Region:Global

Author(s):Geetanshi

Product Code:KRAC0126

Pages:85

Published On:August 2025

By Type:The market is segmented into land-based casinos, online casinos, sports betting, lottery, poker rooms, live casino, baccarat, blackjack, slots, and other types. Among these, online casinos have gained significant traction due to the convenience they offer, allowing players to gamble from the comfort of their homes. The increasing penetration of smartphones, digital payments, and internet connectivity has further fueled the growth of this segment, making it a dominant force in the market. Land-based casinos remain significant, especially in established destinations, but the shift toward digital platforms is accelerating .

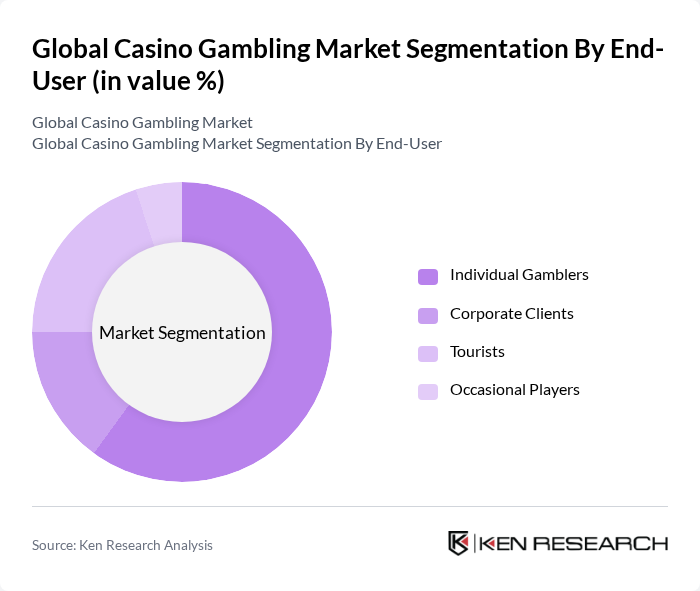

By End-User:The end-user segmentation includes individual gamblers, corporate clients, tourists, and occasional players. Individual gamblers represent the largest segment, driven by the increasing number of people engaging in gambling activities for entertainment. The rise of online platforms and mobile gaming has made it easier for individuals to participate, contributing to the growth of this segment. Additionally, the influx of tourists in gambling hotspots and the integration of casinos with hospitality and entertainment offerings have also bolstered the market .

The Global Casino Gambling Market is characterized by a dynamic mix of regional and international players. Leading participants such as MGM Resorts International, Caesars Entertainment Corporation, Las Vegas Sands Corp., Wynn Resorts, Limited, Genting Group, International Game Technology (IGT), Light & Wonder, Inc. (formerly Scientific Games Corporation), Bet365 Group Ltd., Flutter Entertainment plc, DraftKings Inc., 888 Holdings plc, Kindred Group plc, Betfair Group plc, Evolution AB, Aristocrat Leisure Limited, Melco Resorts & Entertainment Limited, Galaxy Entertainment Group, SJM Holdings Limited, Boyd Gaming Corporation, Penn Entertainment, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the casino gambling industry appears promising, driven by technological advancements and evolving consumer preferences. As the integration of virtual reality and augmented reality becomes more prevalent, casinos are likely to enhance their gaming experiences, attracting a tech-savvy audience. Additionally, the focus on responsible gambling initiatives will likely shape regulatory frameworks, fostering a safer environment for players. These trends indicate a dynamic landscape where innovation and consumer engagement will be pivotal for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Land-Based Casinos Online Casinos Sports Betting Lottery Poker Rooms Live Casino Baccarat Blackjack Slots Other Types |

| By End-User | Individual Gamblers Corporate Clients Tourists Occasional Players |

| By Game Type | Slot Machines Table Games Electronic Gaming Machines Video Poker |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Distributors |

| By Customer Demographics | Age Groups Gender Income Levels |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers Cryptocurrency Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Land-based Casino Operations | 100 | Casino Managers, Operations Directors |

| Online Gambling Platforms | 80 | Product Managers, Marketing Executives |

| Regulatory Compliance in Gambling | 60 | Compliance Officers, Legal Advisors |

| Consumer Behavior in Gambling | 90 | Casino Patrons, Market Researchers |

| Emerging Trends in Sports Betting | 70 | Sports Betting Analysts, Industry Consultants |

The Global Casino Gambling Market is valued at approximately USD 288 billion, reflecting significant growth driven by online gambling popularity, technological advancements, and the expansion of casinos in emerging markets.