Region:Europe

Author(s):Shubham

Product Code:KRAC0572

Pages:97

Published On:August 2025

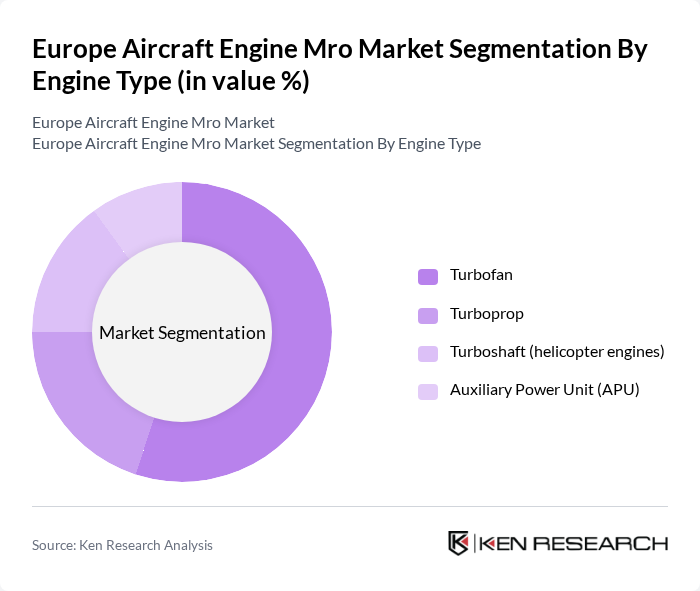

By Engine Type:The market is segmented into four main engine types: Turbofan, Turboprop, Turboshaft (helicopter engines), and Auxiliary Power Unit (APU). Among these, the Turbofan engines dominate the market due to their widespread use in commercial aviation, offering high efficiency and reliability. The increasing number of commercial aircraft and the demand for fuel-efficient engines have led to a significant focus on MRO services for Turbofan engines .

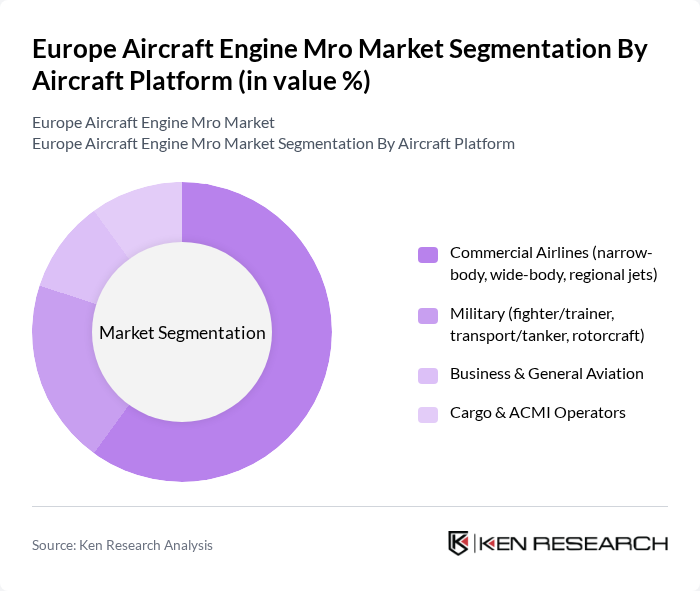

By Aircraft Platform:The market is categorized into Commercial Airlines (narrow-body, wide-body, regional jets), Military (fighter/trainer, transport/tanker, rotorcraft), Business & General Aviation, and Cargo & ACMI Operators. The Commercial Airlines segment leads the market, driven by the increasing air passenger traffic and the need for regular maintenance of a growing fleet of aircraft. The demand for MRO services in this segment is further supported by the trend towards longer aircraft lifespans and the need for compliance with safety regulations .

The Europe Aircraft Engine MRO market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolls?Royce Holdings plc, GE Aerospace (General Electric Company), Safran S.A. (including CFM International JV), MTU Aero Engines AG (MTU Maintenance), Pratt & Whitney (RTX), Lufthansa Technik AG, Air France Industries KLM Engineering & Maintenance (AFI KLM E&M), SR Technics, Turkish Technic A.?., FL Technics, UAB, AAR CORP., Collins Aerospace (RTX), Iberia Maintenance, TAP Maintenance & Engineering (TAP M&E), Sabena Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe Aircraft Engine MRO market appears promising, driven by technological advancements and increasing air traffic. The adoption of predictive maintenance technologies is expected to enhance operational efficiency, while the integration of artificial intelligence in diagnostics will streamline processes. Additionally, the focus on sustainability will likely lead to innovative practices in engine maintenance, ensuring compliance with stringent environmental regulations and meeting the evolving demands of the aviation industry.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Turbofan Turboprop Turboshaft (helicopter engines) Auxiliary Power Unit (APU) |

| By Aircraft Platform | Commercial Airlines (narrow-body, wide-body, regional jets) Military (fighter/trainer, transport/tanker, rotorcraft) Business & General Aviation Cargo & ACMI Operators |

| By Engine MRO Activity | Engine Overhaul & Shop Visit Engine Repair & Modular Workscopes (hot section, fan/LPT, HPC/HPT) Engine Parts & Rotables (LRUs, LLPs, blades/vanes) Engine Testing & Test Cell Services On?wing & Line Maintenance |

| By Service Provider | OEM?Affiliated MRO (e.g., Rolls?Royce, GE Aerospace, Pratt & Whitney, Safran) Airline MRO (e.g., Lufthansa Technik, AFI KLM E&M, Turkish Technic) Independent MRO (e.g., MTU Maintenance, SR Technics, FL Technics) Specialist Shops & Test Facilities |

| By Geography | Germany France United Kingdom Italy Spain Turkey Rest of Europe |

| By Contract Model | Time & Material (T&M) Power?by?the?Hour (PBH)/By?the?Hour (BTH) Fixed?Price & Not?to?Exceed (NTE) Exchange & Leasing (green?time engines) |

| By Customer Type | Network/Flag Carriers Low?Cost Carriers (LCCs) Cargo/Freight Operators Government & Defense |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft MRO Services | 150 | Maintenance Directors, Operations Managers |

| Military Aircraft Engine Maintenance | 100 | Defense Procurement Officers, Technical Managers |

| Business Jet Engine Overhaul | 80 | Fleet Managers, Aviation Maintenance Technicians |

| Helicopter Engine Repair Services | 70 | Helicopter Operations Managers, Safety Inspectors |

| Engine Component Repair and Overhaul | 90 | Quality Assurance Managers, Parts Procurement Specialists |

The Europe Aircraft Engine MRO market is valued at approximately USD 11 billion, reflecting a robust segment within the broader aircraft MRO market, which is estimated to be in the low-to-mid teens in billion-USD terms.