Region:Europe

Author(s):Shubham

Product Code:KRAA1852

Pages:84

Published On:August 2025

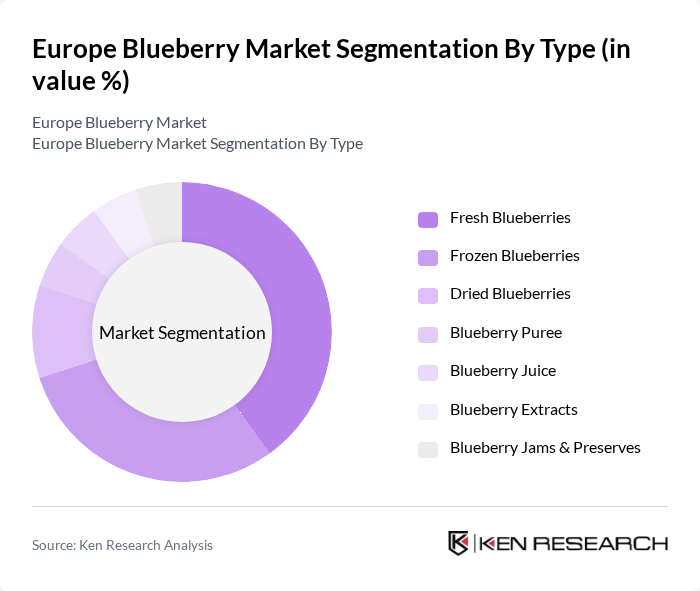

By Type:The blueberry market can be segmented into various types, including fresh blueberries, frozen blueberries, dried blueberries, blueberry puree, blueberry juice, blueberry extracts, and blueberry jams & preserves. Among these, fresh blueberries are the most popular due to their direct consumption appeal and health benefits. The demand for frozen blueberries is also significant, driven by their convenience and longer shelf life, making them a preferred choice for food manufacturers and consumers alike .

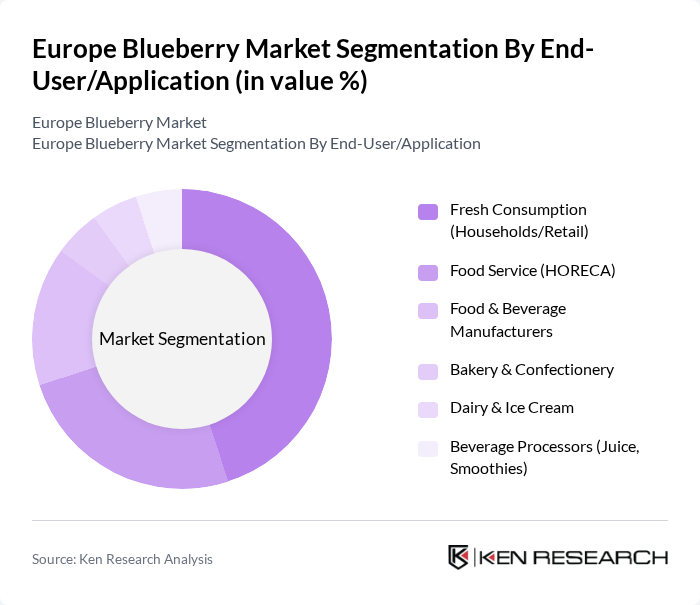

By End-User/Application:The market can also be segmented based on end-users, including fresh consumption (households/retail), food service (HORECA), food & beverage manufacturers, bakery & confectionery, dairy & ice cream, and beverage processors (juice, smoothies). Fresh consumption is the leading segment, driven by healthy snacking trends and the prominence of blueberries in retail. The food service sector is expanding as restaurants and cafes incorporate blueberries into menus, aided by year?round supply from European and counter?seasonal origins .

The Europe Blueberry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Driscoll’s, Naturipe Farms, LLC, Driscoll’s of Europe, Middle East & Africa (EMEA), Fall Creek Farm & Nursery, Inc., Hortifrut S.A., Planasa Group, SanLucar Fruit S.L., Dutch Berries (BestBlue Group B.V.), Costa Group Europe (Costa/Total Produce JV operations), Royal Refruiting (Reybanpac Europe) – Blueberries, BerryWorld Group, The Summer Berry Company, Global Berry (Global Plant Genetics & partners), Polish Berry Cooperative (PBC), Blue Whale (France) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the blueberry market in Europe appears promising, driven by increasing consumer demand for healthy and organic products. As sustainability becomes a priority, producers are likely to adopt eco-friendly practices, enhancing their market appeal. Additionally, technological advancements in cultivation and distribution will streamline operations, potentially reducing costs. The market is expected to see innovations in product offerings, including functional foods and supplements, catering to health-conscious consumers and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Blueberries Frozen Blueberries Dried Blueberries Blueberry Puree Blueberry Juice Blueberry Extracts Blueberry Jams & Preserves |

| By End-User/Application | Fresh Consumption (Households/Retail) Food Service (HORECA) Food & Beverage Manufacturers Bakery & Confectionery Dairy & Ice Cream Beverage Processors (Juice, Smoothies) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-grocery Convenience & Specialty Stores Foodservice Distributors Direct-to-Processor/Wholesale |

| By Country | Spain Poland Germany Netherlands United Kingdom France Italy Rest of Europe (including Portugal, Romania, Serbia, Ukraine) |

| By Cultivation Method | Conventional Organic |

| By Packaging Type | Clamshells (Retail Packs) Bulk Crates Frozen Pouches/Cartons Eco-Friendly/Compostable Packaging |

| By Price Tier | Premium Mid-Range Value/Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blueberry Growers | 100 | Farm Owners, Agricultural Managers |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Directors |

| Retail Sector Insights | 70 | Category Managers, Retail Buyers |

| Consumer Preferences | 150 | Health-Conscious Consumers, Grocery Shoppers |

| Market Analysts and Experts | 60 | Agricultural Economists, Market Researchers |

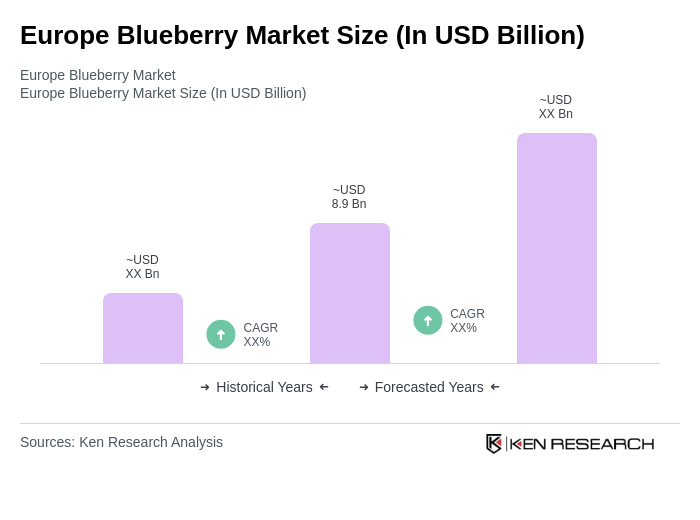

The Europe Blueberry Market is valued at approximately USD 8.9 billion, reflecting a robust demand for blueberries driven by consumer preferences for fresh and healthy produce, as well as significant import trade values across the region.