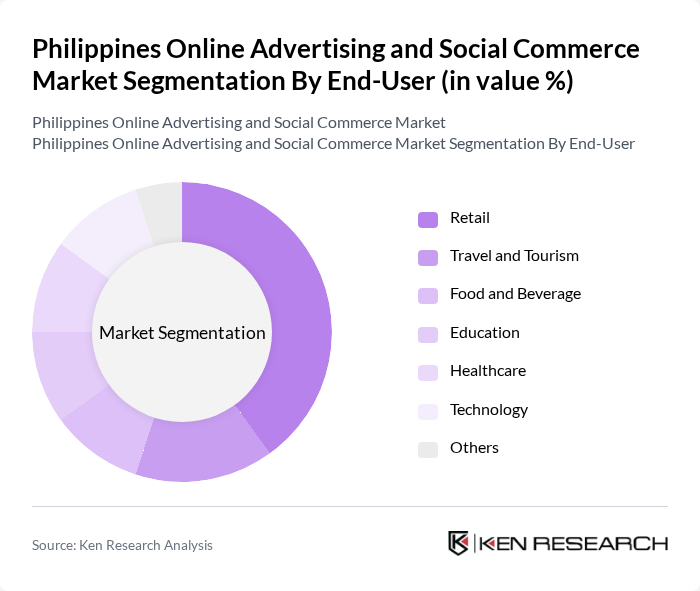

Philippines Online Advertising and Social Commerce Market Segmentation

By Type:The online advertising and social commerce market can be segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Influencer Marketing, Affiliate Marketing, Video Advertising, and Others. Among these, Social Media Advertising has emerged as a dominant force due to the widespread use of platforms like Facebook, Instagram, and TikTok, which allow businesses to reach targeted audiences effectively.

By End-User:The end-user segmentation of the online advertising and social commerce market includes Retail, Travel and Tourism, Food and Beverage, Education, Healthcare, Technology, and Others. The Retail sector is the leading end-user, as businesses increasingly leverage online platforms to reach consumers directly, especially during the pandemic, which accelerated the shift to e-commerce.

Philippines Online Advertising and Social Commerce Market Competitive Landscape

The Philippines Online Advertising and Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Facebook, Inc., Google LLC, Lazada Group, Shopee, Instagram, Inc., TikTok, AdSpark, Inc., Globe Telecom, Inc., Smart Communications, Inc., Viber Media S.A., Kumu, Zalora, Grab Holdings Inc., PayMaya Philippines, Inc., UnionBank of the Philippines contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Online Advertising and Social Commerce Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of the future, the Philippines boasts an internet penetration rate of approximately 75%, translating to around 83 million users. This growth is driven by improved infrastructure and affordable data plans, which have increased access to online platforms. The World Bank reports that the country's digital economy is projected to contribute $28 billion to GDP by the future, highlighting the significant role of internet access in driving online advertising and social commerce.

- Rise of Mobile Commerce:Mobile commerce in the Philippines is expected to reach $12 billion in the future, fueled by the widespread use of smartphones, which account for over 90% of internet access. The rapid adoption of mobile payment solutions, such as GCash and PayMaya, has facilitated seamless transactions. According to the Philippine Statistics Authority, mobile commerce transactions have increased by 30% year-on-year, indicating a robust shift towards mobile platforms for online shopping and advertising.

- Growth of Social Media Usage:The Philippines ranks among the top countries globally for social media usage, with over 76 million active users in the future. Filipinos spend an average of 4 hours and 15 minutes daily on social media platforms. This high engagement presents a lucrative opportunity for advertisers, as brands can leverage social media for targeted campaigns. According to Hootsuite, 90% of internet users in the country follow brands on social media, enhancing the effectiveness of online advertising strategies.

Market Challenges

- Data Privacy Concerns:The implementation of the Data Privacy Act in the Philippines has raised significant concerns among advertisers regarding compliance. As of the future, 60% of businesses report challenges in navigating the regulatory landscape, which can lead to hefty fines for non-compliance. The increasing scrutiny on data collection practices has made advertisers cautious, potentially stifling innovative marketing strategies that rely on consumer data for targeted advertising.

- High Competition Among Advertisers:The online advertising space in the Philippines is becoming increasingly saturated, with over 1,000 active digital marketing agencies competing for market share. This intense competition has led to rising costs for ad placements, with average costs per click increasing by 20% in the future. As advertisers strive to differentiate themselves, many face challenges in achieving visibility and engagement, making it crucial to adopt innovative strategies to stand out in a crowded marketplace.

Philippines Online Advertising and Social Commerce Market Future Outlook

The Philippines online advertising and social commerce market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As brands increasingly adopt personalized advertising strategies, the integration of artificial intelligence and data analytics will enhance targeting capabilities. Furthermore, the rise of video content and influencer marketing will reshape advertising dynamics, allowing brands to engage consumers more effectively. The focus on sustainability in advertising will also gain traction, aligning with global trends and consumer expectations for responsible marketing practices.

Market Opportunities

- Emerging Influencer Marketing:The influencer marketing sector in the Philippines is projected to grow to $1 billion in the future, as brands increasingly collaborate with local influencers to reach targeted demographics. This trend is driven by the authenticity and relatability influencers bring, making them effective brand ambassadors. Companies can leverage this opportunity to enhance brand visibility and consumer trust through strategic partnerships with influencers.

- Integration of AI in Advertising:The adoption of artificial intelligence in advertising is expected to revolutionize the industry, with investments in AI technologies projected to reach $500 million in the future. AI can optimize ad targeting, improve customer engagement, and enhance data analysis capabilities. By utilizing AI-driven insights, advertisers can create more effective campaigns that resonate with consumers, ultimately driving higher conversion rates and ROI.