Region:Europe

Author(s):Dev

Product Code:KRAD0455

Pages:88

Published On:August 2025

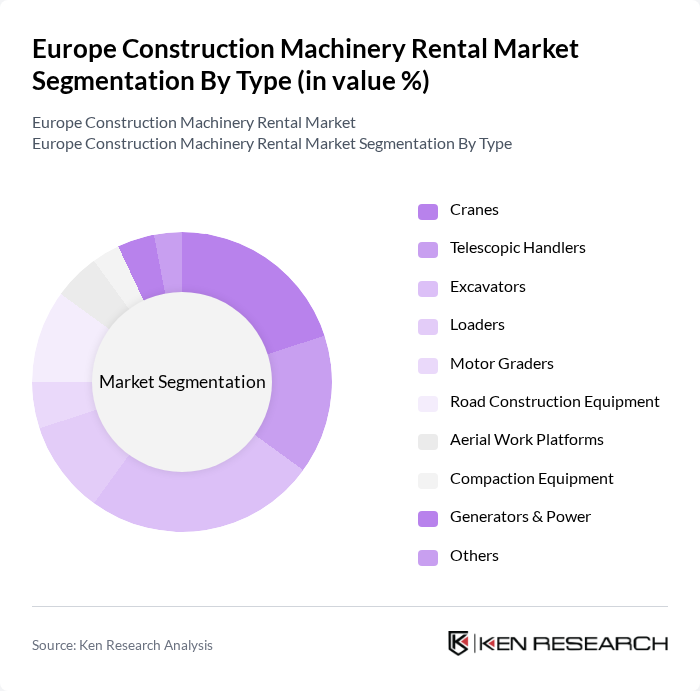

By Type:The market is segmented into various types of construction machinery, including cranes, telescopic handlers, excavators, loaders, motor graders, road construction equipment, aerial work platforms, compaction equipment, generators & power, and others. Each type serves specific functions in construction projects, catering to diverse operational needs.

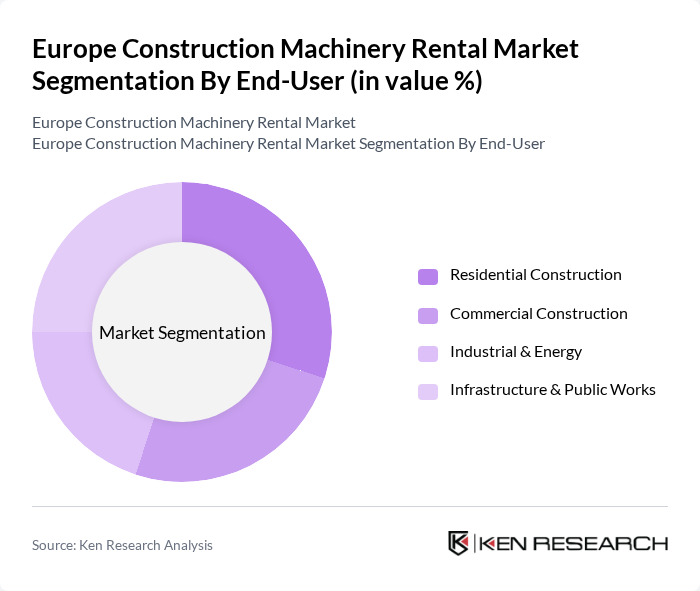

By End-User:The end-user segmentation includes residential construction, commercial construction, industrial & energy, and infrastructure & public works. Each segment reflects the diverse applications of rental machinery across different construction sectors, highlighting the market's adaptability to various customer needs.

The Europe Construction Machinery Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Loxam Group, Boels Rental, Ramirent (Ramirent Group), Cramo (Cramo Group), Kiloutou, HSS Hire Group, Speedy Hire, Ashtead Group plc (Sunbelt Rentals UK), United Rentals (Europe), Riwal Holding Group, Mateco Group, Zeppelin Rental GmbH, HKL Baumaschinen GmbH, GAM Rentals (GAM Alquiler), Aggreko plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe construction machinery rental market appears promising, driven by ongoing infrastructure investments and a growing preference for rental services. As companies increasingly adopt sustainable practices and advanced technologies, the demand for eco-friendly and efficient machinery is expected to rise. Additionally, the expansion of digital platforms for equipment rental will enhance accessibility and streamline operations, positioning the market for significant growth in the coming years, particularly in emerging economies within Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | Cranes Telescopic Handlers Excavators Loaders Motor Graders Road Construction Equipment Aerial Work Platforms Compaction Equipment Generators & Power Others |

| By End-User | Residential Construction Commercial Construction Industrial & Energy Infrastructure & Public Works |

| By Application | Building Construction Road Construction Civil Infrastructure (Rail, Utilities, Airports) Demolition & Earthmoving Landscaping |

| By Rental Duration | Short-Term Rentals (Daily/Weekly) Long-Term Rentals (Monthly/Project-Term) |

| By Region | Germany United Kingdom France Italy Spain Nordics Benelux Central & Eastern Europe |

| By Pricing Model | Hourly Rental Daily Rental Weekly Rental Monthly Rental Project-Based/Framework Agreements |

| By Service Type | Dry Hire (Equipment Only) Operated Hire Full-Service (Maintenance, Insurance, Delivery) Value-Added Services (Telematics, Training, Fuel) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Machinery Rental Companies | 120 | CEOs, Operations Managers, Business Development Heads |

| Construction Project Management Firms | 90 | Project Managers, Procurement Officers, Site Supervisors |

| Equipment Operators and Technicians | 80 | Field Technicians, Equipment Operators, Maintenance Supervisors |

| Construction Industry Associations | 50 | Policy Makers, Industry Analysts, Research Directors |

| End-User Industries (e.g., Infrastructure, Residential) | 90 | Construction Managers, Financial Analysts, Strategic Planners |

The Europe Construction Machinery Rental Market is valued at approximately USD 35 billion, driven by increasing infrastructure projects, urbanization, and a growing preference for rental services over ownership, which helps companies reduce capital expenditure and operational costs.