Region:Europe

Author(s):Rebecca

Product Code:KRAC0311

Pages:82

Published On:August 2025

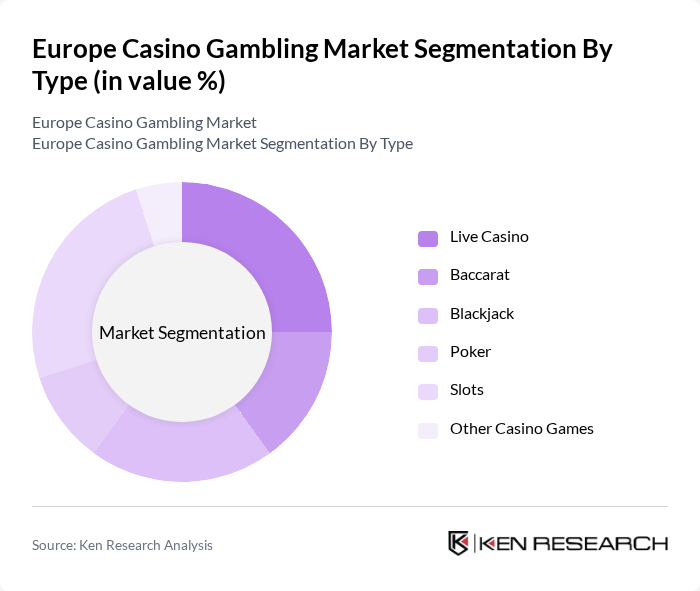

By Type:

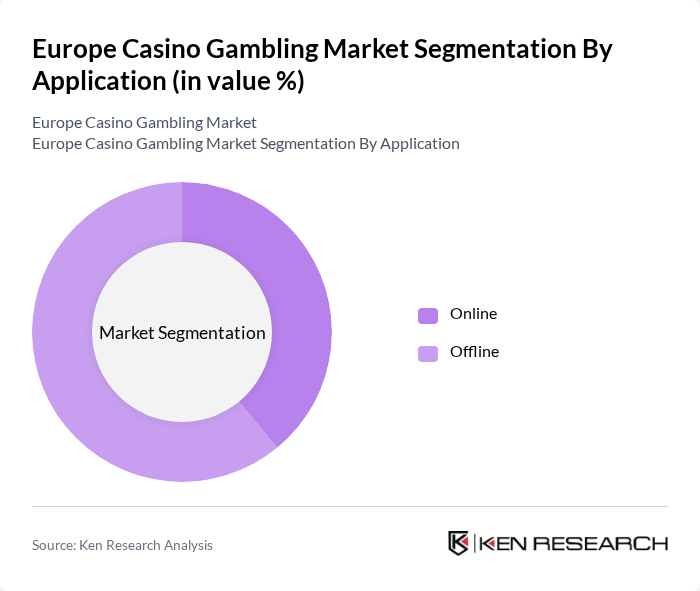

By Application:

By Geography:

The Europe Casino Gambling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bet365 Group Ltd., William Hill PLC, Flutter Entertainment PLC, Entain PLC, Kindred Group PLC, 888 Holdings PLC, LeoVegas AB, Betsson AB, Novomatic AG, Scientific Games Corporation, Playtech PLC, Evolution AB, Merkur Gaming GmbH, Red Tiger Gaming Ltd., Yggdrasil Gaming Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European casino gambling market appears promising, driven by technological advancements and changing consumer preferences. As mobile gambling continues to grow, operators are likely to invest in enhancing user experiences through personalized gaming options. Additionally, the integration of virtual reality is expected to create immersive environments, attracting a younger demographic. However, the market must navigate regulatory challenges and adapt to the evolving landscape to sustain growth and capitalize on emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Live Casino Baccarat Blackjack Poker Slots Other Casino Games |

| By Application | Online Offline |

| By Geography | Germany United Kingdom France Italy Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Land-based Casino Patrons | 100 | Regular Casino Visitors, High Rollers |

| Online Gambling Users | 90 | Online Gamblers, Mobile App Users |

| Casino Operators | 40 | Casino Managers, Marketing Directors |

| Regulatory Authorities | 40 | Policy Makers, Compliance Officers |

| Gaming Technology Providers | 50 | Product Managers, Software Developers |

The Europe Casino Gambling Market is valued at approximately USD 45 billion, reflecting significant growth driven by the increasing acceptance of online gambling platforms and technological advancements in gaming experiences.